?It?s a manic depressive economy. Every other month we decide we might be in a recession,? said Kevin Hassett of the American Enterprise Institute.

Global Market Comments

June 8, 2015

Fiat Lux

Featured Trade:

(JUNE 25 NEW YORK STRATEGY LUNCHEON)

(WHY STOCKS HATED THE MAY NONFARM PAYROLL),

(SPY), (TLT), (IWM), (FXE), (VIX),

(HAVE CALM WATERS RETURNED FOR SHIPPING STOCKS?),

($BDI), (DRYS), (SEA), (GNK),

?(RIO), (BHP), (KOL), (FXA), (EWA)

SPDR S&P 500 ETF Trust (SPY)

iShares Trust - iShares 20+ Year Treasury Bond ETF (TLT)

iShares Trust - iShares Russell 2000 ETF (IWM)

CurrencyShares Euro Trust (FXE)

VOLATILITY S&P 500 (^VIX)

Baltic Dry Index ($BDI)

DryShips, Inc. (DRYS)

Claymore/Delta Global Shipping (SEA)

Genco Shipping & Trading Ltd. (GNK)

Rio Tinto plc (RIO)

BHP Billiton Limited (BHP)

Market Vectors Coal ETF (KOL)

CurrencyShares Australian Dollar ETF (FXA)

iShares MSCI Australia (EWA)

When the US Department of Labor announced its blockbuster May nonfarm payroll showing a 280,000 gain, stocks behaved like the world had just ended.

The 32,000 in March and April upward revisions didn?t help either.

You would think data showing that the economy is improving much faster than many realized would be positive for ?RISK ON? equity investments.

It wasn?t.

Now, the laser focus is on the bond market, which is collapsing globally. The complete disappearance of liquidity is exacerbating the moves.

Bond traders are now hyper sensitive to any news of a stronger American economy, which will soon lead to higher interest rate rises by Janet Yellen?s Federal Reserve.

A world is ending, but not the one you think. The zero interest rate regime on which we have all become heavily addicted over the last eight years is about to go into the history books.

Welcome to the looking glass world of investment these days. Good new is bad news and bad news good.

Players are in a manic depressive mood, expecting the economy to plunge into recession one month, and then discounting a robust recovery the next.

Then there?s Greece, which threatens to default on its debt on alternate days, and then offers to pay on the others. This has prompted the Euro (FXE) to undergo more gyrations than a circus contortionist.

Not a friendly environment for a trader. Sturm und drang with no net movement in the indexes doesn?t pave the road to trading riches. Even staying long volatility (VIX) is not working, unless you have the fastest finger in Chicago.

This is why I am keeping the Mad Hedge Fund Trader model trading portfolio to an absolute minimum bare bones of positions, a single 10% weighting in the S&P 500 that I snapped up at the Friday lows. And even that one has me edgy.

After polling many of my most loyal, long-term readers, I learned that they would rather see a small number of great trades than a large number of positions that include a few losers.

So, cherry picking it is, at least, for now.

To say that the nonfarm was fantastic is something of an under statement.

Private nonfarm jobs jumped by a dynamic 262,000. High paying professional and business services employment increased by a runaway 63,000. Leisure and hospitality ramped up to 57,000. Health care picked up 47,000.

The big loser was mining (coal, gold, silver), which shed 17,000 jobs. Headline unemployment held steady at 5.5%, while average hourly earnings rose by 0.3%.

It was almost a perfect report.

It certainly reinforces my own forecast of a hot 3% GDP growth rate for the final three quarters of 2015. The question bedeviling traders and investors alike now is, ?How much of this growth is already discounted in today?s prices??

You almost wonder if stocks are tired of going up, which have been appreciating for more than six years. Stock buyers need a new story.

With a discount Euro beckoning, it sounds like this summer will be the best ever to take a long vacation.

Looks Like This is a Down Day

Looks Like This is a Down Day

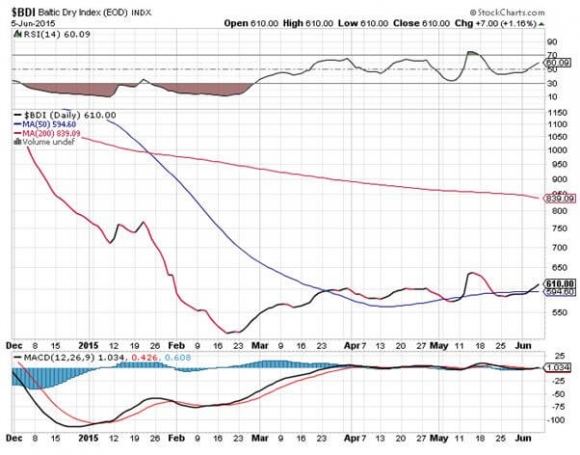

The shipping stocks have had an OK year so far in 2015. The big question remains: ?Is it real,? and ?Is it sustainable??

This sector has been down for so long that most investors left it for dead ages ago. All that was missing was the tolling of the Lutine Bell at the Lloyds of London insurance exchange to mark news of a sunken ship.

Lured by the heroin of artificially cheap financing during the 2000?s, the industry massively expanded capacity, believing that international trade would continue to grow at double digit rates forever.

It didn?t.

Sound familiar? Think of it as ?subprime at sea.?

Then the 2008 financial crisis hit, and demand evaporated. International trade, the main driver of freight rates, collapsed. Rates dropped as much as 90%, and share prices even more.

In those dark days, readers delighted in sending me maps of laid up ships with forlorn crews in Singapore harbor, which at the worst, numbered in the hundreds. You could almost walk to neighboring Malaysia and not get your ankles wet.

For most industries, the economy bottomed shortly thereafter and began a long, slow recovery. Not so for shipping.

China, the world?s largest buyer of bulk commodities, saw its economy peak in 2010, with annualized GDP growth halving since then from 13.5% to 7.0%.

This unleashed a second, even more vicious crisis for the shipping industry. With massive capital requirements, order times for new ships lasting three years, and hefty cancellation fees common, recovery delays are not what you want to hear about.

Ships ordered at the peak of the financing bubble suddenly started showing up in large numbers. So, the industry remained with excess capacity of 20%, especially in the dry bulk, container and crude oil tanker segments.

This was happening in the face of steadily rising fuel prices, thanks to events in Iran, Egypt, Libya, Syria, the Ukraine and now Iraq. The China slowdown also caused scrap metal rates to plummet, so downsizing shippers were paid less for junking their older, smaller, less fuel efficient bottoms.

American energy independence, thanks to the ?fracking? boom, means fewer ships are needed to carry oil from a tempestuous Middle East.

It has been the perfect storm of perfect storms. All but seven of the 30 largest shipping companies bled money in 2012, lots of it. Cumulative industry losses amounted to a mind numbing $7 billion over the previous four years. Companies continued to hemorrhage cash, and shareholders suffered.

And then a funny thing happened. The Chinese economic data slowly started to get better. Any price tied to business activity in the Middle Kingdom started marching upward in unison, including those for iron ore (BHP), (RIO), the Australian dollar (FXA), and Chinese and Australian stocks (FXI), (EWA).

This improvement, no matter how uncertain it may be, was not lost on the shipping industry. Capesize charter rates surged from $5,000 to $16,500, while Panamax rates are expected to fly from $8,000 to $9,500 by January.

Shipping stocks, the most highly leveraged of asset classes, skyrocketed. This enabled the Baltic Dry Index ($BDI), a measure of the cost of chartering bulk carriers for coal, iron ore, wheat, and other dry commodities, to steadily improve.

Apparently, it is off to the races once again.

I am not normally a person who buys a stock after it has just doubled, unless Costco is running a special on Jack Daniels. But if a share has fallen 99%, a double takes it down to only 98%, leaving it still absurdly cheap.

Shipping stocks fell so far, they were well below long dated option value. That means the market thought all of these guys were going under, which was never going to happen.

This is certainly the case with Dry Ships (DRYS), your poster boy for the Greek shipping industry. Adjusted for splits, the shares cratered from $120 to $0.60. It has just clawed its way up to $0.72. The company?s fleet consists of 38 dry bulk carriers, 10 tankers, and has orders for another four ships.

It has completed a major refinancing that takes the firm out of the fire and puts it back into the frying pan. This should buy (DRYS) some time, while other competitors, like Genco Shipping and Trading (GNK) are expected to go under, removing unwanted overcapacity from the market.

It also wisely diversified into offshore oil drilling right at the bottom of the market, picking up a 59% stake in Ocean Rig (ORIG) and its two semisubmersible rigs.

(DRYS) is not your typical ?widows and orphans? type investment. The web is chock full of allegations of insider trading, nepotism, and self-dealing by senior management.

It is domiciled in the Marshall Islands, so don?t expect much transparency. Pass the smell test, it does not. After all, it is a Greek shipping company.

If (DRYS) scares you, and it should, there are safer ways to play the rebound. The Guggenheim Shipping ETF (SEA) offers a broad mix of industry exposure with lower volatility. It is up a healthy 17% so far this year.

Even in the best-case scenario, shipping will never return to the heady growth rates of the naughts. China is highly unlikely to ever return to the breakneck growth rates of yore. The law of large numbers is kicking in with a vengeance.

It is modernizing its economic strategy, from one led by a low value added commodity exports, to a more domestically driven, services oriented approach. The bad news for shippers: The new model uses fewer bulk commodities, and therefore the ships to carry them.

However, if the China recovery is real, even a modest one, then the shipping industry offers one of the best multiple baggers that I can think of.

Just make sure you don?t get seasick from the volatility.

The Lutine Bell

The Lutine Bell

?This goes down as a cycle that is short on respect, but long on resiliency,? said economist, David Rosenberg.

Global Market Comments

June 5, 2015

Fiat Lux

Featured Trade:

(WEDNESDAY MAY 13 GLOBAL STRATEGY WEBINAR),

(JUNE 19 DALLAS, TEXAS GLOBAL STRATEGY LUNCHEON),

(WHY FOOD PLAYS ARE ABOUT TO EXPLODE),

(MOS), (POT), (AGU), (DBA), (MOO)

The Mosaic Company (MOS)

Potash Corp. of Saskatchewan, Inc. (POT)

Agrium Inc. (AGU)

PowerShares DB Agriculture ETF (DBA)

Market Vectors Agribusiness ETF (MOO)

?

Note: Short letter today. No Internet!

Pack your portfolios with agricultural plays like Potash (POT), Mosaic (MOS), and Agrium (AGU) if Dr. Paul Ehrlich is just partially right about the impending collapse in the world?s food supply. You might even throw in long positions in wheat, corn, soybeans, and rice.

The never dull and often controversial Stanford biology professor told me he expects that global warming is leading to significant changes in world weather patterns that will cause droughts in some of the largest food producing areas, causing massive famines.

Food prices will skyrocket, and billions could die. At greatest risk are the big rice producing areas in South Asia, which depend on glacial run off from the Himalayas. If the glaciers melt, this will be gone.

California faces a similar problem if the Sierra snowpack disappears. Rising sea levels displacing 500 million people in low-lying coastal areas is another big problem.

One of the 78-year-old professor?s early books ?The Population Bomb? was required reading for me in college in 1970, and I used to drive up from Los Angeles to hear his lectures (followed by the obligatory side trip to the Haight-Ashbury).

Other big risks to the economy are the threat of a third world nuclear war caused by population pressures, and global plagues facilitated by a widespread growth of intercontinental transportation and globalization. And I won?t get into the threat of a giant solar flare frying our electrical grid. ?Super consumption? in the US needs to be reined in where the population is growing the fastest.

If the world adopts an American standard of living, we need four more Earths to supply the needed natural resources. We need to raise the price of all forms of carbon, preferably through taxes, but cap and trade will work too.

Population control is the answer to all of these problems, which is best achieved by giving women an education, jobs, and rights, and has already worked well in Europe and Japan.

All sobering food for thought.

Global Market Comments

June 4, 2015

Fiat Lux

Featured Trade:

(JUNE 29 LONDON STRATEGY LUNCHEON)

(AN EVENING WITH THE CHINESE INTELLIGENCE SERVICE),

(FXI), (CYB), (BIDU), (CHL), (BYDDF), (CHA)

iShares China Large-Cap (FXI)

WisdomTree Chinese Yuan (CYB)

Baidu, Inc. (BIDU)

China Mobile Limited (CHL)

BYD Company Ltd. (BYDDF)

China Telecom Corp. Ltd. (CHA)

Global Market Comments

June 3, 2015

Fiat Lux

Featured Trade:

(JUNE 22 WASHINGTON DC GLOBAL STRATEGY LUNCHEON)

(THE GLOBAL IMPACT OF THE NEW JAPANESE IRA?S),

(DXJ), (FXY), (YCS), (NMR), (SNE),

(A SPECIAL NOTE ON EXERCISED OPTIONS)

WisdomTree Japan Hedged Equity (DXJ)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

Nomura Holdings, Inc. (NMR)

Sony Corporation (SNE)

Nearly two years ago, the Japanese government introduced the Individual Retirement Account for individual investors in Japan for the first time.

The move was part of Prime Minister Shinzo Abe?s multifaceted efforts to revive Japan?s economy, and could unleash as much as $690 billion in net buying into Japanese equities by 2018.

The move was inspired by American IRA?s, which were first introduced in 1981. After that, the Dow average soared by 25 times. It is amazing to what lengths people will go to avoid the taxman.

Starting October 1, 2013 individuals have been permitted to contribute up to ?1 million a year into Nippon Individual Savings Accounts (NISA) or some $8,000, while married couples can chip in ?2 million.

These funds are exempt from capital gains and dividend taxes for five years. At the same time, capital gains taxes will rise from 10% to 20%.

Thanks to a 22-year long bear market, only 7.9% of personal assets in Japan are currently invested in stocks, compared to 34% in the US. Individuals account for only 28% of the daily trading volume in Tokyo, while foreigners take up 63%. Still, that?s up from only 21% a year earlier.

Over the past 10 years, individuals sold a net $214 billion in equities, keeping their eyes firmly on the rear view mirror. Almost all of the funds were deposited into bank accounts yielding near zero.

Even 10 year Japanese Government Bonds are yielding only 0.41% as of today. That doesn?t buy you much sushi in your retirement.

Over the past three years, Japan has enjoyed having the world?s fastest growing industrialized economy. The latest data show that it is expanding at a white hot 3.5%, versus a far more modest 2% rate in the US, and only 0.5% in Europe.

Early indications are that the NISA?s are hugely popular. Japanese brokers have launched a massive advertising effort to promote the program, which promises to substantially boost their own earnings. Firms have had to lay on extra customer support staff to assist with online applications, where clueless investors have spent two decades in hiding. That certainly makes Japanese brokers, like Nomura (NMR), a buy. Another of my favorites is Sony (SNE).

To get some idea of the potential, take a look at how Merrill Lynch?s stock performed after 1981, which rose by many multiples. The bear market has lasted for so long that many applicants confess to investing in equities for the first time in their lives.

Since Shinzo Abe announced his candidacy for prime minister and his revolutionary economic and monetary program nearly four years ago, the Japanese stock market (DXJ) has soared by an amazing 176% in US dollar terms. The short Japanese yen 2X ETF (YCS) has similarly rocketed by a huge 232%.

Regular readers of the Mad Hedge Fund Trader have been mercilessly pounded to buy Japanese stocks and sell short the Japanese yen for the best of three years. I can almost hear ?Oh no, here comes another yen bashing piece!?

The need to bolster Japan?s retirement finances is overwhelming. It has the world?s oldest population, with some 26% of their 127.6 million over the age of 65.

The average life span in Japan is 82.6 years. That is a lot of people to support for a $6 trillion GDP. Thanks to plummeting fertility rates, the population is expected to decline to 106 million by 2055.

By yanking $690 billion out of the banks and moving out the risk spectrum, Abe?s new IRA?s provide additional means through which the economy can permanently return to health.

Higher stock prices will provide cheap equity financing for public companies, which can then reinvest in the domestic economy and create jobs.

I have written endlessly on the fundamental case for a strong Japanese stock market this year (to read my previous articles on yen, please click the following links: ??Rumblings in Tokyo?, ?New BOJ Governor Craters Yen??and ?New BOJ Governor Crushes the Yen?).

So How Does This Order App Work?

So How Does This Order App Work?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.