Watching the entire commodity complex collapse in unison this year was nothing less than amazing, with many down 30% or more. And I mean the broader definition of commodity.

It includes the base metals like copper (JJC), (CU), agricultural products (CORN), (SOYB), (DBA), precious metals (GLD), (SLV), and even energy (USO), (KOL).

If you look carefully, you can find commonality in many, but not all, of these.

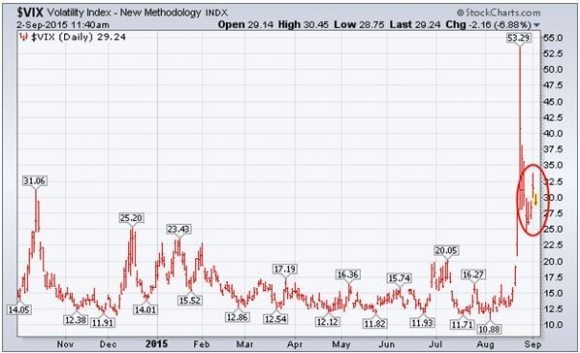

A slowing China meant that global consumption of bulk commodities would recede to a low ebb. The Chinese stock market crash threw gasoline on the fire.

A bull market in US stocks produced a world clamoring for paper assets at the expense of hard ones.

And of course, the high prices seen in all of these nearly four years ago cured high prices, drawing in new production from untold corners of the earth.

This is how bubbles always end.

What leaves many scratching heads is how widespread the route became. Those clever people who used one commodity to hedge another were left with portfolios of ashes, as everything plunged in lockstep.

The big talk now among my global strategist friends is this: will this year?s dogs become next year?s Cinderellas?

It is easy to imagine how this could happen. For a start, the higher paper stocks rise, the cheaper commodities look. They are now starting to appear like great laggard/diversification plays.

Here is another conundrum.

The world is on track for a global synchronized recovery, with the US. China, Japan and Europe all going ?pedal to the metal? to spur economic growth.

So how is it supposed to do this without using more commodities?

Yes, you can argue, there are big stockpiles to eat through before we see any real price appreciation. But stores can be exhausted in mere months.

This is why I am starting to get interested in the entire commodity space. I have already executed a couple of profitable trades in Freeport McMoRan (FCX) this year-- one of the world?s largest copper producers.

And if my old friend, Carl Icahn, is interested, should I be?

I look forward to more visits to the trough.

Higher prices for commodities in 2016 may not turn out to be a fairy tale after all.