The red hot performance of the Mad Hedge Fund Trader?s Trade Alert Service has maintained its blistering pace from last year, picking up another 5.73% profit in the first two trading weeks of 2014. The S&P 500 was down during the same period. Since the beginning of 2013, I am up 73.23%.

2013 closed with a total return for followers of 67.45%. Including both open and closed trades, all nine of the Trade Alerts issued so far this year were profitable, a success rate of 100%.

The three-year return is now an eye popping 128.3%, compared to a far more modest increase for the Dow Average during the same period of only 35%. That brings my averaged annualized return up to 41.6%.

This has been the profit since my groundbreaking trade mentoring service was launched in 2010. It all is a matter of the harder I work, the luckier I get.

The hot streak continues. It seems like I can do no wrong, but am avoiding walking under ladders, breaking mirrors, and trading on Friday the 13th.

I held on to every risk on position during the two-week December correction, fully expecting the pause to become the springboard for a new run to all time highs by year-end. That is exactly what happened in the wake of the Federal Reserve?s decision to taper its quantitative easing program by only $10 billion a month, mere sofa change given the size of our bond market.

The rally then came to a dead stop, once the New Year?s celebrations were over. The disappointing December nonfarm payroll of 74,000 didn?t help. But I held on to every ?RISK ON? position. That turned out to be the perfect thing to do.

In the rapid surge that followed this week, I took profits in the Financials Select Sector SPDR ETF (XLF), thanks to the leadership of the big banks. Ditto for my long position in the S&P 500 (SPY).

I also did well with my bets on the Technology Select Sector ETF (XLK). I benefited from a huge run in Apple (AAPL), its deal with China Mobile (CHL) assuring that my call options expired at their maximum value.

My assumption that Obamacare would herald a new golden age for the health care industry proved dead on, with my long in Gilead Sciences (GILD), racing to new highs. My short in the Japanese yen (FXY) provided yet another paycheck, like the ever faithful rich uncle.

Progress in the Geneva peace talks with Iran crush oil and robbed me of some of my profits in my Energy Sector Select SPDR ETF (XLE), but I still closed out positive. I even made a small amount of money in my Treasury bond short, despite a ferocious five point rally against me.

I am now 70% in cash, awaiting better entry points in the market on which I can pounce. I am still lugging a long in Softbank (SFTBY) shares at cost, awaiting the Alibaba IPO. I also slapped on a short position I AT&T (T) yesterday, a favorite hedge fund target, capitalizing on an ever weakening cash flow position in the company.

My esteemed colleague, Mad Day Trader Jim Parker, has also been coining it. Since April, his own performance numbers have just come back from the auditors, revealing that he is up a staggering 374%. That is just for an eight month year!

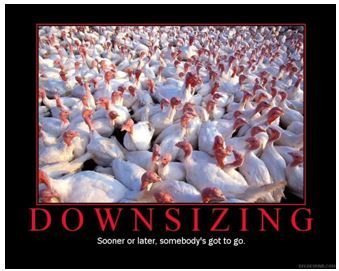

The coming winter promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere in 2014.

The Trade Alerts should be coming hot and heavy. Please join me on the gravy train. You will never get a better chance than this to make money for your personal account.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars.? Upgrade to?Mad Hedge Fund Trader PRO?and you will also receive Jim Parker?s?Mad Day Trader?service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the blue ?SUBSCRIBE NOW? button.