Global Market Comments

April 13, 2016

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE APRIL 15 HOUSTON STRATEGY LUNCHEON)

(WHY IS THE JAPANESE YEN SO STRONG?)

(FXY), (YCS), (UUP),

(AN EVENING WITH BILL GATES, SNR.),

(TESTIMONIAL)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

PowerShares DB US Dollar Bullish ETF (UUP)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Houston, Texas on Friday, April 15, 2016.

A three course lunch will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be tossing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $238.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private downtown Houston club the location of which will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

In short, nobody knows.

I have talked to about every currency guru out there and all seem as puzzled, perplexed, befuddled, and confused as I am.

Not only that, there hasn?t been any confirmation of the strong yen from other asset classes, which has rocketed from a low of ?125.85 last June to a high of ?107.60 this week.

Normally when the yen is strong, you expect stocks (SPY), (IWM), junk bonds (HYG), and emerging markets (EEM) to be in free fall. They aren?t. In fact all of these high beta asset classes are pushing up against one-year highs.

Either the virile yen is presaging a gut wrenching crash in stock prices, or it isn?t. Go figure.

However, I do have a few theories.

1) The strong yen is part of a generalized weak dollar move (UUP) triggered by the cancellation of the next seven Federal Reserve interest rate hikes brought on by the January stock crash. The Chinese stock crash poured gasoline of the flames.

Over the long term, interest rate differentials explain all foreign currency moves, and the greenback just gave up its advantage.

2) A lot of hedge funds ended 2015 with large short positions in the yen, making them ripe for a short squeeze.

In fact, the net trader?s position swung from a short of 30,300 futures contracts in December to long 50,000 contracts in January. This is a humongous swing of $9 billion in underlying.

Since then, there was been a continuing cycle of traders reestablishing shorts based on poor Japanese fundamentals, then getting stopped out, and repeating the cycle again and again, taking the yen ever higher, and the P&L?s of traders ever lower.

3) April is the beginning of the Japanese fiscal year, and the yen is always strong as Japanese repatriate foreign profits to invest in Japan and avoid local taxes.

4) Despite this massive move in the yen against the long-term economic interests of Japan, the Bank of Japan has not lifted a finger to stop it with more quantitative easing. Negative interest rates only made the yen stronger. As central bank meetings came and went with no effective action, new yen buying waves were triggered.

You really have to ask the question of ?How stupid can a government get before they do the right thing?? The answer, to the pain of many forex traders is ?A lot more stupid than you think.?

5) The truly amazing thing is that the strong yen continued in the face of a massive capital flight from Japan fleeing the country?s new negative interest rate policy.

According to Japan?s Ministry of Finance, some $3.2 billion left Japan for sunnier climes and higher interest rates in January, followed by $27 billion in February and a staggering $53 billion in March. This enormous outflow will continue for the rest of this year. Notice the hyperbolic increase.

6) Even more amazing is that the yen has continued to appreciate in the face of huge sales of Japanese stocks by foreign investors in Q1, some $63 billion. They are seeking to duck the hit Japanese corporate earnings will take from the strong yen. Some 10% of the total Japanese foreign earnings have vaporized in just three months.

All of this is proof that this is not your father?s trading markets. All asset classes are trading totally differently than they have in the past.

The last time I experienced conditions like this it was in Japan in the early 1990?s, right at the onset of a 20-year financial and economic crash.

Real individual and institutional end investors had totally abandoned the market. All that were left we an odd assortment of hedge funds, bank proprietary books, and spivs.

After the initial six month, 50% crash in the Nikkei Average, nobody made any money. Traders were just batting the same stock back and forth like in a ping-pong match, with little net overall movement.

In other words, it was a trader?s worst nightmare. No one earned even enough to cover their nighttime sushi and Suntory Whiskey bills. And this went on for two decades.

Today, I have a grand total of five subscribers in my former home of Japan. I have over 100 in Singapore catering to the enormous offshore Chinese business.

I don?t think this is happening right now in the US. Still, the similarity is unnerving.

So what happens next?

As we approach the second half of 2016, the prospects for a new round of Fed rate raises will return. When that happens, it is back to the penalty box for the yen as its dire fundamentals reassert themselves once more.

I expect it to quickly give up all of its gains for this year and maybe more. One can only hope.

That?s when you plow back into long positions in the (YCS) and short positions in the (FXY).

Priced More Than She is Worth?

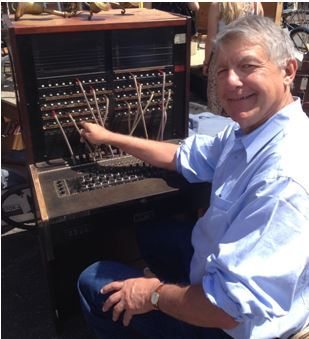

I had a chat with Bill Gates, Sr. recently, co-chairman of the Bill and Melinda Gates Foundation, the world's largest private philanthropic organization. There, a staff of 800 helps him manage $30 billion.

The foundation will give away $3.1 billion this year, a 10% increase over last year. Some $1.5 billion will go to emerging nation healthcare and another $750 million to enhance American education.

The foundation's spending in Africa has been so massive, that it is starting to have a major impact on conditions and is part of the bull case for investing.

The fund happens to be one of the best-managed institutions out there, having sold the bulk of its Microsoft (MSFT) stock just before the dotcom bust and moving the money into Treasury bonds.

Mr. Gates' pet peeve is the precarious state of the US K-12 public education system, where teaching is not as good as it could be, expectations are low and financial incentives and national standards are needed.

When asked about retirement, he says, "Having a son with a billion dollars puts a whole new spin on things." Now a razor-sharp 88, his favorite treat is the free Net Jet miles he gets from his son Bill every year. In his memoir Showing up for Life, he says a major influence on his life was his Scoutmaster 70 years ago.

Being an Eagle Scout myself, I quickly drilled him on some complex knots, and he whipped right through all of them.

The world needs more Bill Gates, Seniors.

A Bowline Knot

A Bowline Knot

Nice work! ?You do great analysis and execution.?I got a 100% overnight profit on the (UVXY) calls!

Zev

Potomac, Maryland

You?ve Got to Be Dialed in the Get These Trades

You?ve Got to Be Dialed in the Get These Trades

?WE are in the seventh year of an expansion and the seventh year of a bull market. Investors are at a crossroads now, whether to hold cash or stocks,? said Tom Lee, founder of Fundstrat Global Advisors.

Global Market Comments

April 12, 2016

Fiat Lux

Featured Trade:

(APRIL 13 GLOBAL STRATEGY WEBINAR),

(APRIL 25 CHICAGO GLOBAL STRATEGY LUNCHEON),

(A NOTE ON THE FRIDAY APRIL 15 OPTIONS EXPIRATION)

SPDR S&P 500 ETF (SPY)

SPDR Gold Shares (GLD)

Come join me for the Mad Hedge Fund Trader?s Global Strategy Luncheon, which I will be conducting in Chicago on Monday, April 25th.

A three course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $235.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets,? please click here.

We have a couple of options positions that expire on Friday, April 15 and I just want to explain to the newbies how to best maximize their profits.

These include:

The S&P 500 SPDRs ETF (SPY) April 15, 2016 $182 puts

The? SPDR Gold Trust (GLD) April 15, 2016 $109-$112 vertical bull call spread

My bet that gold would rise, despite all market conditions, proved dead on accurate. This makes our third consecutive win with the barbarous relic. All we need now is another substantial dip so we can get back in, rolling our options up and out.

The S&P 500 (SPY) is another story. We originally purchased this as a hedge against our many deep-in-the-money (SPY) call spreads, all of which proved profitable. My plan was to take profits on the $182 puts on the next dip if the market, and bring in profits on both the long and the hedge.

However, the dip never came. What ensued was the strongest and sharpest move up in market history. The market didn?t take in a single breath. As a result, our (SPY) April 15, 2016 $182 are going to expire worthless, shaving some 4.87% off our 2016 performance.

That?s a hit and a half!

Netting it all out, we still managed a profit on our (SPY) longs. It took a once a century event to deprive us of our bragging rights.

Those once a century events are darn hard to call.

Provided that some 9/11 type event doesn?t occur by Friday, the (GLD) position should expire at its maximum profit point. In that case, your profits on this position will amount to 12.35% in 18 trading days.

Many of you have already emailed me asking what to do with these winning positions. The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

You don?t have to do anything.

Your broker (are they still called that?) will automatically use your long $109 call position to cover your short $112 call position in the April (GLD), cancelling out the total holding.

The profit will be credited to your account on Monday morning April 18, and the margin freed up.

If you don?t see the cash show up in your account on Monday, get on the blower immediately.

Although the expiration process is now supposed to be fully automated, occasionally mistakes do occur. Better to sort out any confusion before losses ensue.

I don?t usually run positions into expiration like this, preferring to take profits two weeks ahead of time, as the risk reward is no longer that favorable.

But we have a ton of cash right now, and I don?t see any other great entry points for the moment. Better to keep the cash working and duck the double commissions. This time being a pig paid off handsomely.

If you want to wimp out and close the position before the expiration, it may be expensive to do so.

Keep in mind that the liquidity in the options market disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration. This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

This expiration will leave me with a very rare 90% cash position. I am going to hang back and wait for good entry points before jumping back in. It?s all about getting that ?Buy low, sell high? thing going.

I?m looking to cherry pick my new positions.

Take your winnings and go out and buy yourself a well earned beer. Or use it to pay your 2015 income tax bill due Monday, April 18.

Well done, and on to the next trade.

Looking for the Next Whopper

Looking for the Next Whopper

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.