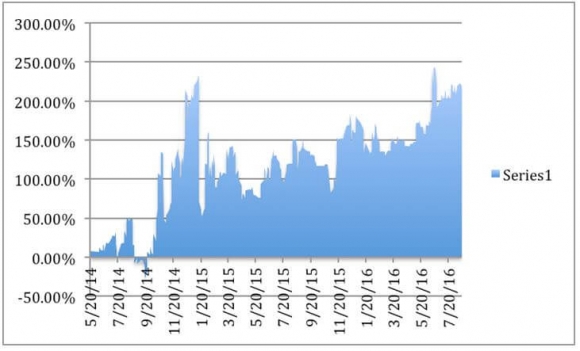

August has been our biggest positive month in a year for subscribers to the Diary of a Mad Hedge Fund Trader, gaining more than 7%. During September, 2015, I brought in a ballistic 11.99% for investors.

My 69 month performance hit 205% at the Friday close, a new all time high.

More on that tomorrow.

In the meantime, the new Fed policy has suddenly become crystal clear.

At the Jackson Hole confab Chairwoman Janet Yellen said that ?The case for a rate hike has strengthened,? but then laid out a list of qualifications and conditions as long as her very short arm.

Stocks rocketed.

An hour latter, vice chairman Stanley Fischer then opined that there might not only be one rate hike this year, BUT TWO.

Stocks tanked.

So here is the new Fed policy in a nutshell: Evolve from changing their mind from every day to EVERY HOUR!

Think of it as the Twitter version of a central bank.

If those who built the Internet 30 years ago had only known, they would have deliberately short-circuited their IBM mainframes.

The net net of all of this is that the intraday range for the (SPY) came in at 2.6 points, the first time it has exceeded 1% in 1 ? months.

I bobbed and weaved as is demanded by the markets these days. I used the $15 point rally in the (SPX) to buy the Volatility Index (VIX) through the (VXX). The (VIX) then soared by some 20% in the next 60 minutes.

It was one of the most rapid profits I have booked in my entire half century long career.

I then used the $15 dip that followed to take profits on my existing short position in the (SPY).

All in all it was a pretty good day, except that I learned the Oakland Raiders, whose stadium I can see from my office, might move to Las Vegas. It?s something about the neighborhood.

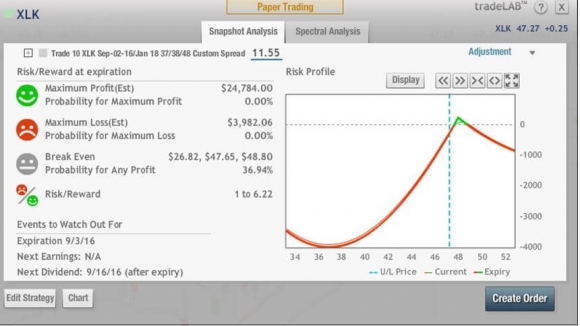

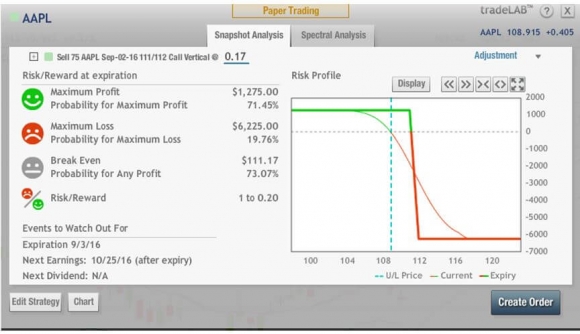

Most individual traders have a horrendous experience trading the (VIX). Time decay eats them alive.

However, by going with a call spread structure you nearly neutralize this problem. Suddenly, time decay and contango become your friends.

What my former Berkeley economics professor has done is set the stage for another three weeks of tedious, boring, sideways market action into the Fed?s September 20-21 Open Market Committee Meeting to see if she actually does it.

Worst case, the (VIX) continues to bounce around this level. Best case, it gently rises into the meeting. Either one is a ?win? for this (VXX) position.

With Janet?s Jackson Hole speech, the preeminent market-moving event of the month is now behind us.

The next one will be the August Nonfarm Payroll released on Friday, September 1, and the big Fed interest rate decision on September 20-21.

It all sets up a nice yawn going into the September 2-5 Labor Day weekend. There should be no major breakouts, or breakdowns.

On Monday, August 29 at 10:30 AM EST, the Dallas Fed Manufacturing Survey should see some gains.

Tuesday, August 30 will be a big day. That?s when we receive an update on the S&P Case-Shiller Home Price Index. Extreme home shortages is the key, high growth markets should keep the numbers rising.

On Wednesday, August 31 at 10:00 AM we see Pending Home Sales, which are moving from strength to strength. We also get no less than three Fed speakers that day, further adding to our monetary confusion.

On Thursday, September 1 at 8:30 AM EST the Weekly Jobless Claims should confirm that employment remains at four decade highs. We will also get the PMI Manufacturing Index at 9:45.

Friday, September 2 should be a snore, with nothing major happening ahead of a three day weekend heralding the end of summer.

We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for the past two months, driving oil prices lower.

More on that tomorrow.