One hundred years from now, historians will probably date the beginning of the fall of the American Empire to 1986. That is the year President Ronald Reagan ordered Jimmy Carter?s solar panels torn down from the White House roof, and when Chinese Premier Deng Xiaoping launched his secret ?863? program to make his country a global technology leader.

Is the End Near for the US?

Is the End Near for the US?

? The big question today is who will win one of the biggest opportunities of our generation. Some 27 years later, the evidence that China is winning this final battle is everywhere.? China dominates in windmill power, controls 97% of the world?s rare earth supplies essential for modern electronics, is plunging ahead with ?clean coal?, and boasts the world?s most ambitious nuclear power program. It is a dominant player in high-speed rail, and is making serious moves into commercial and military aviation. It is also cleaning our clock in electric cars, with more than 30 low cost, emission free models coming to the market by the end of 2013. Looking from a distance, one could conclude that China has already won the technology war. Not if Tesla?s (TSLA) Elon Musk has anything to say about it. Our only serious entrant in this life or death competition is the Tesla Model S-1, which has been on the market now for a year.? At $80,000 per vehicle for the long range version that accounts for 90% of sales, production is now ramping up to a modest 40,000 units a year. My Model X SUV won?t be delivered until January 2015. Elon tells me that he plans to bring out a $40,000, 300-mile range ?Next Gen? vehicle by 2018, which will reach 500,000 in annual production. And they will all be 100% ?Made in the USA.?

And the Winner Is?

And the Winner Is?

? General Motors? (GM) pitiful entrant in this sweepstakes, the Chevy Volt, has utterly failed to reach the firm?s sales targets. It is, in fact, a hybrid that runs on battery power for the first 40 miles, when a weak conventional gasoline engine takes over to deal with ?range anxiety.? Still, I receive constant emails from drivers who say they absolutely love the cars, with many still driving around on the original year old tank of gas. And at $39,000, with dealer discounts and tax subsidies, it IS cheap. This is all far more than a race to bring commercial products to the marketplace. At stake is nothing less than the viability of our two economic systems. By setting national goals, providing unlimited funding, focusing scarce resources, and letting engineers run it all, China can orchestrate assaults on technical barriers and markets that planners here can only dream about. And let?s face it, economies of scale are possible in the Middle Kingdom that would be unimaginable in America.

Nissan Leaf

Nissan Leaf

The laissez faire, libertarian approach now in vogue in the US creates a lot of noise, but little progress. The Dotcom bust dried up substantial research and development funding for technology for a decade. A ban on government funding of stem cell research, for religious reasons, left us seriously behind in that crucial field. An administration that believed that global warming was a leftist hoax, coddled big oil, and put alternative energy development on a back burner. While China was ramping up clean coal research, President Bush was closing down ours. Never mind that the people supplying us with 2 million barrels of crude a day from the Middle East are trying to kill us through whatever means possible, and are using our money to do it. But Americans are finally figuring out that we can?t raise our standard of living selling subprime loans to each other, and that a new direction is needed.

Toyota Plug-In Prius

Toyota Plug-In Prius

Mention government involvement in anything these days and you get a sour, skeptical look. But this ignores the indisputable verdict of history. Most of the great leaps forward in US economic history were the product of massive government involvement. I?m thinking of the transcontinental railroad, the Panama Canal, Hoover Dam, the atomic bomb, and the interstate highway system. All of these were far too big for a private company ever to consider. If the government had not funneled billions in today?s dollars into early computer research, your laptop today would run on vacuum tubes, be as big as a skyscraper, and cost $100 million.

Check Out My New Laptop

Check Out My New Laptop

I mention all of this not because I have a fascination with obscure automotive technologies or inorganic chemistry (even though I do). Long time readers of this letter have already made some serious money in the battery space. This is not pie in the sky stuff; this is where money is being made now. I caught a 500% gain by hanging on to Warren Buffet?s coat tails with an investment in the Middle Kingdom?s Build Your Dreams (BYDDF) four years ago. I followed with a 250% profit in Chile?s Sociedad Qimica Y Minera (SQM), the world?s largest lithium producer. Tesla?s own shares have been the top performer in the US market in 2014, up over 400%. These are not small numbers. I have been an advocate and an enabler of this technology for 40 years, and my obsession has only recently started to pay off big time. We?re not talking about a few niche products here. The research boutique, HIS Insights, predicts that electric cars will take over 15% of the global car market, or 7.5 million units by 2020. Even with costs falling, that means the market will then be worth $225 billion. Electric cars and their multitude of spin off technologies will become a dominant investment theme for the rest of our lives. Think of the auto industry in the 1920?s. (TSLA), (BYDDF), and (SQM) are just the appetizers.

the term ?battery? after his experiments with brass keys and lightning. In 1859, Gaston Plant? discovered the formula that powers the Energizer bunny today.

I Don?t Look 154 Years Old, Do I?

I Don?t Look 154 Years Old, Do I?

Further progress was not made until none other than Exxon developed the first lithium-ion battery in 1977. Then, oil prices crashed, and the company scrapped the program, a strategy misstep that was to become a familiar refrain. Sony (SNE) took over the lead with nickel metal hydride technology, and owns the industry today, along with Chinese and South Korean competitors.

BYD F3

BYD F3

We wait in gas lines to ?fill ?er up? for a reason. Gasoline has been the most efficient, concentrated, and easily distributed source of energy for more than a century. Expect to hear a lot about the number 1,600 in coming years. That is the amount of electrical energy in a liter (0.26 gallons), or kilogram of gasoline expressed in kilowatt-hours. A one-kilogram lithium-ion battery using today?s most advanced designs produces 200 KwH. Stretching the envelope, scientists might get that to 400 KwH in the near future. But any freshman physics student can tell you that since electrical motors are four times more efficient than internal combustion ones, that is effective parity with gasoline. Since no one has done any serious research on inorganic chemistry since the Manhattan project, until Elon Musk came along, the prospects for rapid advances are good. A good rule of thumb is that costs will drop by half every four years. So Tesla S-1 battery that costs $30,000 today will run $15,000 in 2017 and only $7,500 in 2021. Per Kilowatt battery costs are dropping like a stone, from $1,000 a kWh in the Nissan Leaf I bought three years ago to $365. kWh in my new Tesla S-1. In fact, the Tesla, is such a revolutionary product that the battery is only the eighth most important thing. The additional savings that no one talks about is that an electric motor with only eleven moving parts requires no tune-ups for the life of the vehicle. This compares to over 1,000 parts for a standard gas engine. You only rotate tires every 6,000 miles. That?s because the motor runs at room temperature, compared to 500 degrees for a conventional engine, so the parts last forever. Visit the Tesla factory, and you are struck by the fact that there are almost no people, just an army of German robots. Few parts mean fewer workers, and lower costs. All of the parts are made at the Fremont, CA plant, eliminating logistical headaches, and more cost. By only selling the vehicle online, the expense of a huge dealer network is dispatched. The US government rates the S-1 as the safest car every built, a fact that I personally tested with my own crash. Consumer Reports argues that it is the highest quality vehicle every manufactured.

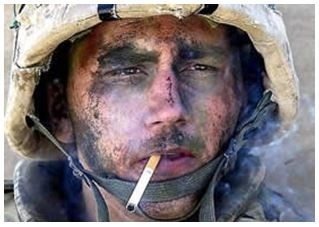

My Personal Crash Test

My Personal Crash Test

Indeed, the Tesla S-1 is already the most registered car in America?s highest earning zip codes. Oh, and did I tell you that the car is totally cool?

Anything for a Green Card

Anything for a Green Card

Consumers were the ultimate winners of that face off as the profusion of technologies the space program fathered pushed standards of living up everywhere. I bet that?s how this contest ends as well. The only question is whether the operating instructions will come in English?or Mandarin.

My Personal Crash Test

My Personal Crash Test