Global Market Comments

July 8, 2015

Fiat Lux

EMERGENCY OIL ISSUE

Featured Trade:

(SPECIAL UPDATE ON THE OIL COLLAPSE),

(USO), (XOM), (OXY), (COP), (LINE)

United States Oil Fund LP (USO)

Exxon Mobil Corporation (XOM)

Occidental Petroleum Corporation (OXY)

ConocoPhillips (COP)

Linn Energy, LLC (LINE)

?

The Middle East is a miserable place to be during Ramadan, a month where the faithful reevaluate their lives and recommit to the teachings of Islam. This year it runs from June 17 to July 17.

During this period, the Muslims are not permitted to eat or drink from sunrise to sunset, or criticize others, or engage in a long list of other hurtful activities.

Although infidels, such as myself, are exempt from these rules, living amidst a population subject to these eighth century laws can be wearing. Everyone is starving, exhausted, and in a foul mood. Restaurants don?t open until sunset. Then people party all night, keeping you awake.

In the more fundamentalist conservative countries, like Saudi Arabia, Oman, and Kuwait, the Religious Police beat offenders with sticks and clubs that they come across in public.

That includes those eating, drinking, or women wearing immodest dress, like short pants and tank tops. Did I mention it reached 120 degrees yesterday in those countries?

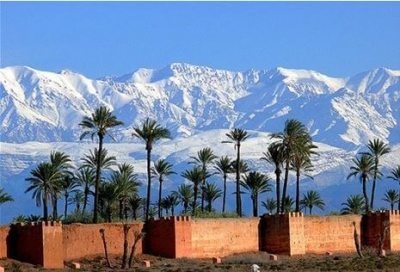

As a result, anyone who can afford to do so flees to more liberal regimes during the fasting period, like Turkey, Egypt, and Morocco.

As a result, I am bumping into quite a few interesting people in the five star hotels here who have quite a lot to say about the price of oil.

A rash of hurried negotiations has suddenly broken out between American and European oil majors and the government of Iran. The word is out. Iran is going to imminently cave on US demands of inspections of nuclear facilities, especially the military ones.

The fact that this is all happening now is no coincidence. According to the Koran, Ramadan is a time to ?make peace with those who have wronged us.?

The hard numbers being assigned to these contracts is having the effect of increasing the size of the carrot for both the West and Iran to wind up the talks. The impact will be to permit Iran to rejoin the global economy for the first time in 36 years.

This paves the way for Iran to double its oil exports from 1.2 to 2.4 million barrels a day immediately, and then double them again once desperately needed energy infrastructure investments are made.

It won?t take long for this impending tsunami of oil to hit the markets. The Reuters news agency is reporting that 38 million barrels of Iranian oil are sitting in 15 VLCC tankers slow cruising the Persian Gulf and Indian Ocean.

The second the ink is dry on any US/Iran agreements, these ships are sailing for western and Asian ports to make delivery.

This is why you have seen a cataclysmic plunge in the price of Texas tea over the past few weeks, from $62 to $51, some 18%.

Saudi Arabia has responded to the decline by aggressively cutting prices for their largest customer, and ramping up production even more, in a determined effort to boost market share.

Therefore, the March low of $43 now seems within range, and maybe then some. You have already seen this in the contango for far month futures markets, which have widened fantastically. The world has returned to paying huge premiums for storage.

In case you missed the generational low at these prices four months ago, you now have another shot.

The share prices of my favorite oil plays, Exxon Mobile (XOM), Occidental Petroleum (OXY), Conoco Phillips (COP), and Linn Energy (LINE) all saw this route coming months ago and are already there.

In fact, the weak energy sector, which accounts for 10% of the S&P 500, was a major reason why the index failed to break out to new highs a few weeks ago.

I think that energy could be one of your seminal investment plays for the rest of 2015. Crude should make it back up to the $90 handle within the next three years, riding on the back of the global synchronized economic recovery.

After that, the question arises of whether the next move is to $10, as carbon based energy forms are replaced by alternatives on a large scale. Allow for a Moore?s Law type exponential growth of efficiencies, and we?ll soon be there.

That is Saudi Arabia?s current $5 per barrel cost of production, plus a 20% profit margin and $4 for shipping. Remember, it was only $8 as recently as 1998.

Just thought you?d like to know.

And now, back to my loyal rental camel, whose price, it turns out, is determined by, you guessed it, the price of oil.