Global Market Comments

May 24, 2016

Fiat Lux

Featured Trade:

(DON'T MISS THE MAY 25 GLOBAL STRATEGY WEBINAR),

(WHY I?M BUYING BONDS),

(TLT),

(TESTIMONIAL)

iShares 20+ Year Treasury Bond (TLT)

Having flip-flopped twice so far in 2016, my bet is that the Federal Reserve flip-flops on its monetary policy, yet again.

Yes, buying bonds may appear like high treason for someone who has been trading stocks for a half century (I?m currently reading the biography of Benedict Arnold, a deeply misunderstood man).

I have made money on the well known ?Sell in May and Go Away? effect for the past ten years.

What?s different this year is that even conservative managers who usually ?poo poo? this seasonal phenomenon are coming around to my way of thinking, and getting extremely nervous.

At last week?s Wednesday afternoon massacre, the central bank suddenly flipped with its April minutes from an easing to a decided tightening mode.

You can therefore count on markets to fully discount a 25 basis point rate rise by the June 17 meeting.

And then you know what? ?Brexit,? weak economies in Europe, Japan, and China, weak corporate sales, the US presidential election, and a strong dollar will suddenly come to the fore, and they?ll sit on their hands for the umpteenth time.

Markets and traders will get caught wrong footed once again. Bond prices and the (TLT) will rocket. Yields will collapse, taking the ten-year Treasury bond yield down to 1.36%, or to new 60 year lows.

If all of this makes me sound like a reverse psychologist, you?d be right. But we have to trade the market we have, not the one we want.

The great irony is that the world will clamor to buy US Treasury bonds because, with a lofty 1.85% yield, they are one of the highest paying government debt issues on the planet.

It?s all proof that if you live long enough, you see everything.

That makes the iShares 20+ Year Treasury Bond Fund ETF (TLT) June 2016 $124-$127 in-the-money vertical bull call spread a great hedge for any other ?RISK ON? assets you may want to hold for the next month, like stocks.

I therefore expect the (TLT) to continue to trade in a sideways range up to the June Fed meeting, which will enable me to max out my profit on this position.

Bonds prices are already hinting this will happen, as the (TLT) has only given back 3.5 points since the Wednesday upset.

You would expect at least a ten point hickey if a rate rise was really going to happen, as we saw with the run up to the December 25 basis point hike.

By the way, bond traders are much smarter than stock traders, as they are backed by much more formidable research departments. Follow their lead with a laser like focus.

That is what a 30-year non-stop bull market buys you these days.

It all traces back to my thesis that this is not a deflationary decade, but a deflationary century.

Did you know that the cost of home lighting fell 1,000 fold from 1850 to 1900 when consumers switched from whale oil to electricity? I learned that little nugget reading Thomas Edison?s bio last week.

The cost of street cleaning in Boston in 1900 was astronomical, as the city then supported 700 horses per square mile, each of which produced 50 pounds of manure a day! Today that cost is effectively zero.

We are in a comparable downshifting of the structural cost of everything now, some 116 years later.

If the wheels fall off of this trade for any reason, I?ll be outta there quickly with a stop loss. Markets are volatile and tempestuous beasts these days, and can produce more manure than the lifetimes of 700 horses.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Expect The Fed to Flip Flop Again

John's newsletter is, in my view, the Secretariat of the investment newsletter derby. No one else is even a close second.

Gary

New Jersey

?Without profits, the market can?t go anywhere,? said independent research consultant David Darst.

Global Market Comments

May 23, 2016

Fiat Lux

Featured Trade:

(ARE STOCKS LYING?),

(SPY), (UUP), (FXE), (EUO), (GLD), (TLT), (USO),

(SHORT SELLING SCHOOL 101),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL),

?(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

SPDR S&P 500 ETF (SPY)

PowerShares DB US Dollar Bullish ETF (UUP)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

SPDR Gold Shares (GLD)

iShares 20+ Year Treasury Bond (TLT)

United States Oil (USO)

ProShares Short S&P500 (SH)

ProShares UltraShort S&P500 (SDS)

ProShares Short QQQ (PSQ)

ProShares Short Dow30 (DOG)

ProShares Short Russell2000 (RWM)

ProShares UltraPro Short S&P500 (SPXU)

Apple Inc. (AAPL)

VOLATILITY S&P 500 (^VIX)

iPath S&P 500 VIX ST Futures ETN (VXX)

Renaissance IPO ETF (IPO)

iShares Edge MSCI USA Momentum Factor (MTUM)

PowerShares S&P 500 High Beta ETF (SPHB)

AdvisorShares Ranger Equity Bear ETF (HDGE)

?

In the wake of the Fed?s Wednesday flip-flop, I?m sitting here looking at my screens.

The dollar, Euro, Yen, US Treasury bonds, commodities, gold, silver, and oil all say interest rates are RISING on June 17.

Stocks are saying they?re FALLING.

The million-dollar question is: Who?s lying?

My bet is that it?s stocks that are telling the porky pies.

Here is the tell. The Federal Reserve April Open Market Committee minutes said that a rate rise was on the table if the economic data justify it.

The problem is that having shown their cards for an imminent rate rise, the global market assumption will be that a rate rise in four weeks is a sure thing.

This pretty much screams at you how all asset classes will trade for the next month.

The US dollar (UUP), lured on by the prospect of an expanding yield advantage over the rest of the world, will continue to appreciate. The Euro (FXE), Yen (FXY), US Treasury bonds (TLT), commodities, gold, silver, and oil (USO) will fall.

It?s that simple.

I have to tell you that having traded stocks for a half century, I learned long ago that stocks are congenital liars. So this is not a new thing.

Look no further than the latest batch of data releases. Even though the S&P 500 (SPY) is just short of an all time high, US equity mutual funds have shown net outflows of nearly $20 billion.

It is corporate buy backs and mergers and acquisitions that are levitating the indexes up here. Take those away, and there is nothing but air supporting prices up here.

Think of it as a Wiley Coyote moment.

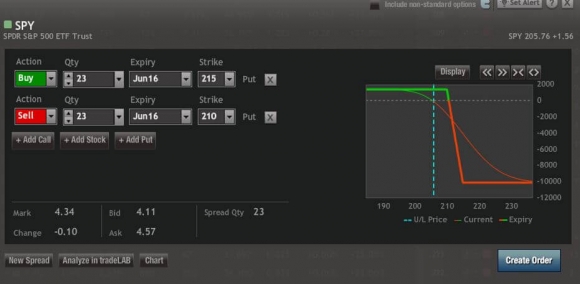

That is why I sold short the market once again on Friday, specifically through purchasing the S&P 500 SPDR?s (SPY) June, 2016 $210-$215 in-the-money vertical bear put spread at $4.34. This represents a tactical layering on top of my existing short positions.

To lose money, the S&P 500 has to trade at or above the $210 level at the June 17 expiration in 20 trading days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you can?t do the options, buy the ProShares Short S&P 500 Short Fund ETF (SH) (click here for the prospectus at http://www.proshares.com/funds/sh.html), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS) (click here for the prospectus at http://www.proshares.com/funds/sds.html).

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

Then what happens next?

The Fed will stay true to their words, and NOT raise rates in June because, guess what, the economic data don?t justify it. Investors will believe they have a free pass on rates for the rest of 2016 and a global rally ensures.

Having flip-flopped, the Fed will flip-flop again.

That gives my short play here a life of about three weeks, which is just shy ?of the entire maturity of my current trading book.

Then it will be time to step out of the market and let IT tell you what it is going to do next.

Sounds to me like a good time to take a cruise.

Queen Mary 2 anyone?

Not An Investment Strategy

With the stock market falling for the next few weeks, or even months, it?s time to rehash how to profit from falling markets one more time.

There is nothing worse than closing the barn door after the horses have bolted.

No doubt, you will receive a wealth of short selling and hedging ideas from your other research sources and the media at the next market bottom. That is always how it seems to play out.

So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now, while stock markets are still only 3% short of an all time high, and unchanged on the year.

Market?s could be down 10% by the time this is all over.

THAT IS MY LINE IN THE SAND!

There is nothing worse than fumbling around in the dark looking for the matches after a storm has knocked the power out.

I?m not saying that you should sell short the market right here. But there will come a time when you will need to do so. Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type:

Bear ETFs

Of course the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain the in the (SH).

In actual practice, it doesn?t work out like that. The ETF has to pay management operating fees and expenses, which can be substantial. After all, nobody works for free.

There is also the ?cost of carry,? whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF.

Still individuals can protect themselves from downside exposure in their core portfolios through buying the (SH) against it (click here for the prospectus: http://www.proshares.com/funds/sh.html). Short selling is not cheap. But it?s better than watching your gains of the last seven years go up in smoke.

Virtually all equity indexes now have bear ETF?s. Some of the favorites include the (PSQ), a short Play on the NASDAQ (click here for the prospectus: http://www.proshares.com/funds/psq.html), and the (DOG), which profits from a plunging Dow Average (click here for the prospectus: http://www.proshares.com/funds/dog_index.html).

My favorite is the (RWM) a short play on the Russell 2000, which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus: http://www.proshares.com/funds/rwm.html).

Leveraged Bear ETFs

My favorite is the ProShares Ultra Short S&P 500 (SDS), a 2X leveraged ETF (click here for the? prospectus: http://www.proshares.com/funds/sds.html). A 10% decline in the (SPY) generates a 20% profit, maybe.

Keep in mind that by shorting double the market, you are liable for double the cost of shorting, which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry, this ETF or you might be disappointed.

3X Leveraged Bear ETFs

3X Leveraged Bear ETFs

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus: http://www.proshares.com/funds/spxu.html).

First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error.

Eventually, they all go to zero, and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further added to costs.

Yes, I know the charts can be tempting. Leave these for the professional hedge fund intra day traders they are meant for.

Buying Put Options

For a small amount of capital, you can buy a ton of downside protection. For example, the April (SPY) $182 puts I bought for $4,872 allowed me to sell short $145,600 worth of large cap stocks at $182 (8 X 100 X $6.09).

Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better be good with these, because when the market goes against you, put options can go poof, and disappear pretty quickly.

That?s why you read this newsletter.

Selling Call Options

One of the lowest risk ways to coin it in a market heading south is to engage in ?buy writes?. This involves selling short call options against stock you already own, but may not want to sell for tax or other reasons.

If the market goes sideways, or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially they get called away, but at a higher price, so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

I?ll give you a concrete example. Let?s say you own 100 shares of Apple (AAPL), which closed on Friday at $95.13, worth $9,513. If you sell short 1 July, 2016 $100 call at $1.30 against them, you take in $130 in premium income ($1.30 X 100 because one call option contract is exercisable into 100 shares).

If Apple close2 below $100 on the July 15, 2016 expiration date, the options expire worthless and you keep your stock and the premium. You are then free to repeat the strategy for the following month. If (AAPL) closes anywhere above $100 and your shares get called away, you still make money on the trade.

Selling Futures

This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risk for an entire portfolio of shares by simply selling short futures contracts for a stock index.

For example, let?s say you have a portfolio of predominantly large cap stocks worth $100,000. If you sell short 1 June, 2016 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market.

The margin requirement for one contract is only $5,000. However if you are short the futures and the market rises, then you have a big problem, and the losses can prove ruinous.

But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom and pop investing for their retirement fund.

Most 401ks and IRAs don?t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument.

That said, get the futures markets right, and it is the quickest way to make a fortune, if your market direc

tion is correct.

Buying Volatility

Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it through buying the iPath S&P 500 VIX Short Term Futures ETN (VXX), or buying call and put options on the (VIX) itself.

If markets fall, volatility rises, and if markets rise, then volatility falls. You can therefore protect a stock portfolio from losses through buying the (VIX).

I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read ?Buy Flood Insurance With the (VXX)? by clicking here.

Selling Short IPO?s

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That?s because many are held by hot hands, known as ?flippers,? and don?t have a broad institutional shareholder base.

Many of the recent ones don?t make money and are based on an, as yet, unproven business model. These are the ones that take the biggest hits.

Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus: http://www.renaissancecapital.com/ipoinvesting/ipoetf/ipoetf.aspx).

Buying Momentum

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum, while falling markets produce falling momentum.

So selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here: https://www.ishares.com/us/products/251614/MTUM.

Buying Beta

Beta, or the magnitude of share price movements, also declines in down markets. So selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship.

The Index is compiled, maintained and calculated by Standard & Poor's and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months.

The Fund and the Index are?rebalanced and reconstituted quarterly in?February, May, August and November. To learn more, read the prospectus by clicking here:? https://www.invesco.com/portal/site/us/financial-professional/etfs/product-detail?productId=SPHB.

Buying Bearish Hedge Funds

Another subsector that does well in plunging markets are publicly listed bearish hedge funds. There are a couple of these that are publicly listed and have already started to move.

One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus: http://www.advisorshares.com/fund/hdge). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

![Wile E. Coyote - TNT]() Oops, Forgot to Hedge

Oops, Forgot to Hedge

Global Market Comments

May 20, 2016

Fiat Lux

Featured Trade:

(MAY 25 GLOBAL STRATEGY WEBINAR),

(THE FLIP FLOPPING FED STRIKES AGAIN!),

(SPY), (GLD), (ABX), (GDX), (XLU), (XLF),

(PRESIDENT HILLARY?S COMING TAX HIT)

SPDR S&P 500 ETF (SPY)

SPDR Gold Shares (GLD)

Barrick Gold Corporation (ABX)

VanEck Vectors Gold Miners ETF (GDX)

Utilities Select Sector SPDR ETF (XLU)

Financial Select Sector SPDR ETF (XLF)

Boy, the Federal Reserve must really hate traders.

Once again, a flip flopping Fed has reversed its message to the market, suggesting that interest rates will rise as soon as its June 17 meeting.

The news came out with the release of its April Open Committee Meeting minutes. It?s clear that as soon as financial markets stopped crashing, a rate rise was back on the table.

The revelation pulled the rug out from traders who were expecting no move on interest rates until December at the earliest.

Markets were stunned senseless by the surprise for a few minutes. Then, the lower interest plays, like gold (GLD) and utilities (XLU) started to crater, while rising rate plays, such as the banks (XLF), had a banner day.

This was a big problem, as most hedge funds had overweight positions in the yellow metal, one of the top performing assets of 2016. Those long gold stocks (GDX), (ABX) particularly took it in the shorts.

Fortunately, I made more than ample profits on my short positions in the S&P 500 (SPY), the Russell 2000, and the Japanese yen (FXY), (YCS) to offset any losses in the barbarous relic.

That is why the word ?Hedge? is in the Mad Hedge Fund Trader. I?m sorry, but I?m spoiled. I like to make money ALL the time!

Yesterday?s developments still left our May performance at an envious 10.62%. The 2016 year-to-date number stands at 11.83%. Our five-year gain stands at 204.08%.

These are numbers any manager would kill for in this tempestuous trading year. The harder I work, the luckier I get.

The great irony here is that I don?t believe the Fed will raise rates in June. The numbers from the economy don?t justify it. A US Q1 GDP growth rate of a piddling 0.5% is nothing to write home about.

And even the Fed won?t believe in a rate rise if the UK leaves the European Community, a distinct possibility on June 23.

That means stocks will continue to discount a rate rise for another month, and then not get it. That translates into selling every rally in stocks until then and then covering your shorts mid month.

The 200-day moving average beckons at $199.68, then the February 11 low at $181.20.

The problem is that central banks have been known to make mistakes, especially ours.

Will She, or Won?t She?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.