Global Market Comments

June 27, 2013

Fiat Lux

Featured Trade:

(UPDATED 2013 STRATEGY LUNCHEON SCHEDULE),

(THE BITTER MEDICINE FOR THE STATES),

(THE FALLING MARKET FOR KIDS),

(HOLLYWOOD CASHES IN ON WALL STREET TROUBLES)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?STRATEGY LUNCHEONS?.

New York City - July 2

London, England - July 8

Amsterdam, Netherlands - July 12

Berlin, Germany - July 16

Frankfurt, Germany - July 19

Portofino, Italy - July 25

Mykonos, Greece - August 1

Zermatt, Switzerland - August 9

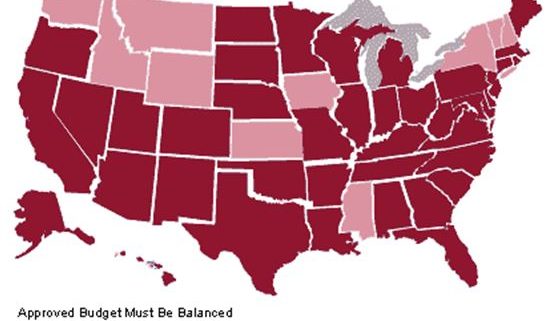

On a map, it appears that the United States is made up of 50 states. The fiscal reality is that we have 20 Portugal?s, 15 Italy?s, 10 Ireland?s, 3 Greece?s, and 2 Spain?s.

In the aftermath of the Great Recession, state GDP?s saw the sharpest drop since 1981. States shoveled money out of the economy nearly as fast as the Obama administration shoveled it in. During the bubble, the states wildly overestimated revenues, thought they were richer than they really were, and bulked up on social services as if the party would go on forever.

As a result, spending grew faster than the economy for many years, especially when it came to building new prisons. Because of the ephemeral nature of property and stock gains, that movie now has to run in reverse, and state services have to shrink down to what they can afford.

During the last two recessions, state and local governments hired, easing some of the pain at the local level. Not this time. Teachers, policemen, and firemen have been laid off with reckless abandon, the oldest and most expensive usually targeted to go first.

Entitlements, primarily state employee pension payments, are going to have to be the top priority, which in many cases now exceed those in the private sector. The headache is so huge that it is mathematically impossible for any tax increase to address the shortfall alone. No action at all brings slower economic growth and fewer jobs. This is all one reason why I am pounding the table for a long-term growth rate of 2%-2.5% which the financial markets have only recently started to embrace.

Until the 19th century, children used to provide income and security for their parents as they worked on the family farm. That dynamic continued when industrialization brought families into the cities and kids into the factories.

Since then, children have been a great short. A hundred years of state mandated education and child labor laws increased the cost of raising children while reducing their income potential. Today many offspring stay in increasingly expensive schools until their mid-twenties without earning a dime of income.

A century ago, 10 children were a godsend. Today they would be ruinous. Spending on children has flipped from an investment to conspicuous consumption. I count myself in the latter category, as I have five kids of my own. The cost of children is proving to be the most effective form of birth control. The problem is that it is working too well, as fertility rates are collapsing in all parts of the globe, except in the Islamic world.

Many nations have fertility rates that during 2005-2010 plunged far below the 2.1 replacement rate, like Taiwan (1.14) Italy (1.18), Japan (1.27), and Russia (1.34). The US is nearly at breakeven at 2.05, versus a world average of 2.55, and an amazing 7.19 in the sub Saharan nation of Niger. This is partially being offset by lifespans that have doubled since 1800 in the industrialized world from 40 to 80, and are now quickly ratcheting up in emerging nations.

The World Bank expects the global population to jump by 2 billion to 9 billion by 2050, and then flatten out. The big question for all of us: what does a zero population growth mean for the economy, which until now has always been driven on an endlessly rising number of consumers? How soon will financial markets start to discount its implications, whatever they are? Expect to hear a lot more about this issue.

I have done many things in my life: hedge fund manager, pilot, cowboy, journalist, stockbroker, mountain climber, translator, guide, etc, etc. etc. Now add technical consultant to Hollywood to the list.

According to the New York Times, Simon Baker, star of the TV show ?The Mentalist?, is using the Diary of a Mad Hedge Fund Trader as a resource to humanize Wall Street traders in the upcoming film entitled ?Margin Call? (click here to read the review). This is not an easy task, as the public generally considers denizens of the pit as greedy, soulless, money-grubbing monsters, difficult to empathize with in any setting.

The star-studded thriller includes Kevin Spacey, Demi Moore, and Jeremy Irons, and focuses on a 24-hour period during the height of the financial crisis at a fictional Wall Street bank. No doubt, the producers hoped to ride on the coattails of Oliver Stone?s sequel to the classic film, Wall Street.

As with the last film, the great industry guessing game is identifying who and which institutions in real life are being portrayed. The film was released last fall to mixed reviews. This, I must see. Hey Kevin, baby, have your people call my people and let?s do lunch! To buy the DVD on Amazon, please click here.

Demi?s Looking to Make Some New Investments

Global Market Comments

June 26, 2013

Fiat Lux

Featured Trade:

(JULY 8 LONDON STRATEGY LUNCHEON),

(MEET MAD DAY TRADER JIM PARKER AT THE JULY 2 NEW YORK LUNCH),

(WHERE THE ECONOMIST "BIG MAC" INDEX FINDS CURRENCY VALUE),

(FXF), (FXE), (FXA), (CYB)

(ANOTHER MIRACLE FROM TESLA), (TSLA), (SCTY)

CurrencyShares Swiss Franc Trust (FXF)

CurrencyShares Euro Trust (FXE)

CurrencyShares Australian Dollar Trust (FXA)

WisdomTree Chinese Yuan (CYB)

Tesla Motors, Inc. (TSLA)

SolarCity Corporation (SCTY)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Jim Parker, who runs our Mad Day Trader Service, will be making a last minute appearance at my New York strategy luncheon on July 2. There you can ask him any questions you want about his new short term trade mentoring program, which goes on sale on Monday. You can buy his service as a stand-alone product for $2,000 per year, or $1,000 as an upgrade to your existing Global Trading Dispatch package.

To buy tickets for the luncheon, please buy a ticket for $209 by clicking here. I just ordered the food, and I decided to go for the Big Apple menu with the New York style cheesecake for dessert. See you there, and don?t forget about the strict dress code.

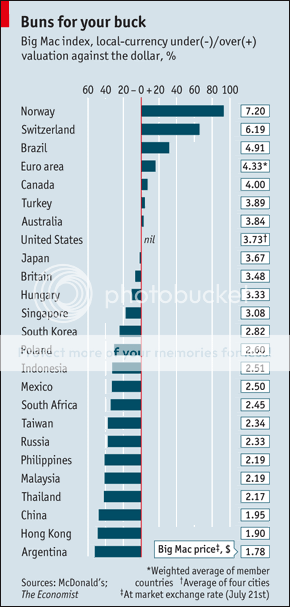

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations.

Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald?s (MCD) premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation.

What are its conclusions today? The Swiss franc (FXF), the Brazilian real, and the Euro (FXE) are overvalued, while the Hong Kong dollar, the Chinese Yuan (CYB), and the Thai Baht are cheap. I couldn?t agree more with many of these conclusions. It?s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas. I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my ass. Better to use it as an economic forecasting tool, than a speedy lunch.

The Big Mac in Yen is Definitely Not a Buy

The Big Mac in Yen is Definitely Not a Buy

Tesla has announced a new battery swapping service that will enable drivers to get a full charge for their all-electric Model S-1 sedans in 90 seconds. The service will be available at strategically located charging stations around the country, and will cost $60, about the cost of an equivalent full tank of gas.

The swap is fully automated. You just drive over a machine and it is all done for you. No crawling under the car on your back is required.

There, owners will have the option of getting a fast charge for free in 45 minutes, or the instant battery swap. Given that the 270-mile range of the car is greater than the range of by bladder, I?ll probably be opting for the former.

The move offers some very interesting long-term implications. It certainly means that Tesla is not worried about the life of its 1,000-pound lithium ion batteries, which cost about $32,000 per vehicle to produce. If the range starts to fade, you just take it in for a swap.

In any case, the company?s mercurial founder and Iron Man model, Elon Musk, has other plans for old, depleted batteries. For a start, they can be used as backup storage devices for solar powered homes wired by his other firm, Solar City (SCTY), a top performing stock of 2013.

In the meantime, Tesla?s shares are impossibly maintaining a stratospheric price of over $100, valuing the company at $11 billion, and making it the number one performing American stock this year. This is despite announcing its first recall for a minor weld holding down the rear seat.

I tell my kids that I rode a time machine ten years into the future, bought the Tesla, and brought it back home to drive them. Ever the wise aleck, my oldest son asked why I didn?t obtain something more valuable, like a sports statistics magazine showing who will win the next ten Super Bowls. Now, that would be useful!

For a video of Elon demonstration the battery swap process last week and a fabulous piece of marketing, please click here. No wonder people are going gaga over this company!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.