“The only surprise to me is that so many people were surprised,” said Nobel Prize winning economist Joseph Stiglitz, about the financial crisis he predicted.

Global Market Comments

September 9, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SEPTEMBER LIVES UP TO ITS REPUTATION)

(COPX), (USO), (ARE), (UUP), (TLT), (JNK), (GLD), (SPY), (NASD), ($VIX)

One of my Concierge clients holds a weekly staff meeting. Each employee is told his family is being held hostage and can only be rescued if they recommend the top-performing stock for the coming week. Then everyone throws in their two cents worth.

Last week, for the first time in the company’s history, no one could come up with a single name, even if it meant sacrificing their family (nobody was really sacrificed).

That speaks volumes.

In fact, until last week, every asset class in the market was discounting an imminent recession: Commodities (COPX), energy (USO), real estate (ARE), and the US dollar (UUP). Reliable recession hideouts like bonds (TLT), fixed income (JNK), and gold (GLD) caught an endless bid. Only the stock market (SPY), (NASD) wasn’t reading from the same music sheet.

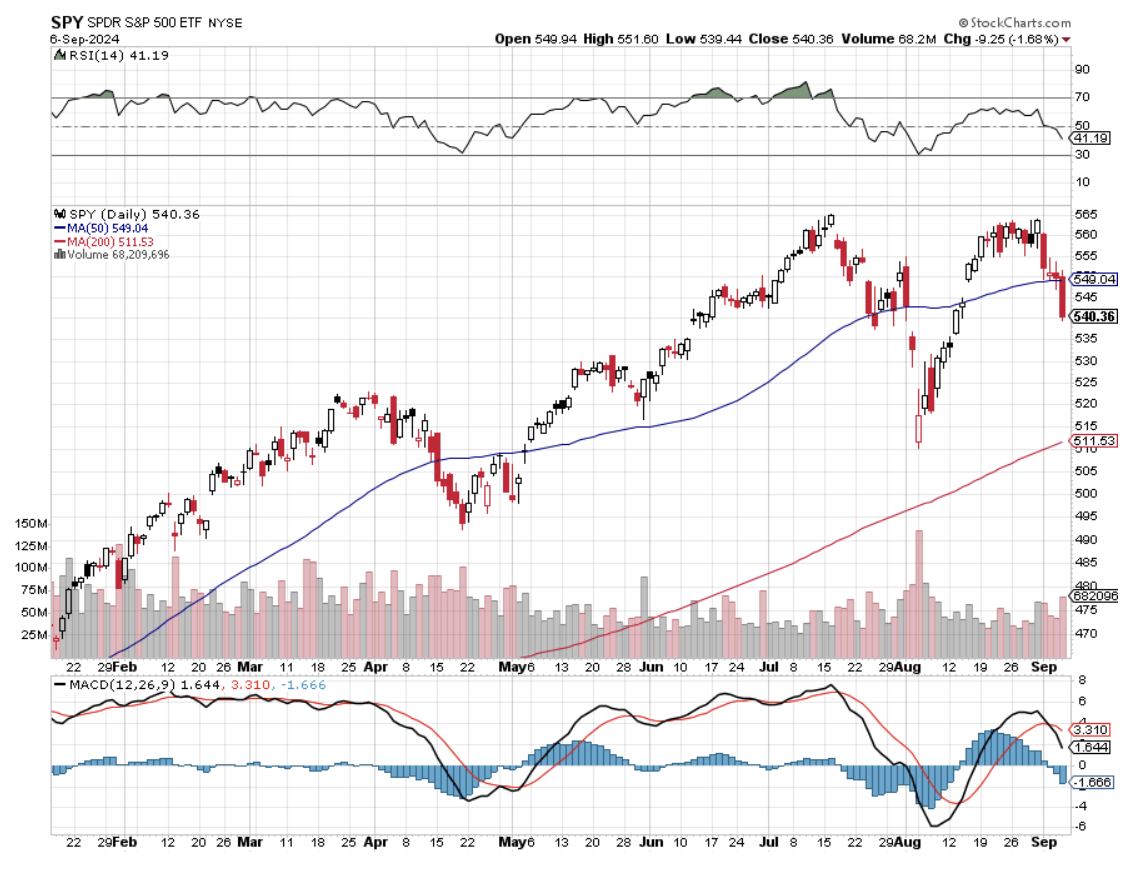

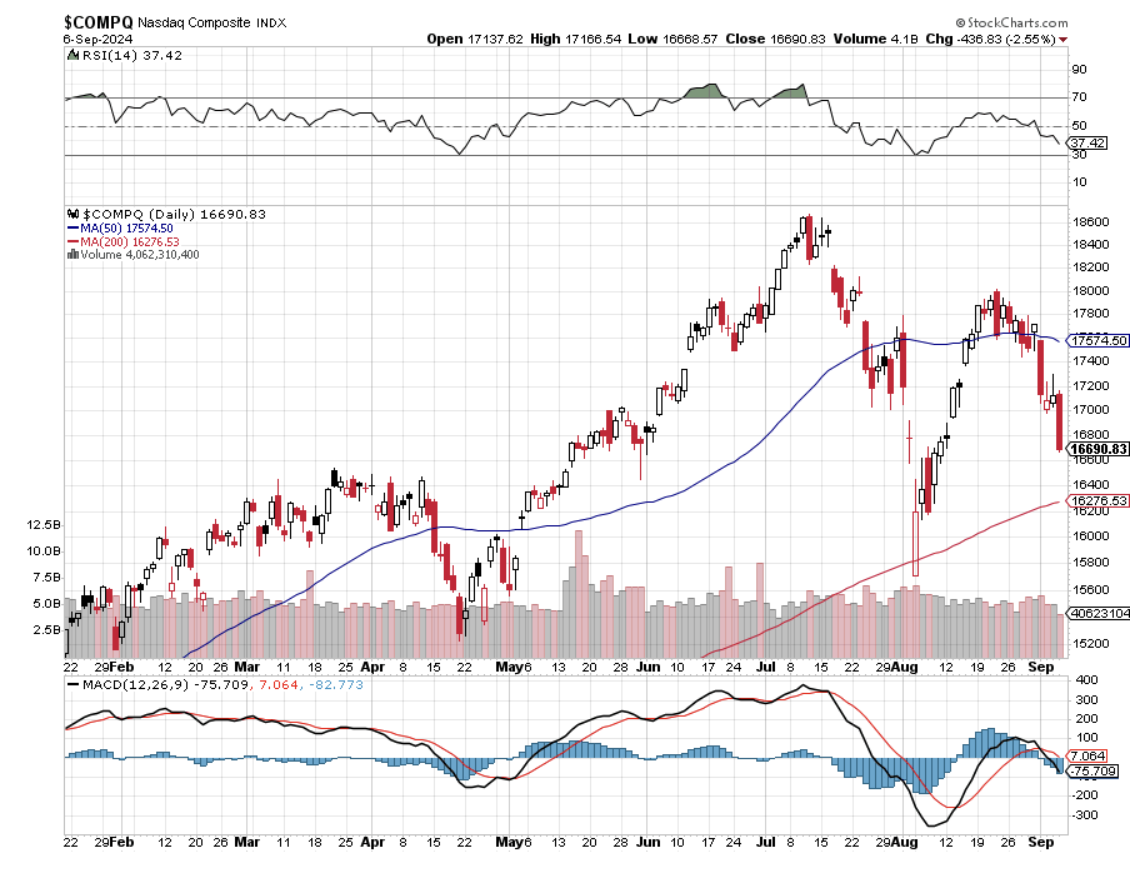

Well, stocks finally got the memo, delivering the worst week in 2 ½ years. Suddenly, the glass has gone from half full to half empty. Permabears have suddenly morphed from complete idiots to maybe having something to say. Here it is only September 9 and the Month from Hell is already living up to its awful reputation. Is the stock market the slow learner in the bunch?

I came back from Europe in August rested, refreshed, invigorated, and in a near state of panic. The last 11% rally in the (SPY) made absolutely no sense to me whatsoever. Either the September jobs data would come in hot, canceling the Fed’s expected interest rate cut. Or, the data would come in cold, proving that the Fed waited too long to cut rates and inviting a recession, causing stocks to tank.

It would have been one of the worst self-inflicted wounds and own goals of all time.

What was especially dangerous was that we were going into the worth trading month of the year, September, with the (SPY) showing a crystal-clear double top on the charts.

It was a perfect lose/lose situation.

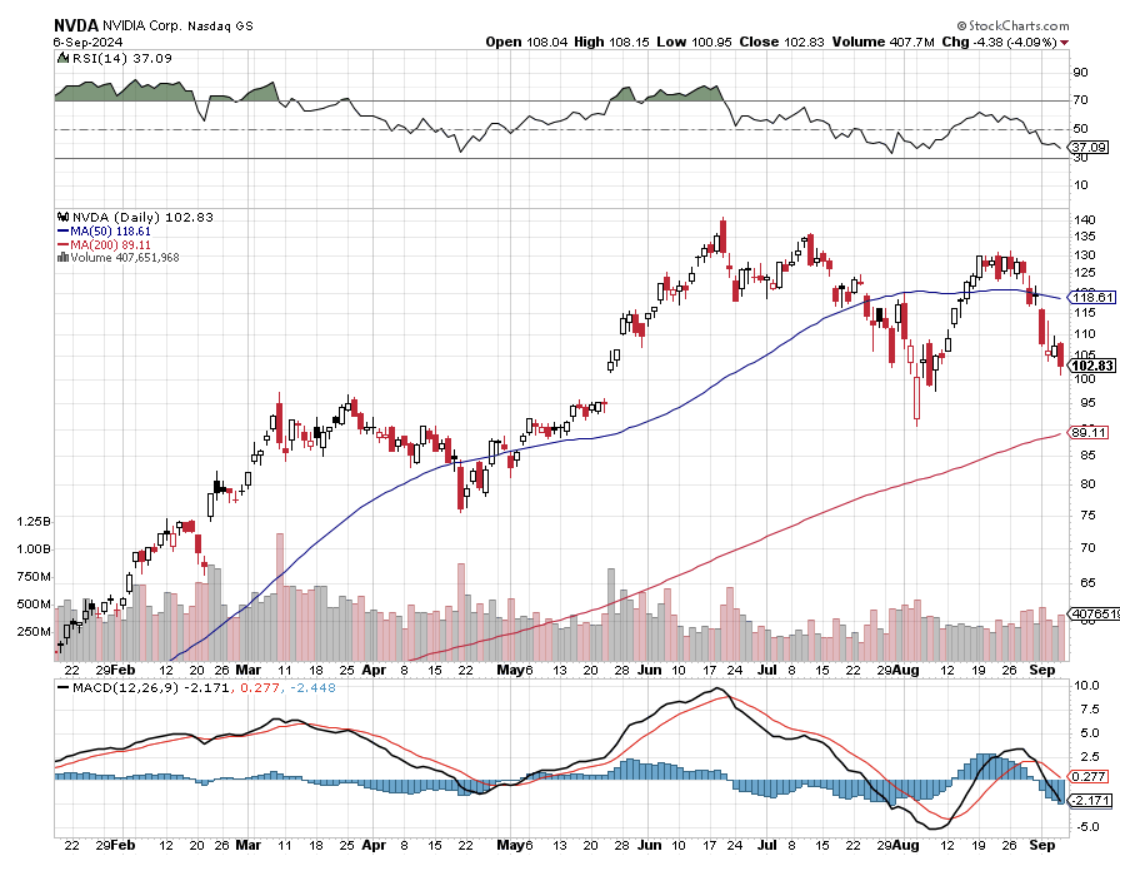

Seasonals are important, especially this month. This is because most mutual funds run an annual year that ends on September 30. To window dress their books and those glossy marketing brochures, they sell all their losers (think energy) in September and use the cash to buy more of their winners in October. (NVDA) yes, (XOM) not so much. This creates a swing in the indexes every year of 10%-20%.

To learn more about the seasonals, read tomorrow’s letter in detail, IF YOU SELL IN MAY AND GO AWAY, WHAT TO DO IN SEPTEMBER?

So I did what I usually do when the market refuses to give me marching orders. I let all my positions expire with the August 16 options expiration, took back the cash, and then sat on my hands. Suddenly, a 100% cash position was looking like a stroke of genius. It cleared the cobwebs, moved the fog away from my eyes, and took the monkey off my back all in one fell swoop.

And you know what? After surveying my big hedge fund clients, I learned they were doing exactly the same thing.

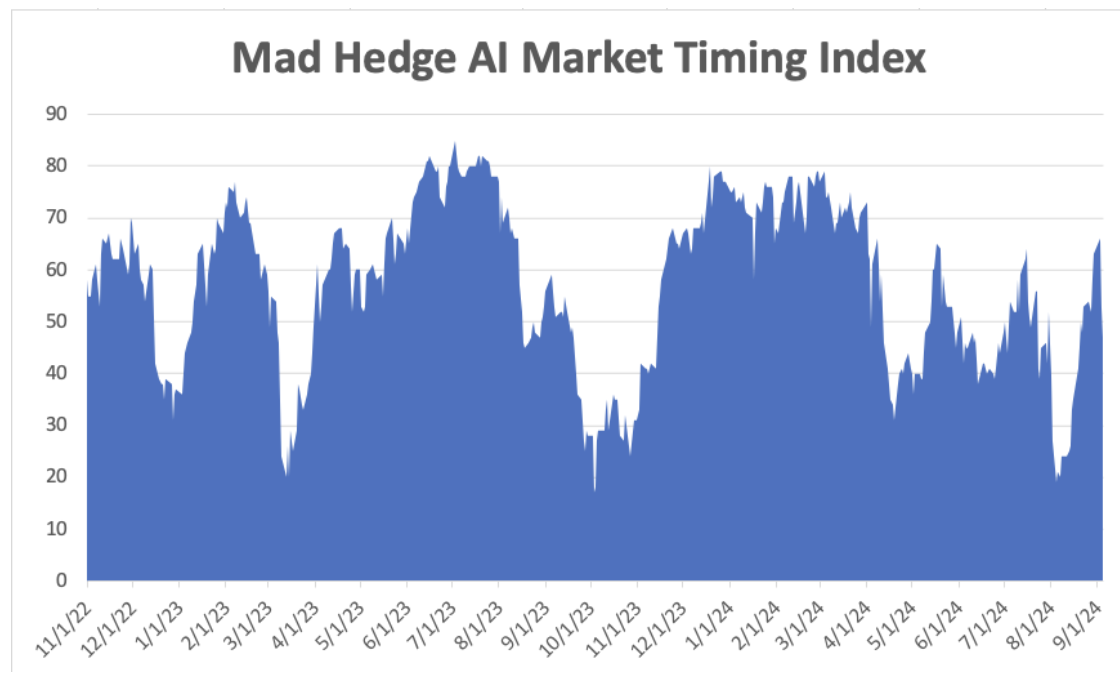

Let me pass on another piece of interesting intel. All of the many algorithms the hedge fund industry follows are bunching up around two specific bottoms for the stock market in coming months: September 18, the Fed rate cut day, and October 22, two weeks before the presidential election.

With any luck, other classic “BUY” signals will kick in at the same time with the Mad Hedge Market Timing Index below 20 by then and the Volatility Index ($VIX) over $30. It could be the best entry point of the year.

What has been fascinating is how much money has been pouring into the interest rate plays I have been banging the table about for the last six months. When was the last time the stock market has been led by AT&T (T), Altria (MO), and Crown Castle International (CCI)? You might have to look behind the radiator to find some old, dusty research on these names.

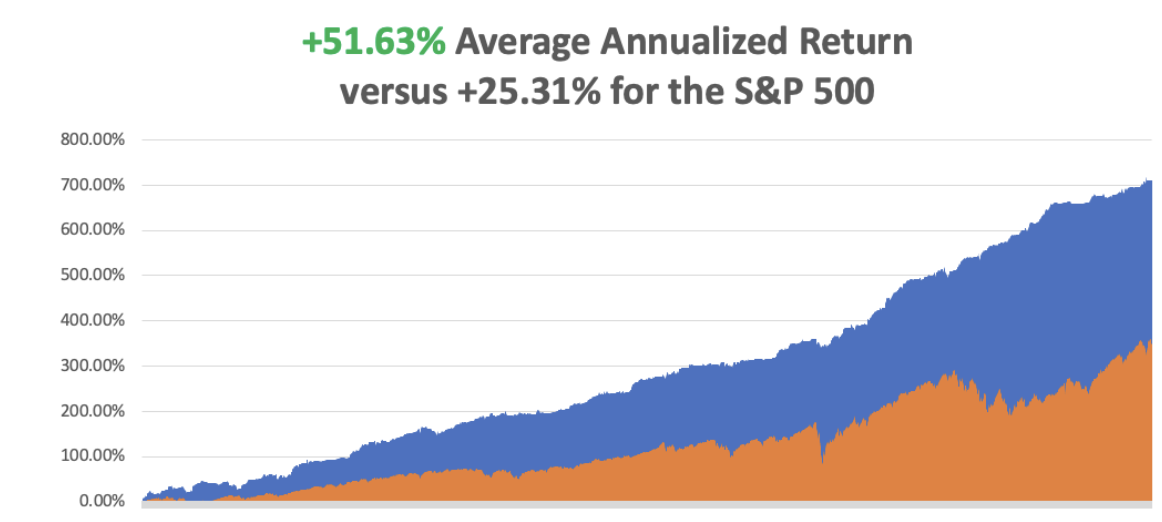

So far in September, we are down by -1.21%. My 2024 year-to-date performance is at +33.49%. The S&P 500 (SPY) is up +13% so far in 2024. My trailing one-year return reached +51.89. That brings my 16-year total return to +710.12. My average annualized return has recovered to +51.63%.

I executed only one trade last week, covering a short in Tesla at cost. I am now maintaining a 100% cash position. I’ll text you next time I see a bargain in any market. Now there is none. There is no law dictating that you have to have a position every day of the year. Only your broker wants you to trade every day.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 47 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +72.24%.

Try beating that anywhere.

Nonfarm Payroll Report Fades at 142,000, but the Headline Unemployment Rate stays at 4.2%. More shocking is that the previous two months saw substantial downward revisions. The BLS cut July’s total by 25,000, while June fell to 118,000, a downward revision of 61,000. If the Fed doesn’t cut by 0.50% on September 18, the stock market will crash.

Broadcom Beats and Stock Tanks driven by strong sales of its AI products and VMware software. But management’s guidance for the current quarter disappointed investors, sending shares of the chipmaker down nearly 7% in the after-market. This is too harsh of a reaction to an otherwise solid print. Buy (AVGO) on dips.

ADP Employment Change Report Hits 3 ½-Year Low, up only 99,000 in August. Economists polled had forecast private employment would advance by 145,000 positions after a previously reported gain of 122,000.

Biden Blocks Nippon Steel Takeover of US Steel, no doubt to save the jobs these deals usually destroy. Good thing we got out of the (X) LEAPS a year ago at max profit. (X) dropped 20% on the news. Not a good time to concentrate on industry.

No Subpoenas Here Says NVIDIA, refuting rumors that it was the target of an antitrust action. Don’t believe everything you read on the internet.

The Yield Curve has De-Inverted, meaning that short-term interest rates have fallen below long-term ones. Two-year interest rates at 3.72% are now 0.03% lower than ten-year ones at 3.75%. It’s a clear signal to the Fed that rates must be cut soon.

Weekly Jobless Claims Drop 5,000 to 227,000. The weekly jobless claims report from the Labor Department on Thursday, the most timely data on the economy's health, also showed unemployment rolls shrinking to levels last seen in mid-June. It reduces the urgency for the Federal Reserve to deliver a 50-basis points interest rate cut this month.

US Oil Production Hits All-Time High. In August 2024, U.S. oil production hit a record 13.4 million barrels per day according to the U.S. Energy Information Administration. Big Oil has become more productive as horizontal drilling and hydraulic fracturing, which is also known as fracking, have seen technological breakthroughs. The fossil fuel industry benefits from tax incentives, such as the intangible drilling costs tax credit, that are built into the tax code. The intangible drilling costs tax break is expected to benefit oil and gas companies by $1.7 billion in 2025 and $9.7 billion through 2034

Crude Oil Now Down on the Year, after a precipitous weekend selloff. Blame a weak China, lost OPEC discipline, and overproduction by Iraq. The bearish Goldman Sachs commodities report was also a factor. Avoid the worst-performing asset class in the market.

Eli Lilly is now a trillion-dollar stock, the first Biotech to do so. The drug giant is riding the wave of Mounjaro and Zepbound, its blockbuster injectable GLP-1 medications for weight loss. The drugs are also used to treat diabetes and cardiovascular disease. Eli Lilly’s shares have soared 65% this year.

Goldman Goes Big on Gold. Central banks in emerging market countries are continuing to buy gold — with purchases tripling since the middle of 2022 amid fears of U.S. financial sanctions and a mountain of sovereign debt. Goldman is taking a more selective approach to commodity investing as soft demand in China weighs on crude oil and copper prices. The investment bank has slashed its Brent oil outlook by $5 to a range of $70 to $85 per barrel and delayed its copper target of $12,000 per metric ton until after 2025.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, September 9 at 3:00 PM EST, Consumer Inflation Expectations are out

On Tuesday, September 10 at 6:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, September 11 at 7:30 AM, the Core CPI is printed.

On Thursday, September 12 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Producer Price Index.

On Friday, September 13 at 8:30 AM, the University of Michigan Consumer Sentiment. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I was having lunch at the Paris France casino in Las Vegas at Mon Ami Gabi, one of the top ten-grossing restaurants in the United States. My usual waiter, Pierre from Bordeaux, took care of me with his typical ebullient way, graciously letting me practice my rusty French.

As I finished an excellent, but calorie packed breakfast (eggs Benedict, caramelized bacon, hash browns, and a café au lait), I noticed an elderly couple sitting at the table next to me. Easily in their 80s, they were dressed to the nines and out on the town.

I told them I wanted to be like them when I grew up.

Then I asked when they first went to Paris, expecting a date sometime after WWII. The gentleman responded, “Seven years ago.”

And what brought them to France?

“My father is buried there. He’s at the American Military Cemetery at Colleville-sur-Mer along with 9,386 other Americans. He died on Omaha Beach on D-Day. I went for the D-Day 70th anniversary.” He also mentioned that he never met his dad, as he was killed in action weeks after he was born.

I reeled with the possibilities. First, I mentioned that I participated in the 40-year D-Day anniversary with my uncle, Medal of Honor winner Mitchell Paige, and met with President Ronald Reagan.

We joined the RAF fly-past in my own private plane and flew low over the invasion beaches at 200 feet, spotting the remaining bunkers and the rusted-out remains of the once floating pier. Pont du Hoc is a sight to behold from above, pockmarked with shell craters like the moon. When we landed at a nearby airport, I taxied over railroad tracks that were the launch site for the German V1 “buzzbomb” rockets.

D-Day was a close-run thing and was nearly lost. Only the determination of individual American soldiers saved the day. The US Navy helped too, bringing destroyers right to the shoreline to pummel the German defenses with their five-inch guns. Eventually, battleships working in concert with very lightweight Stinson L5 spotter planes made sure that anything the Germans brought to within 20 miles of the coast was destroyed.

Then the gentleman noticed the gold Marine Corps pin on my lapel and volunteered that he had been with the Third Marine Division in Vietnam. I replied that my father had been with the Third Marine Division during WWII at Bougainville and Guadalcanal and that I had been with the Third Marine Air Wing during Desert Storm.

I also informed him that I had led an expedition to Guadalcanal two years ago looking for some of the 400 Marines still missing in action. We found 30 dog tags and sent them to the Marine Historical Division at Quantico, Virginia for tracing. I proudly showed them my pictures.

When the stories came back it, turned out that many survivors were children now in their 80s who had never met their fathers because they were killed in action on Guadalcanal.

Small world.

I didn’t want to infringe any further on their fine morning out, so I excused myself. He said Semper Fi, the Marine Corps motto, thanked me for my service, and gave me a fist pump and a smile. I responded in kind and made my way home.

Oh and say “Hi” when you visit Mon Ami Gabi. Tell Pierre that John Thomas sent you and give him a big tip. It’s not easy for a Frenchman to cater to all these loud Americans.

Third Marine Air Wing

The D-Day Couple

The American Military Cemetery at Colleville-sur-Mer

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Over the long term, all of the fiat currencies of the world are involved in a competitive devaluation. The structural stresses in most of the western economies are such that central banks will attempt to continue to substitute liquidity for solvency,” said Rick Rule, director, president and CEO of Sprott U.S. Holdings, a precious metals specialist.

Global Market Comments

September 6, 2024

Fiat Lux

Featured Trade:

(ANOTHER CRYPTO VICTIM BITES THE DUST)

Global Market Comments

September 5, 2024

Fiat Lux

Featured Trade:

(COFFEE WITH RAY KURZWEIL)

(GOOG)

Global Market Comments

September 4, 2024

Fiat Lux

Featured Trade:

(I HAVE A NEW OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE)

(TESTIMONIAL)

Global Market Comments

September 3, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE HIDDEN AI IN YOUR LIFE),

(SPX), (NVDA), (CSCO), (LEN), (DHI), (KBH), (SMCI), (BRK/B), (META), (AAPL), (GOOGL), (TSLA), (JNK), (HYG), (FXA), (FXE), (FXB), (FXC), (EEM), (IWM)

It's great to be back in California, even just temporarily.

Driving down to visit a Concierge client, the weather is hot and dry, the scenery is spectacular. What were once endless hills of dry grass are now countless miles of vineyards. Boy, has the Golden State changed a lot since 1952.

The vines are heavy with grapes. I stopped by and picked a purple bunch to test out the fruit. The grapes were rich and sweet. It looks like 2024 is going to be a good vintage. No wonder there is a wine glut.

It's going to be a vintage year for Mad Hedge performance as well. We picked up a welcome +3.74% in the testing month of August, +33.61% so far in 2024, and +711.32% since inception.

The harder I work, the luckier I get.

Which raises the most important question of the day: Did September just happen in August? The price action we saw last month is certainly reminiscent of many recent faith-testing Septembers and Octobers.

If that is the case, then it could be off to the races from now. Except this time, it won’t be just a Magnificent Seven rally. It will be an everything rally as the bull broadens out to include all interest rate sectors, which is almost everything.

(SPX) 6,000 by yearend looks like a piece of cake.

The bottom line for all of this is that investors and the markets are still wildly underestimating the impact artificial intelligence will have on our futures, and therefore stock prices. Publishing the Mad Hedge AI Letter three times a week (click here for the link), I can see AI sneaking into every aspect of our lives without our knowledge.

I visited my doctor the other day and they asked for my Medicare card. I didn’t have it because there is no use for this US government ID in Europe from where I just returned. The receptionist said, “Don’t worry, may I have your phone please?” She went into my photos app, searched for “Medicare” and there it appeared instantly. Apple had surreptitiously installed an AI search function on my phone without even telling me.

Try it!

What we are witnessing is the greatest capital spending binge since WWII 83 years ago, when in three short years, the US produced 297,000 aircraft, 193,000 artillery pieces, 86,000 tanks, and two million army trucks. It also double-tracked all east-west rail lines and created from scratch four atomic bombs.

And you want to short that???

The indexes certainly have plenty of room to run. Since the 2020 pandemic bottom, virtually all money has gone into big tech and out of the rest of the market, generating net outflows out of equities and into bonds. What happens when you get net inflows into big tech AND the rest of the market? Markets go up a….lot.

Dow 240,000 here we come.

Now for the challenging chore of sector picking.

Bonds (TLT) are usually the first pick at the beginning of any interest rate-cutting cycle. However, this has been the best telegraphed interest rate cut in history so most of the juice has already been squeezed out of this one. The (TLT) has moved a prolific $18 off the $82 bottom with no interest rate cuts at all. So there might be $5 or $10 of upside left this year, but no more.

Derivative high-yield plays have much more to offer. Those would include junk bonds (JNK), (HYG), BB-rated loans (SLRN), and REITS like the Vornado Realty Trust (VOR), my favorite Crown Castle International (CCI), and Health Properties (DOC).

Utilities usually do well in falling interest rate cycles as they are such big borrowers. In this basket, you can throw NextEra Energy (NEE), Southern Company (SO), and Duke Energy (DUK).

Falling rates also reliably deliver a weak US dollar, so buy every foreign currency play out there (FXA), (FXE), (FXB), (FXC). Also, buy foreign stock markets like the (EEM).

And then there are always big borrowing small caps (IWM), poor performers for the last decade which can always use the life jackets of falling interest rates. Keep in mind that 40% of small caps are regional banks and another 40% are money losers.

And then there are the old reliables. Any of the Magnificent Seven will probably work if you can get them on any selloff like we had on August 5.

So far in August, we are up by +2.67%. My 2024 year-to-date performance is at +33.61%. The S&P 500 (SPY) is up +18.23% so far in 2024. My trailing one-year return reached +52.25. That brings my 16-year total return to +710.24. My average annualized return has recovered to +51.91%.

I executed no trades last week and am maintaining a 100% cash position. I’ll text you next time I see a bargain in any market. Now there are none. I am running one short in Tesla (TSLA).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 49 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +74.24%.

Try beating that anywhere.

NVIDIA Dives on Fabulous Earnings, one of the greatest “Buy the rumor, sell the news” moves of all time. The stock dropped to $25, or 17.85% off its all-time high. Production snags with its much-awaited Blackwell chips are to blame. The company’s quarterly met or beat analysts’ estimates on nearly every measure. But Nvidia investors have grown accustomed to blowout quarters, and the latest numbers didn’t qualify. Buy (NVDA) on this dip.

PCE Rises a Modest 02% in July. That is the so-called core personal consumption expenditures price index, which strips out volatile food and energy items, according to Bureau of Economic Analysis data out Friday. On a three-month annualized basis — a metric economists say paints a more accurate picture of the trajectory of inflation — it advanced 1.7%, the slowest this year

Pending Home Sales Drop 5%, and 8.5% YOY, on a signed contracts basis. Many buyers are waiting until after the presidential election to make a move. Pending home sales fell in all four regions last month. The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.

Sales of new U.S. single-family homes rocketed by 10.6%, their highest level in more than a year in July. A drop in mortgage rates boosted demand, offering more evidence that the housing market is recovering. Sales reached a seasonally adjusted annual rate of 739,000 units last month, the highest level since May 2023. It was also the sharpest increase in sales since August 2022. New home sales are counted at the signing of a contract. Buy homebuilders on dips (LEN), (DHI), (KBH).

US GDP Reaccelerates to 3.0% Growth in Q2, up from the previous estimate of 2.8%, according to the Bureau of Economic Analysis. Stronger consumer spending more than offset other categories. Can’t beat the USA.

Weekly Jobless Claims Remain Unchanged at 231,000, down 2,000. After being inflated by weather and seasonal factors in July, initial jobless claims in August are stabilizing at a slightly lower level, another indication that layoffs remain low.

Is Costco (CSCO) the Next Stock Split? Costco, which has risen nearly 40% since the start of 2024, is a potential candidate. Given the company’s share price—over $900 as of Tuesday—and the trend among other retailers with similarly high prices to split.

Hindenburg Research Attacks Super Micro, alleging "accounting manipulation" at the AI server maker, the latest by the short seller whose reports have rocked several high-profile companies. Close ties with chip giant Nvidia have allowed Super Micro, known for its liquid cooling technology for high-power semiconductors, to capitalize on the surge in demand for AI servers.

Though revenue has surged, margins have taken a hit recently due to the rising costs of server production and pricing pressure from rivals including Dell. Avoid (SMCI).

Berkshire Hathaway Tops $1 Trillion Market Cap, a long-time Mad Hedge recommendation. It’s the first nontech company ever to do so, even though (BRK/B) has a major holding in Apple (AAPL). Keep buying the big dips. The stock has rallied this year on strong insurance results and economic optimism. The Omaha, Nebraska-based company joins the ranks of a small group to crack the milestone, dominated by technology giants like Alphabet Inc. (GOOGL), Meta Platforms Inc. (META) and Nvidia Corp. (NVDA).

S&P Case Shiller Hits New All-Time High in June. Prices nationally rose 5.4% in June from the year prior. An index measuring prices in 20 of the nation’s large metropolitan areas gained 6.5% from the year prior. On an unadjusted basis, it was the national index’s fourth consecutive all-time high. Prices in New York, San Diego, and Las Vegas grew the most, with year-over-year gains ranging from 8.5% and 9%, while those in Portland, Ore., Denver, Colo., and Minneapolis grew the least.

Canada Imposes 100% Tariff on Chinese EVs. The problem for Tesla is that they had been supplying the Canadian market from their China factory. The supply can be replaced with US-made cars but at a much higher cost. Tesla sold off $8 on the news. Sell rallies in (TSLA).

Is the US Tipping into Recession? A continued drop in job openings will translate into faster increases in unemployment, an argument in favor of the Fed beginning to cut interest rates to guard the labor market. The next jobs reports could be crucial. Policymakers face the dilemma of two risks: being too slow to ease policy, potentially causing a 'hard landing' with high unemployment ... or cutting rates prematurely, leaving the economy vulnerable to rising inflation

Yield Chasers Post Record Demand for Junk Bonds. That’s helped make 2024 the busiest year for the issuance of new corporate high-yield bonds, with $357 billion sold so far, since the easy money days during the pandemic. Issuance of US leveraged loans, meanwhile, is running at its fastest pace on record. Buy (JNK) and (HYG).

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, September 2 we have Labor Day. All US markets will be closed.

On Tuesday, September 3 at 6:00 AM EST, the ISM Manufacturing PMI is released.

On Wednesday, September 4 at 7:30 PM, the JOLTS Job Openings Report is printed.

On Thursday, September 5 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the ADP Employment Report.

On Friday, September 6 at 8:30 AM, the August Nonfarm Payroll Report is released. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, having visited and lived in Lake Tahoe for most of my life, I thought I’d pass on a few stories from this historic and beautiful place.

The lake didn’t get its name until 1949 when the Washoe Indian name was bastardized to come up with “Tahoe”. Before that, it was called the much less romantic Lake Bigler after the first governor of California.

A young Mark Twain walked here in 1863 from nearby Virginia City where he was writing for the Territorial Enterprise about the silver boom. He described boats as “floating in the air” as the water clarity at 100 feet made them appear to be levitating. Today, clarity is at 50 feet, but it should go back to 100 feet when cars go all-electric.

One of the great engineering feats of the 19th century was the construction of the Transcontinental Railroad. Some 10,000 Chinese workers used black powder to blast a one-mile-long tunnel through solid granite. They tried nitroglycerine for a few months but so many died in accidents they went back to powder.

The Union Pacific moved the line a mile south in the 1950s to make a shorter route. The old tunnel is still there, and you can drive through it at any time if you know the secret entrance. The roof is still covered with soot from woodfired steam engines. At midpoint, you find a shaft to the surface where workers were hung from their ankles with ropes to place charges so they could work on four faces at once.

By the late 19th century, every tree around the lake had been cut down for shoring at the silver mines. Look at photos from the time and the mountains are completely barren. That is except for the southwest corner, which was privately owned by Lucky Baldwin who won the land in a card game. The 300-year-old growth pine trees are still there.

During the 20th century, the entire East Shore was owned by one man, George Whittell Jr., son of one of the original silver barons. A man of eclectic tastes, he owned a Boing 247 private aircraft, a custom mahogany boat powered by two Alison aircraft engines, and kept lions in heated cages.

Thanks to a few well-placed campaign donations, he obtained prison labor from the State of Nevada to build a palatial granite waterfront mansion called Thunderbird, which you can still visit today (click here ). During Prohibition, female “guests” from California crossed the lake and entered the home through a secret tunnel.

When Whittell died in 1969, a Mad Hedge Concierge Client bought the entire East Shore from the estate on behalf of the Fred Harvey Company and then traded it for a huge chunk of land in Arizona. Today the East Shore is a Nevada State Park, including the majestic Sand Harbor, the finest beach in the High Sierras.

When a Hollywood scriptwriter took a Tahoe vacation in the early 1960s, he so fell in love with the place that he wrote Bonanza, the top TV show of the decade (in front of Hogan’s Heroes). He created the fictional Ponderosa Ranch, which tourists from Europe come to look for in Incline Village today.

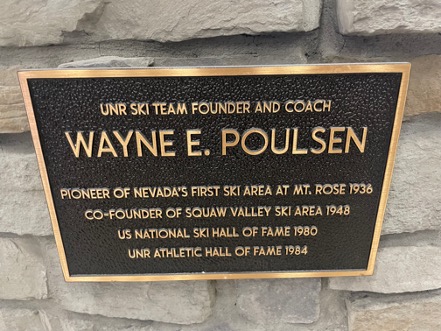

In 1943, a Pan Am pilot named Wayne Poulson who had a love of skiing bought Squaw Valley for $35,000. This was back when it took two days to drive from San Francisco. Wayne flew the China Clippers to Asia in the famed Sikorski flying boats, the first commercial planes to cross the Pacific Ocean. He spent time between flights at a ranch house he built right in the middle of the valley.

His wife Sandy bought baskets from the Washoe Indians who still lived on the land to keep them from starving during the Great Depression. The Poulson’s had eight children and today, each has a street named after them at Squaw.

Not much happened until the late forties when a New York Investor group led by Alex Cushing started building lifts. Through some miracle, and with backing from the Rockefeller family, Cushing won the competition to host the 1960 Winter Olympics, beating out the legendary Innsbruck, Austria, and St. Moritz, Switzerland.

He quickly got the State of California to build Interstate 80, which shortened the trip to Tahoe to only three hours. He also got the state to pass a liability limit for ski accidents to only $2,000, something I learned when my kids plowed into someone, and the money really poured in.

Attending the 1960 Olympic opening ceremony is still one of my fondest childhood memories, produced by Walt Disney, who owned the nearby Sugar Bowl ski resort.

While the Cushing group had bought the rights to the mountains, Poulson owned the valley floor, and he made a fortune as a vacation home developer. The inevitable disputes arose and the two quit talking in the 1980’s.

I used to run into a crusty old Cushing at High Camp now and then and I milked him for local history in exchange for stock tips and a few stiff drinks. Cushing died in 2003 at 92 (click here for the obituary)

I first came to Lake Tahoe in the 1950s with my grandfather who had two horses, a mule, and a Winchester. He was one-quarter Cherokee Indian and knew everything there was to know about the outdoors. Although I am only one-sixteenth Cherokee with some Delaware and Sioux mixed in, I got the full Indian dose. Thanks to him I can live off the land when I need to. Even today, we invite the family medicine man to important events, like births, weddings, and funerals.

We camped on the beach at Incline Beach before the town was built and the Weyerhaeuser lumber mill was still operating. We caught our limit of trout every day, ten back in those days, ate some, and put the rest on ice. It was paradise.

During the late 1990’s when I built a home in Squaw Valley I frequently flew with Glen Poulson, who owned a vintage 1947 Cessna 150 tailwheel, looking for untouched high-country lakes to fish. He said his mother had been lonely since her husband died in 1995 and asked me to have tea with her and tell her some stories.

Sandy told me that in the seventies she asked her kids to clean out the barn and they tossed hundreds of old Washoe baskets. Today Washoe baskets are very rare, highly sought after by wealthy collectors, and sell for $50,000 to $100,000 at auction. “If I had only known,” she sighed. Sandy passed away in 2006 and the remaining 30-acre ranch was sold for $15 million.

To stay in shape, I used to pack up my skis and boots and snowshoe up the 2,000 feet from the Squaw Valley parking lot to High Camp, then ski down. On the way up I provided first aid to injured skiers and made regular calls to the ski patrol.

After doing this for many winters, I finally got busted when they realized I didn’t have a ski pass. It turns out that when you buy a lift ticket you are agreeing to a liability release which they absolutely had to have. I was banned from the mountain.

Today Squaw Valley is owned by the Colorado-based Altera Mountain Company, which along with Vail Resorts owns most of the ski resorts in North America. The concentration has been relentless. Last year Squaw Valley’s name was changed to the Palisades Resort for the sake of political correctness. Last weekend, a gondola connected it with Alpine Meadows next door, creating the largest ski area in the US.

Today there are no Washoe Indians left on the lake. The nearest reservation is 25 miles away in the desert in Gardnerville, NV. They sold or traded away their land for pennies on the current value.

Living at Tahoe has been great, and I get up here whenever I can. I am now one of the few surviving original mountain men and volunteer for North Tahoe Search & Rescue.

On Donner Day, every October 1, I volunteer as a docent to guide visitors up the original trail over Donner Pass. Some 175 years later the oldest trees still bear the scars of being scrapped by passing covered wagon wheels, my own ancestors among them. There is also a wealth of ancient petroglyphs, as the pass was a major meeting place between Indian tribes in ancient times.

The good news is that residents aged 70 or more get free season ski passes at Diamond Peak, where I sponsored the ski team for several years. My will specifies that my ashes be placed in the Middle of Lake Tahoe. At least I’ll be recycled. I’ll be joining my younger brother who was an early Covid-19 victim and whose ashes we placed there in 2020.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Ponderosa Ranch

The Poulson Ranch

At the Reno Airport

Donner Pass Petroglyphs

Global Market Comments

September 2, 2024

Fiat Lux

Featured Trade:

( AUGUST 28 BIWEEKLY STRATEGY WEBINAR Q&A),

(SMCI), (QQQ), (CRWD), (NVDA), (TSLA), (GOLD), (BRK/B), (BAC), (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.