The city is now the most crowded that it has been at any time since WWII. Most hotels have tripled their rates, forcing traveling students on a budget to sleep in doorways and under bridges everywhere.? My usual abode here, The Naval Officers Club near Piccadilly, honored their regular price since I have been such a long term and loyal guest. However, I was the only one in the building not participating in an Olympic event, as the teams of several nations booked every room two years ago. The American team arrived today in their spiffy blue blazers. After randomly driving around London, the hapless bus driver broke down and admitted that he didn?t know where the Olympic Village was. And enterprising athlete whipped out his iPhone, Googled the address, Mapquested the directions, and they finally arrived four hours late. Still, they fared better than the Australian sailing team, whose sales were lost by Qantas Airlines. I decided to flee the madness in London for a day and visit some old friends in the countryside, the 8th Earl and Countess of Carnarvon. The late 7th Earl was an early investor in my first hedge fund and I have kept in touch with the family ever since. ?

During my recent quick run through Chicago, I stopped by Obama?s house on Greenwood Avenue and 50th street in up and coming Hyde Park to say hello. I was thwarted by two concrete crash barriers, 16 cop cars, and army of elderly Chicago police happily pulling overtime. Shifty looking characters wearing long overcoats and sprouting wires out of their ears were everywhere. Needless to say, I did not get invited in for tea and cookies.

Every neighborhood bird nest, flagpole, and chimney sported video cameras, and Google Earth has wiped the block off the map. No wanting to risk my valued Secret Service clearance, I scuttled out of there before anyone started asking questions. Instead, I settled for a visit to the delicious Valois Cafeteria around the corner, the president?s favorite diner, and his preferred bookstore at 57th Street Books. They carried all of his publications. Amazing!

I managed to run into someone, who knew someone, who once babysat Obama?s kids. Need, a presidential pardon, a cushy ambassadorial appointment, a new alternative energy program, or a juicy government contract? I?m now your ?go to? guy! Just make a discreet donation to my favorite 501 (3) (c) and it?s a deal.

It is with a great sense of sorrow that I learned of the passing of industry legend, Barton Biggs. He was 79. I was speaking to him only a few weeks ago when I passed through New York for my strategy seminar, attempting to decipher the medium term trends for these fractious and conflicting markets. It is a reminder of how temporary and fleeting life can be.

Barton was a pioneer in the international investment arena and founding father of the modern hedge fund industry. He became famous for calling market bottoms in 1982, 1987, and 2008. He was a colorful and masterful writer who regularly titillated investors with his iconoclastic and out of consensus ideas. Sound familiar?

Barton grew up as a member of the East coast establishment, his father being the chief investment officer of the Bank of New York. He graduated from Yale in 1955 in creative writing and then did a brief stint in the Marine Corps. He next turned to Wall Street and joined E.F. Hutton as a junior broker (remember ?When E.F. Hutton speaks, people listen??).

In 1965 he spun off to create Fairfield Partners, one of the early long/short US equity hedge funds. After several prosperous years, the fund crashed and burned with the collapse of the ?Nifty 50?. He later told me that was when he first learned of the six standard deviation move. ?The biggest mistake you can make in a bear market is to cover your shorts too soon? he said.

In the mid seventies, he was recruited by a small, white shoed, private partnership called Morgan Stanley & Co. to build up an asset management division from scratch. Barton became my friend and mentor when I joined the firm in the early eighties, and I spent the better part of the decade debating every pebble of the investment landscape with him.

Together, we fought a major uphill battle trying to convince a cautious and blinkered management that the firm?s future lies in international and emerging market equities. Getting them to focus on Toyota and Matsushita instead of General Motors and IBM, we felt like Sisyphus endlessly rolling the boulder up a steep mountain.

Barton persevered, and in the following three decades the business grew to $1 trillion in assets along with a world-class global research department. After Morgan Stanley went public, he became a billionaire in his own right. I bailed to start my own hedge fund a few years later.

In 2003, Barton left (MS) to start a new hedge fund, Traxis Partners. We all thought he was crazy at the time, as it was the last thing you would expect a 71 year old to do. This is a business where 30 year olds regularly drop dead of heart attacks from the stress. That was pure Barton. I heard at one point he reached $5 billion in assets.

He became a regular fixture in the media, offering his wisdom and insights in his characteristic gravelly voice. Always the independent thinker, I know he voted for Obama in the last election, at odds with much of Wall Street.

To listen to my last extended interview with Barton where he gave his global view a few years ago on Hedge Fund Radio, please click here. He was tiring even then, and we had to record the show in 15-minute segments so he could rest in between sessions. But he made the extra effort to give my readers an edge on the market. That was pure Barton too.

Barton will be missed by many.

Sysiphus

I write this to you from my double suite on the Orient Express crossing the Swiss Alps. My manservant, Charles, is off fetching a cup of tea and steam pressing my white dinner jacket for tonight?s formal dinner.

My first night at the Naval & Military Club in London, a group of British Army officers just back from Afghanistan, and their dates, hosted a blowout black tie homecoming party, complete with disc jockey and disco ball. While singing a drunken and rautious ?Rule Britannia? at 4:00 AM we maxed out the amplifiers and ended up blowing the power, not only for our building, but for the entire block.

Suddenly, our 18th century building was plunged back to the 18th century, meaning no lights, Internet, or flushing toilets. Candelabras solved the first problem, and the Financial Times the second, but when nature called, I had to retire to the pub across the street. Each time I did so, I enjoyed a pint of Fuller?s London Pride, not sure if I was making my problem better or worse. Two days later, two truck sized diesel generators on loan from the army magically showed up and solved the power problem, and we returned to the 20th century.

The Globe Theater is a magnificent reproduction of the original, which burned down in 1613 during a canon during scene in Henry VIII (click here for the link at http://www.shakespearesglobe.com/ ). Its thatched roof, open air seats, and 12 inch roughhewn oak beams led me to expect The Bard from Stratford-upon-Avon to walk out any moment. Actors tore through the standing crowds, reciting lines, and embracing a startled few theater goers. Half way through As You Like It, I realized that the devotees sitting next to me were mouthing the lines. They had memorized the entire script.

One afternoon I asked a somewhat doddering old taxi driver to take me to Kensington Palace, who seemed quite impressed. He drove me directly to Harry and Kate?s private entrance. After giving me the gimlet eye, Scotland Yard directed us to the correct entrance for the tourists. I try not to cause international incidents when on vacation, and this time I came close.

England definitely did not show its best face when I walked out of a comedy club into Leicester Square at 2:00 AM. The women were so drunk that they walked barefoot across the vomit covered pavement, unable to walk in high heels.

Another day found me at Christie?s auction house for a private viewing of John James Audubon?s spectacular Birds of America. The multi-volume set was in mint condition, the colors as bright as the day they were printed. Only 70 of the original print run of 140 in 1838 are known to exist. One sold for $11.5 million last year, making it the world?s second most valuable book after the Gutenberg Bible.

My last morning in London found me desperately hailing a taxi in a torrential downpour. The taxi Gods smiled upon me, and I was soon barreling down the streets of Piccadilly and Westminster on the way to Victoria Station. It seems that a 20 pound tip can move mountains here. I arrived with more than enough time for a pre-prandial glass of Champagne before boarding the Orient Express.

Report from London, Part III will be continued tomorrow.

John Thomas

The Mad Hedge Fund Trader

I am writing this report on the Eurostar Express train 300 feet under the English Channel, which is speeding its way from London to Paris at 200 miles per hour.

Waking up in my suite on the Queen Mary 2 at the port of Southampton the other day, the first thing I noticed was that dreadful postwar English architecture. The Germans tried to bomb this place flat to block the shipment of American supplies during WWII, and in the rush to rebuild, style and taste were left by the wayside.

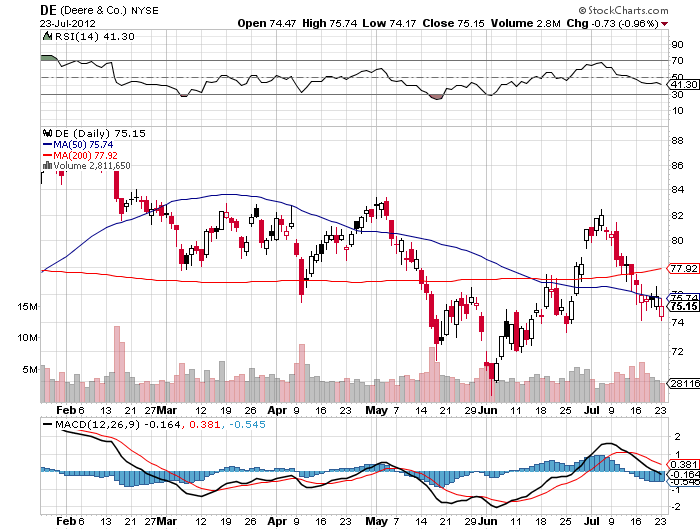

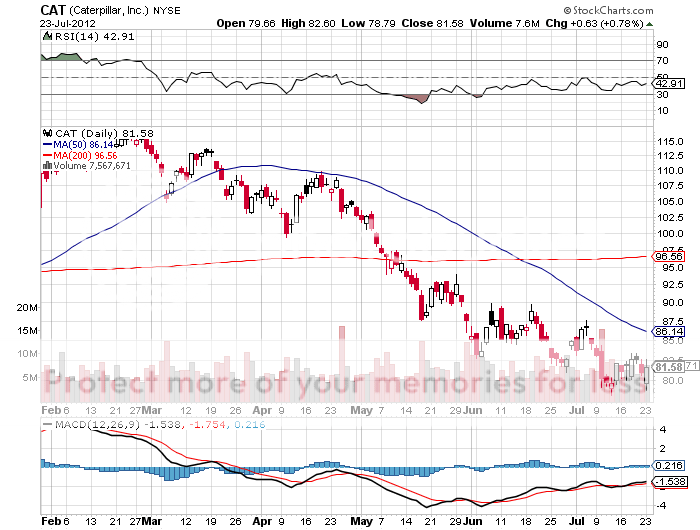

Walking out on my private deck I was greeted with an entirely different view. The pier next to us was parked bumper to bumper with US exports of Caterpillar (CAT) heavy bulldozers and John Deer (DE) tractors, the products of two of my favorite companies. God bless America! Who says we?re in decline?

God Bless America

I saw something else too, Austin Minis, thousands and thousands of them in every conceivable color and design. They crowded the docks, packed every parking structure and lot, and railcars brought in hundreds more by the hour. Roll-on-roll-off ships were loading 3,000 each for shipment to the US.

Who owns Austin Motors these days? Who else but the Germans? In a mere 60 years they have flipped from blocking imports to expediting exports from this southern English transportation hub. History may not repeat itself, but it certainly does rhyme.

To say that much of London is dreading the coming Olympic Games is a vast understatement. Much of the central part of the city has been closed to the public, with parks dedicated to events, and roads closed off to games participants only. Accommodation is so short that an entrepreneurial few have rented out their back yards for visitors to pitch tents.

There are rampant fears that Internet speeds will slow to the point of unusability, putting major multinationals out of business.? The cell phone network is supposed to crash from the backbreaking traffic load. The forecast is for rain on the opening ceremonies. Oh, and a giant asteroid will destroy the earth, at least according to an overwhelmingly downbeat media.

The security is overwhelming. Marine helicopters circle the city with crack snipers on board, the RAF is using fighters to fly combat air patrols, and the army has mounted ground to air missiles of rooftops. I hope they don?t shoot down their own planes. I asked some government officials if I could get an early peak at the Olympic Park and was given a rare flat out ?no?.

Some 4,000 tons of sand sit in front of Buckingham Palace awaiting construction of the courts for the women?s beach volleyball competition. England is suffering the wettest summer in history, and if it doesn?t warm up, the contestants, horror upon horrors, may have to wear clothes! As a result, the black market price for these tickets has fallen below $2,000 each.

More on my report from London tomorrow.

John Thomas

The Mad hedge Fund Trader

It seems that it has become fashionable to bash America these days. As I run around the country giving my strategy luncheons, I hear a lament that has become all too familiar.

America has peaked as a civilization, the story goes, and will follow the British, French, Roman, and even the Egyptian empires into the dustbin of history.? Our standard of living is falling, our technological prowess is fading, and our military strength is weakening. It will be just another generation before the Chinese take over the world and we will all be forced to learn Mandarin in high school, or somebody worse will take their place.

Such bouts of doubt, angst, and self-loathing occur every generation in America. I received a big dose after the US withdrew from Vietnam in 1972. My dad felt the same after Pearl Harbor was attacked in 1941. So did my grandfather when the Lusitania was sunk in 1917. The outbreak of the Civil War in 1861 was considered the country?s darkest day. And then there was the British burning of Washington in 1812. I remember it like it was yesterday.

I say horse feathers, bull-puckey, and balderdash to all this talk. When speaking to foreign governments, military leaders, and central bankers during my global travels I keep hearing a recurring theme. The United States is still the great shining example up on the hill. We are dominant in technology and increasing at an accelerating rate. All I hear about are our country?s strengths.

Our economy can evolve faster than anywhere else on the planet. This is because no one can beat us at creative destruction. Some 22 years into Japan?s stock market crash they are still maintaining companies on life support at enormous expense. We cleansed our system in about six months. And try downsizing outdated unions in Germany. We have cut the union share of labor from 35% to 15% in 30 years. Where else can someone with no money but good ideas become a billionaire in a couple of years?

Since I am a numbers guy, let me throw a few out there just to make my case. With a $15 trillion GDP, ours is triple contenders number two and three at $5 trillion, China and Japan. We are nearly four times Germany?s size at $4 trillion. Our per capita GDP is a staggering twelve times China?s. That means it takes 12 Chinese workers to produce an hour of output compared to our one. This is why America?s per capital income stands at $47,200, compared to only $4,260 in the Middle Kingdom, and many Chinese have to work a 70 hour week to take this home.? They are supposed to be overtaking us? Even the Chinese laugh when I tell them this.

Some 18 of the world?s 50 largest companies are still US based, like Exxon (XOM), Wal-Mart (WMT), Apple (AAPL), and Boeing (BA). But this understates the true picture. Ours occupy far and away the highest end of the value added chain. Many of the rest scrape by copying or pirating our products. You never get ahead that way. Look no further than Apple, which pays workers a minimal $15/day to build US designed products for sale at home with enormous profit margins.

It?s hard to find a strategic industry that we don?t dominate. US companies invented ?fracking? which has untapped vast new energy supplies, making the Middle East irrelevant. Saudi princes come here for their health care, not England or Japan. ?Globalization? has in fact become the polite word for ?Americanization?.

I was standing at Piccadilly Circus in London the other day when a bus stopped and unloaded 50 gorgeous high school girls. I couldn?t for the life of me figure out their nationality. They could have come from anywhere. The teacher had a big butt, so I though maybe American. Then a kid lit up a cigarette and no one cared. Aha! French. They turned out to be the winners of a national English language essay-writing contest and the prize was a trip to the Olympics.

Let me just toss a few more tidbits out there:

*The biggest selling luxury car in China is a GM (GM) Buick

* iPhones, Ford Mustangs, and Katy Perry songs are pouring into a newly freed Libya.

*Cubans and Iranians are erecting illegal satellite dishes so they can watch Law and Order

*Travel around Eastern Europe and all you see are blue jeans

*Over 70% of the drinkers of Coca-Cola are outside the US

*McDonald?s (MCD) has 10,000 hamburger stands abroad

*Microsoft?s (MSFT) Windows operating system runs 90% of the world?s computers

*London has 19,000 people a month joining Match.com

*100,000 readers a day pirate The Diary of a Mad Hedge Fund Trader, and even record a Mandarin version on YouTube

While the US has run big trade deficits for 50 years, we have a perennial surplus in services that goes unnoticed. We remain the force to reckon with in banking and finance, thanks to the reserve currency status of our dollar. Transfer dollars from the UK to Japan and it has to go through New York. This isn?t changing in my lifetime. The world?s wealthy and well connected have long sent their kids to American universities. Six out of ten of the world?s best schools are here, matched only by Oxford, Cambridge, Tokyo University, and Beijing University.

You may be concerned about our rising level of national debt. Aren?t we under saving and over spending? The credit markets beg to differ with you. With 30-year Treasury bond rates at 2.55%, the world is literally throwing money at us as fast as they can. With the long-term inflation rate probably at 3%, this means that our government can borrow money for free!

Foreign individuals and institutions regularly take down more than half of our monthly government debt issues. With Europe in trouble, this trend is accelerating. The government?s error is not that it?s borrowing too much money, but not enough. Prices tell us that there is a severe shortage of US bonds. We could probably double the national debt from here without much impact on interest rates. Apparently, the free marketers don?t look at markets very often.

You have heard me talk a lot about demographics over the years. The US still has a modestly positive slope to its demographic pyramid, which is the best in the developed world. This means that we can expect an ever larger number of young consumers to drive economic growth, largely driven by immigration. This will lead to a new Golden Age for America in the 2020?s, which I believe will be a repeat of the 1950?s. Japan, Russia, and Europe suffer from a diabolical demographic outlook. China doesn?t look so hot either, thanks to its ?One Child? policy. They?re just not making young people anymore.

Since I am also an old and grizzled Marine combat veteran and stay well connected with the military establishment, let me tell you a few harsh realities. Our military technology is the most advanced in human history, unbeatable, deeply feared, and is improving at breakneck speed. The American soldier is the best trained and most lethal ever deployed into the field. Did you know that no Air Force fighter pilot has been shot down in 20 years, despite being almost continuously at war during this entire time? The next generation of US fighters won?t even have pilots, with drones carrying much of the heavy lifting in today?s combat.

The US now provides for the active defense for about half of the landmass of the world; double that protected by the British Empire at its 1914 peak. Two decades after the end of the Cold War, the United States has no enemies of any real consequence. According to the CIA chief, General David Petraeus, Al Qaida has been worn down to a mere 200 active members. The futility of their efforts, confining explosives to shoes and underwear, show how badly things have gone for them.

We have been doing this with ever declining amounts of money. The military share of US GDP has plunged from 50% in 1943 to 6% at the end of the Cold War in 1992 to 4.7% today. It is about to fall off a cliff. Our defense budget is about to drop by half, back to pre 9/11 levels, either through budget cuts or sequestration. The Joint Chiefs are already prepared for this. Cyber warfare and drones are much cheaper than carrier groups and advanced fighters. If we spend less on weapons, the rest of the world will too. In a year, expect to start hearing about this a lot on your dinnertime news.

What about China, you may ask? They have had the blueprints of our most advanced defensive systems for many years now. But having a picture of a weapon is a long way from building one. They lack the technical expertise and the machinery even to copy what we already have. In any case, everyone knows China is indefensible. Torpedo one foreign grain ship, and the country will be starving in six months. China will never pose a threat as long as they can?t live without us and we have all of their money.

Yes, I know that it is an election year. It is up to the party that is out of power to portray conditions here as badly as possible so they can get elected to fix them. The party in power has to convince us how much things have improved so we can stay the course. The misinformation and apples versus oranges comparisons that get doled out as a result can make life complicated, frustrating, and difficult for traders and investors.

The next time I hear we have the world?s highest tax rate I am going to scream! I moved a company here from Europe 20 years ago because the actual taxes paid are low to non-existent. Just ask General Electric (GE), which pays a 3% tax rate. But hey, if this was easy, it would pay minimum wage, not ten figures, so I?ll take things as they are.

And the next time someone tells you that the US is history, consider that person a great short. It is they who are headed for the dustbin.

Things Aren?t That Bad

Can You Spot the American?

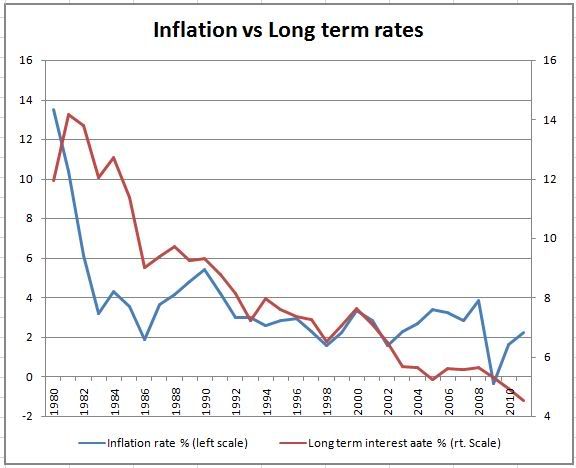

Back in the seventies and eighties, when inflation was soaring well into double digits, the markets were regularly punished by a band of gun slinging traders known as the ?bond vigilantes.? Hard asset prices were running amuck, and there was a laser like focus on the growth of the money supply.

We have just witnessed the largest expansion of the monetary base in history. The Federal Reserve?s balance sheet has ballooned from $800 million to an incredible $2.8 trillion in a mere three years. So where are the bond vigilantes?

The answer is that they were all rounded up and lynched by Paul Volker decades ago. As much as commodity prices rise, the Consumer Price Index remains dead in the water at a 2% annual rate, a shadow of the 14% we saw 30 years ago. And no, it is not a government conspiracy, no fudged numbers, that are keeping the reported inflation rate so low.

The problem is, quite simply, your salary. For every $2 dollars? worth of commodity price inflation we are seeing, there are $3 worth of wages declines. Talk to any businessman, and he will tell you that wages account for at least 50% of his total costs, while commodity cost inputs are only 10%-15%.

Commodity prices can be roaring, but as long has globalization drives down wages at home, as it has for the last 30 years, their overall impact will be modest, at best. So add it all together, and you get an inflation rate that is stagnant at low single digits. You are obviously not working hard enough.

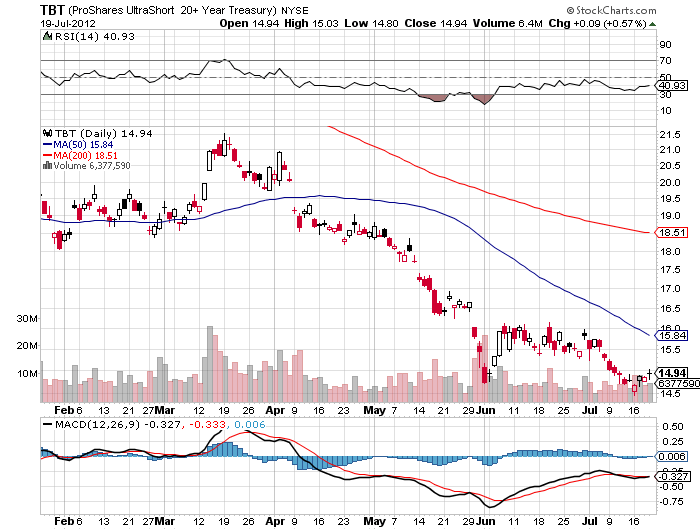

I am interested in all this because I have a dog in this fight. I happen to be short out of the money call spreads on the Treasury bond ETF (TLT). I also have more than a passing interest in the (TBT), a leveraged ETF that bets that the Treasury bond interest rates will rise and prices will fall. I used to think that a resurgence of inflation would take it from the current $14.50 to $200. I don?t believe that anymore. I instead think we will see a rise only to $43, which equates to a ten year Treasury bond yield of 4.10%, up from today?s 1.45%.

That is still a potential gain of nearly 300%, which is better than a poke in the eye with a sharp stick in this zero return world. And that middling profit will not be delivered by a reincarnation of the inflation beast, but by the sheer volume of issuance of bonds demanded by our enormous budget deficits.

The Bond Vigilantes: Gone But Not Forgotten

50 degrees, 26.68 minutes North, 022 degrees, 29.98 minutes East, or 1,000 nautical miles South of Iceland, heading 089 degrees.

Four days of hearing foghorns is starting to get tiring. Captain Wells has been ducking many of his social responsibilities, feeling more secure in the bridge close to the radar. After a few days of intermittent access, the internet is now gone for good, the satellite connection having given up the ghost. People are blaming everything from a lightening strike on the Virginia ground station to late night watching of porn by the crew.

Instead of surfing the net, I am devoting more time to exercise in anticipation of my upcoming Swiss mountain climbing adventures. I have developed a careful routine where I fast walk three times around deck 7 in a brisk wind, take the elevator down to deck 1, walk up their stairs to deck 13, speed past the kennels, the practice golf range, two swimming pools and a bar. I can accomplish all of this three times in an hour, and do it with 40 pounds of books stashed in my backpack. My butler, Peter, tells me there is always a certifiable nut case on every cruise, and I have been designated by the crew as ?THE ONE?.

The 2,600 passengers are quite a mixed batch. We have 1,200 British, 750 Americans, 350 Germans, 80 Canadians, 4 dogs, three cats, and an assortment of other nationalities, and exactly one Japanese couple who didn?t speak a word of English.

I took pity on them and spent an evening translating and catching up on the world at large with them. He was a retired dance instructor, which explains why he and his wife owned the dance floor on most nights. They were grateful for the conversation, for during their entire 30 day cruise from New York to Southampton, then the Baltic Sea and the Norwegian fjords, then back to New York, they had no one to speak to. Still, that was better than last year, when they completed a 105-day round the world cruise with no one to talk to. Before they left, that gave me an exquisite, hand made, traditional Japanese purse as a gift.

The Hard Life at Sea

?Take 200 round trips to Australia, and you really start to rack up the miles,? said Tom Stoker, and automotive sales analyst who just surpassed 10 million frequent flier points on United Airlines. It makes my own 1 million miles seem puny by comparison.

First there was your grade point average, then your SAT score, followed by GMAT and LSAT scores, and finally your FICO. Now there is a new metric with which you will be judged, your ?Influencer? score.

A new breed of marketing research firms are using data from social media sites, like Facebook, Linkedin, and Twitter, to rank members according to their ability to spur their friends to action. Companies like Klout, Peer Index, and Twitter Grader are using complex algorithms to mine their data and rank members. This is far more than just a simple listing of ?friends.?

Scores range from 1-100, with a major league socializer achieving a 40 ranking, and someone like Bono or Martha Steward coming in at a godlike 100. These scores will be made public and could have a major impact on you career prospects, your credit rating, and even your sex life. I can hear this conversation coming already: ?Thanks for the invitation to the opera, honey, but I have a better offer from an 80 to go to the Giants game.?

Do you like your new BMW, American Express card, or Rolex watch and are talking about it with your friends? Advertisers are willing to pay big bucks to get to know you. Last year, Virgin America airline offered free tickets to Los Angeles and San Francisco to highly ranked influencers, while Audi made available special discounts for a new car. Las Vegas casinos are giving away weekends with complimentary show tickets and generous room service tabs.

I have to tell you that I am looking forward to the new system. I just passed 1,200 likes on Facebook and have a massive Twitter following. My website gets 30,000 hits a day and is read in 125 countries, so I should score pretty highly.? I understand that Maria Shriver has recently become available. Hey, Maria! Want to check out my 90? I?ll even fire my cleaning lady!

Will a 90 Tickle Your Fancy?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.