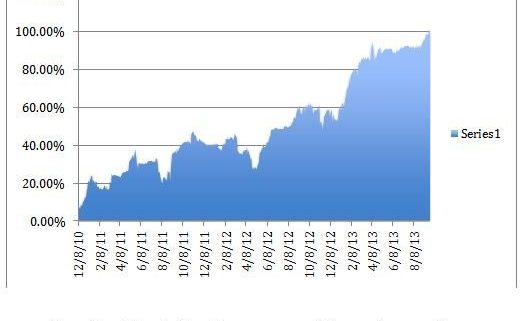

The Trade Alert service of the Mad Hedge Fund Trader has posted a three year return of 101.11%, a new all time high. That compares to a far more modest increase for the Dow Average during the same period of 26%.

This has been the largest profit since the ground-breaking trade mentoring service was launched 34 months ago. The year to date profit is an eye popping 46.06%. This pegs the average annualized return at 35.7%, putting me at the apex of all hedge fund managers.

These numbers come off the back of a blistering September month-to-date of up +8.48%. Carving out the closed 2013 trades alone, 43 out of 53 have made money, a success rate of 81%. In addition, we are carrying six open trades, which are profitable. It is a track record that most big hedge funds would kill for.

This performance was only made possible by correctly calling the near term direction of stocks, bonds, foreign currencies, energy, precious metals and the agricultural products. This may sound easy, until you try it. Some retirement!

It seems that I was among the 1% of market strategists who correctly predicted that the Federal Reserve would not taper its quantitative easing program at its latest meeting. That enabled me to go into the decision with a substantial ?RISK ON? portfolio. I?m sorry, but the numbers were just not there for a data driven Fed to see.

My big win this month has been my major short position in the Japanese yen (FXY), (YCS). The Japan win on hosting the 2020 Olympics gave the beleaguered Japanese currency some extra downside momentum. Then yen has already collapsed in the crosses, and a further major breakdown against the dollar is imminent.

We really coined it on a short position in the Euro (FXE), coming out near the bottom. A new position in copper producer, Freeport McMoRan (FCX), become immediately profitable, jumping some 5% after the Trade Alert went out. I jumped at the $60 selloff in Apple shares in the wake of their latest product launch, instantly, moving into the green with this holding as well. The same is true for my long in the Australian dollar (FXA).

Only my oil short left me with a hickey, which I stopped out of, thanks to the Syria gas attack. Still, if I had held it for only two more hours it would have made money when the Russian peace initiative for Syria was announced. Risk control is paramount if you want to swing for the fences. Welcome to show business.

The coming autumn promises to deliver a harvest of new trading opportunities. On the menu are the taper, a new Fed governor, a debt ceiling crisis, a possible war with Syria, and the death of the bull market in bonds. The Trade Alerts should be coming hot and heavy.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars, order Global Trading Dispatch PRO adds Jim Parker?s Mad Day Trader service.

To subscribe, please go to my website store, click on the orange buttons to get more information.