While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 5, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH WITH 41.6% GAIN),

(DECODING THE GREENBACK),

(THE FUSION IN YOUR FUTURE),

(WHAT ABOUT ASSET ALLOCATION?)

I am writing this to you from my lakefront estate at Incline Village, Nevada. I thought I?d get one more 100-mile hike in before the heavy snow falls. By now the mountain lions have migrated to lower altitudes so it?s safer.

I?ll need the fresh air to map out my trading strategy for 2015 to please the many new subscribers who have recently come on board. This market has killed off a large number of pros this year, and is getting trickier by the day.

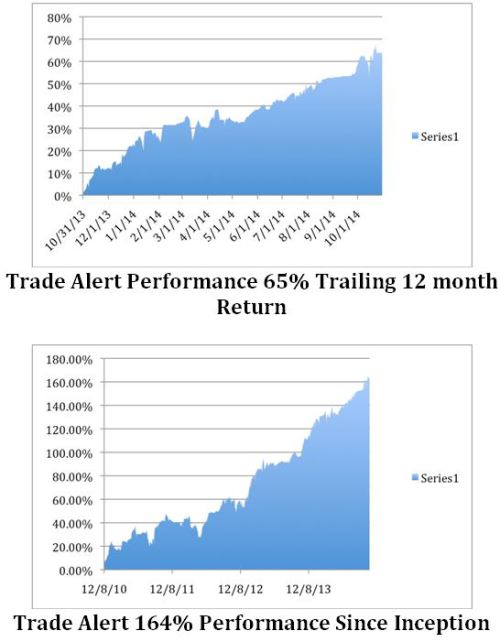

After enduring the turmoil of one of the worst Octobers on record, it turned out to be our best month of the year. Followers closed the month up a mouth watering 6.69%.

That brings us to a profit of 41.6% for 2014, not a bad number to nail to the mast.

This is compared to the miserable performance of the Dow Average, which is up only 2% during the same period. That was on the heels of blockbuster 5.01% gain in September.

The nearly four year return is now at an amazing 164%, compared to a far more modest increase for the Dow Average during the same period of only 35%.

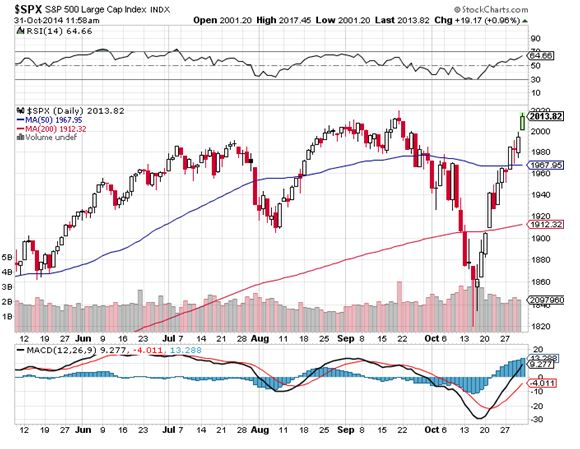

I was actually up 10% at the highpoint last month. I played the month perfectly, running big shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) and covering them right at the bottom.

Then, I went aggressively long Delta Airlines (DAL), Gilead Sciences (GILD), Apple (AAPL), and the (SPY), catching the ferocious rally that followed, and shaking it by the lapels for all it was worth.

Hefty short positions in the euro (FXE), (EUO), and the Japanese yen (FXY), (YCS) were worth their weight in gold. When the Bank of Japan let loose a flock of black swans with their shock and awe monetary easing, the profit on our (FXY) had already been maxed out, while the (YCS) holders caught the entire once in a lifetime, one day 6 point move.

To show you how perfectly things were going, I even managed to come out of a long suffering (TBT) position for a small profit after yields backed up on the ten year Treasury from 1.86% to 2.35%.

Then I came to the bridge too far. Thinking that the market couldn?t possibly rise 10% in two weeks, I sold short an (SPY) November $197-$202 call spread. Wrong! By the time I was stopped out some 6% was knocked off my performance this year.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past seven years. No one got wiped out. No one got a margin call. I quickly cut the highest risk positions, enabling me to ride out the storm with the rest. It all worked.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real, and new ones come in almost every day.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes?Global Trading Dispatch?(my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website at?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

You Really Needed a Suit of Armor to Survive October!

You Really Needed a Suit of Armor to Survive October!

?When you look at the size of the US work force over the next 30 years, it is going to increase by 30%. That compares to Japan, where it is going to be shrinking, Europe, where it is contracting, and even China, where it turns down. The idea that the baby boomers are going to overwhelm this huge growth in the work force is a myth,? said Scott Minerd, Managing Partner of Guggenheim Partners.

Global Market Comments

November 4, 2014

Fiat Lux

Featured Trade:

(IS THERE A BITCOIN IN YOUR FUTURE?)

(TESTIMONIAL)

Global Market Comments

November 3, 2014

Fiat Lux

Featured Trade:

(JAPANESE YEN MELTS DOWN TO 12 YEAR LOW!),

(FXY), (YCS), (SPY), (TLT), (TBT), (DXJ),

(THERE ARE NO GURUS),

(WATCH OUT FOR THE MILLENNIAL VOTER)

(TESTIMONIAL)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

WisdomTree Japan Hedged Equity ETF (DXJ)

Those who woke up early Friday morning may be forgiven for blinking at their screens quite a few times.

The Japanese yen (FXY), (YCS) was down by an incredible 3%, the Dow Average futures were trading at an all time high of $17,400, and the S&P 500 was just short of a new peak at $202.

The Japanese stock market blasted 5% to the upside, taking the Wisdom Tree Japan Hedged Equity ETF (DXJ) up a staggering 8%.

Was this a trick or treat?

It only took a few seconds for me to learn that this was all in reaction to bold moves announced by the Bank of Japan overnight. In one fell swoop, they boosted their target for monetary expansion this fiscal year from Y60 trillion to Y80 trillion, an instant gain of 33%, or $200 billion.

Prorate this number for the difference in out two nations? GDP?s, and that is like the Federal Reserve announcing a new $700 billion monetary stimulus program out of the blue. Quantitative easing is not dead. The baton has merely been passed from the US to Europe and Japan.

The bottom line for us? Asset prices everywhere go higher.

Of course, readers of the Mad Hedge Fund Trader knew all this was coming.

While taking profits yesterday on my Japan yen put spread, I cautioned holders of the ProShares Ultra Short Yen ETF (YCS) to hang on because the beleaguered Japanese currency was headed much lower.

Those who did so were richly rewarded with a one-day pop of $4.50 overnight to $79.50, an all time high.

Parsing through the BOJ statement, it?s clear that these spectacular, once a decade moves were justified.

When the Japanese government implemented a poorly conceived tax increase in April, the BOJ sat on its hands.

After sleeping through most of the year, the hand of Japanese central bank was finally forced by simultaneous weakness in Europe. It is now implementing the Fed QE policy lock, stock, and barrel, given the proven excellent results here in the US. They are only five years late!

An even bigger blockbuster was another announcement made by Japan?s government controlled Pension Investment Corp. that it was totally reshuffling its massive $1.2 trillion investment portfolio.

It is doubling its allocation to international equities from $150 billion to $300 billion. Given the dire conditions in Europe, you can count on most of that money going into the US stocks. That explains our gap up in the (SPX) this morning, and a similar move down in bonds (TLT), (TBT).

Here is their new Model Portfolio:

Domestic Bonds 35%

Domestic Stocks 25%

International Stocks 25%

International Bonds 15%

Total 100%

The net effect of all of this is to effect an epochal move out of bonds and into stocks, and also to increase international investments at the expense of domestic ones.

I believe this is the beginning of a prolonged world-wide investment trend.

The bottom line for us traders here is that the Japanese action opens up the possibility of an entire ?RISK ON? leg upward. This is occurring on top of one of the sharpest legs up in market history.

All of a sudden, my yearend target of $2,100 for the S&P 500 is firmly back on the table. If you have any outstanding short positions on your books, it is better to cover them at the earliest opportunity.

Tally Ho!

Global Market Comments

October 31, 2014

Fiat Lux

Featured Trade:

(NOVEMBER 5 GLOBAL STRATEGY WEBINAR),

(THE 2014 WORLD SERIES FROM YOUR BASEBALL CORRESPONDENT)

What a game! Burp.

The San Francisco Giants trounced the Kansas City Royals 3-2 in what had to be one of the most exciting games in World Series History. After winning four of seven games, the City by the Bay brings home the Commissioner?s Trophy for the third time in five years.

The Giants are starting to rival the incredible run enjoyed by the New York Yankees during the 1920?s. My grandparents went to every game 90 years ago, and enthralling me as a child with tales of Babe Ruth knocking the ball out of the park. Baseball runs in our blood in my family.

I attended game two in San Francisco, and spent the pregame completing my Christmas shopping for the year, feverishly buying commemorative baseballs, knit hats, and T-shirts at $40 a pop. China?s trade surplus must be soaring.

A Niagara Falls of beer was pouring out of the concession stands. The air was electric with enthusiasm. An entire flotilla of yachts and kayaks moored in McCovey cove, watching the game on iPhones, hoping for a home run to fly straight to them.

The F-16?s flew in formation 500 feet overhead right on cue, a GoPro camera broadcasting the cockpit view to a giant screen in the stadium.

Cool!

House Minority Leader, Nancy Pelosi, and California Lieutenant Governor, Gavin Newsome, sat just below me, where else, but in the left infield. In fact, a foul ball almost landed in the lap of the Pelosi.

Staring Giants pitcher, 25-year-old Madison Bumgarner, seemed to defy the laws of physics, using a slight, boyish frame to throw a sizzling 98 mile per hour fast ball. If he would only get a haircut! Are baseball players getting younger, or am I getting older?

I missed heavyweight, Juan ?The Panda? Sandoval, belt out a home run because I was stuck in the 30-minute line to get into the men?s room. The blue clad Royals cheering section went comatose, where else, but in the far upper right field bleachers.

Both sides threatened to score in every inning. We spent virtually the entire game standing on our feet screaming our lungs out.

Many thanks to the San Francisco Bay Area readers who emailed encouragement to me throughout the game. To the Kansas City readers who sent messages like ?Go Royals? when they scored, a pox on your houses, homesteads, teepees, or wherever you live in that God forsaken land.

When the Giants won their games, the fireworks exploded over the bay. The city ignited into celebration, with cars everywhere honking their horns and cable cars ringing bells.

Probably 100,000 poured out of packed bars into the streets for a huge nonstop party. Groping my way through the crowd, I almost got run over by the black GM Suburban?s of Nancy Pelosi?s Secret Service detail attempting a speedy exit.

I almost fell asleep on the last train home. If I had, I would have ended up at the end of the line at Pittsburgh/Bay Point, where I would have gotten mugged and lost all of my $40 T-shirts.

But I didn?t. I?m back to Earth today writing this letter with the mother of all hangovers. My clothes were so covered with spilled beer, cotton candy, and errant mustard and ketchup I undressed directly in the laundry room. Hopefully, the dry cleaner can figure out how to get the chewing gum off my prized Giants jacket.

To watch a two minute video of one of the most exciting games in history, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.