Now we learn that the Ebola virus has been riding New York?s ?A? train subway line since October 21!

That is what we have learned from the physician from Doctors Without Borders, now locked up in the Ebola Ward at Manhattan?s Bellevue Hospital, just returned from treating victims in the West African country of Guinea. His girlfriend and some close friends have been rounded up and are now undergoing 21 day isolation treatment.

As for the 100,000 people who have ridden the ?A? train since, we?ll just have to wait and see. And the Uber drive involved, who knows?

The doctor also went bowling in Brooklyn before he checked himself into the hospital. That will almost certainly signal the death of this much-loved recreation. Who knows where those fingers have been that used that 16 pound ball last?

Looks like I?ll never top my lifetime best of a 200 score.

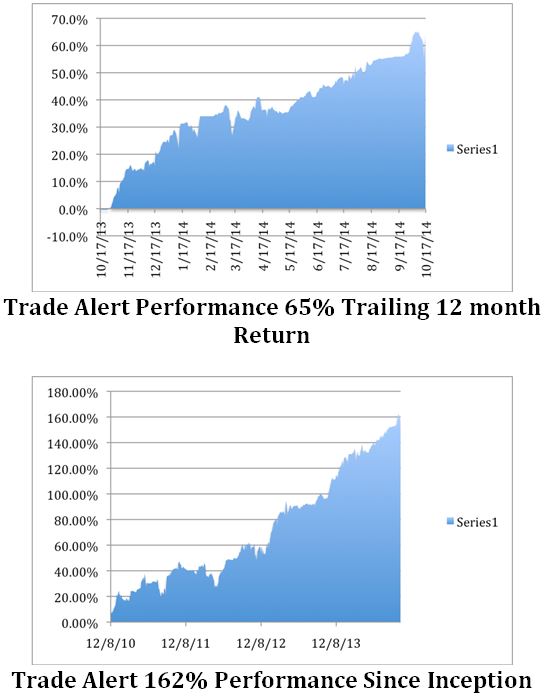

As a long in the tooth trader of most of the world?s major markets, I can tell you to use every Ebola induced market swoon as a buying opportunity. To explain why, I have to delve into my dark and murky past.

Back in the early 1970?s, the well-connected head of the Biology Department at the University of Southern California got me a summer job at the Nuclear Test Site in Nevada.

Some 60 miles north of Las Vegas on lonely US Highway 95, I found four recreational vehicles parked on the right side of the road in the middle of nowhere, the place of business, one of the world?s oldest profession.

But where were the customers? From there, a dirt road headed east and disappeared over a distant mountain range. The road was not on the map.

An hour latter I found myself in Mercury, Nevada, then inside Nellis Air Force base, the mythical ?Area 51.? Baking in 120-degree heat and filled with hundreds of WWII era Quonset huts, Mercury Nevada was one of the most forlorn parts of the world. The sole recreational facility was the swimming pool, which was particularly popular with the coed graduate students after midnight.

My heavy math background got me a job to work on the ultra top secret Neutron Bomb project, although I didn?t find out that?s what is was for another decade. This is where ?yield? didn?t mean interest paid, but ?millions killed.?

Because I came from a biology department I was particularly popular with the biowarfare guys, who were also there in force. My area of expertise was tropical diseases.

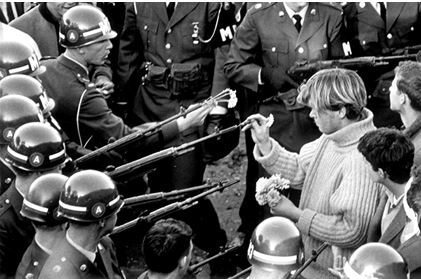

I was often invited to lunch at the commissary so they could pick my brain for potential new vectors. Yes, the subject of Ebola came up, as the kill rate was an attractively high 50%. But it was dismissed because the transmissibility is so poor. You can?t rely on a bioweapon that requires you to hug your enemy.

In the end, the flu virus was settled on as the most effective agent. It is airborne, and the virus reproduces every hour. It has also been field-tested. During the great 1918-1919 Spanish Flu pandemic, 100 million died around the world, mostly those in their teens and twenties, including a couple of great aunts of mine.

Best of all, it naturally originates in China, where contact between humans and pigs is the greatest on the planet. That?s where our viruses combine to form new organisms. You?d never be able to tell the difference between a bioattack and the real thing.

Since then, the US has created hundreds of synthetic viruses and stockpiled their vaccines. The Chinese have created thousands. For more depth on this, click here for ?Will SynBio Save or Destroy the World?.

Which brings us all to where we are today. Why do we have a fixation, not only with Ebola, but ISIL, Russia, China, and the Ukraine as well?

I blame it all on the 24 hour news cycle, a monster with a voracious appetite that has to be constantly fed. Never mind that much of what they pump out is speculation, or is just plain untrue.

The financial media are the worst of all. On market down days they parade out their collection of perma bears. On the up days the perma pulls get the spotlight. Listen to all the advice and you end up buying the up days and selling the down days.

It is a perfect money destruction machine. Too many individual investors run through entire 401k?s and IRA?s before they figure this out, if ever.

I know when many readers see a news flash, they wonder ?Gee, should I sell?? I know people in New York who have become so nervous about Ebola, they have quit shaking hands with people.

I?m a little different.

One moron actually predicted that there would be 300,000 Ebola cases in Liberia by the end of the year. One of the purposes of this newsletter is to separate out fact from fiction, the wheat from the chaff. I take great pleasure in using an Ebola induced market dump to get you to load up on S&P 500 (SPY) calls spreads, as I have done.

I?ll tell you what the stock market thinks about Ebola. The two who caught the disease after the initial fatality are cured. The 48 who came into contact with him are also out of their 21 days quarantine period. So far the US has suffered one fatality from the dread virus, but boasts 330 million survivors.

There was a time in our history when we were flooded with thousands of disease carrying immigrants. They carried everything from black plague to smallpox, cholera, dengue fever, malaria, and tuberculosis.

What the government did then was quarantine all suspected carriers to Angle Island in San Francisco Bay and Ellis Island in New York harbor, until the doctors gave them the all clear. The new quarantine procedures hark back to that day.

You are not going to get the Ebola Virus. Earnings are the primary market focus here, not an African virus. Keep your eye on the ball, and don?t get distracted.

No Ebola Here

No Ebola Here