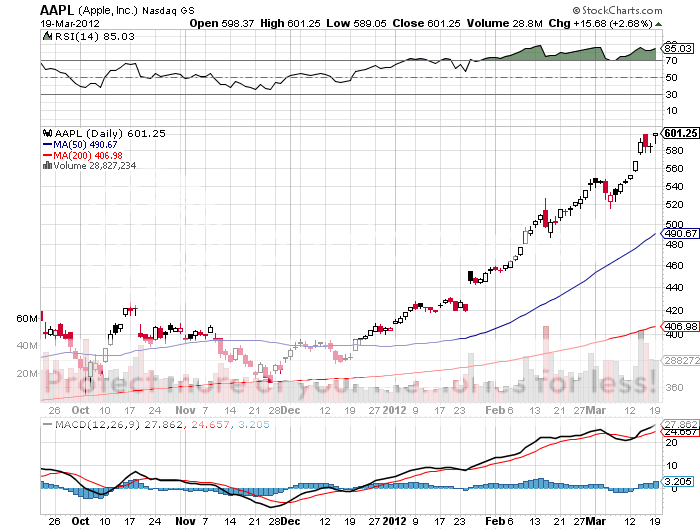

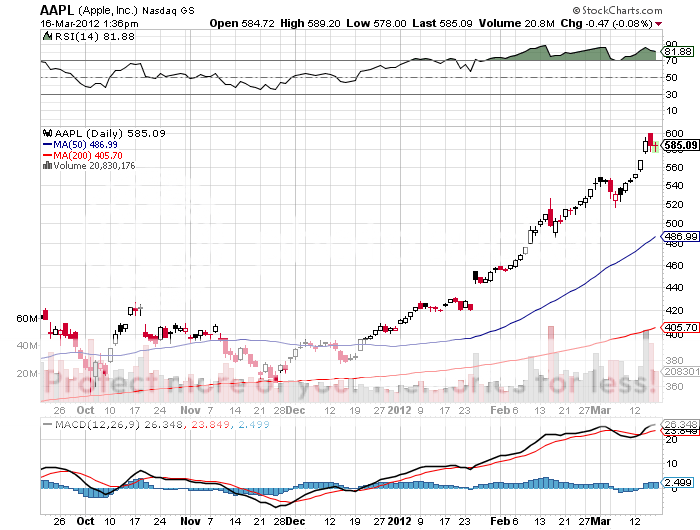

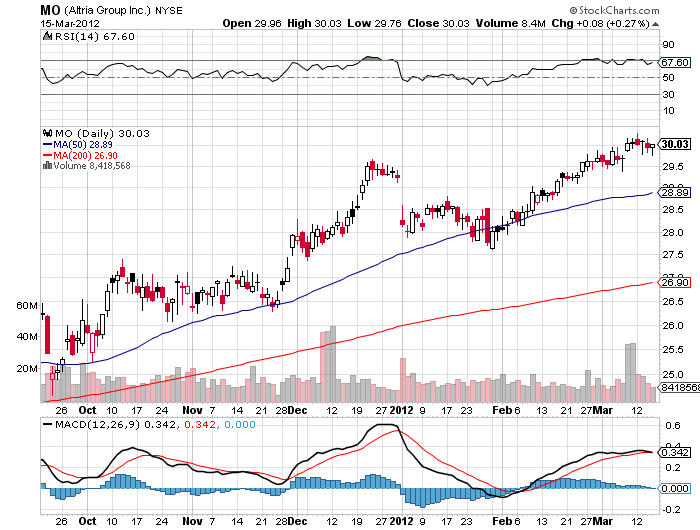

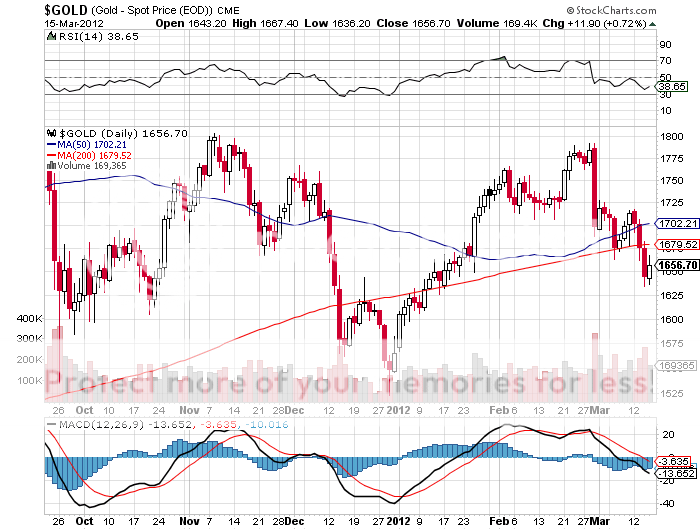

This is the year of the one way move. That has been the harsh lesson of the marketplace since trading commenced at the New Year. We have seen this in Apple, the S&P 500, the Japanese yen, bank shares, natural gas, the volatility index, and now it looks like the Treasury bond market.

Once a move starts, it continues in a straight line. There are no pull backs, corrections, or chances for newcomers to join the party. It is all momentum, or ?momo? as the pit traders refer to it. You either have to close your eyes and buy, or read about it in the newspapers while you are fielding calls from clients complaining about underperformance.

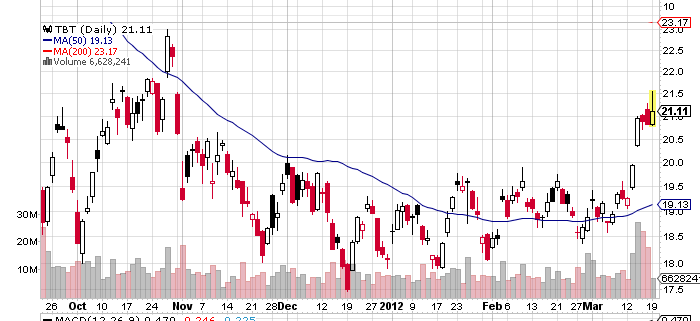

While I am reluctant to buy highs in other asset classes, not so with short Treasury bond plays like the (TBT). The long term case is against Treasury bonds, which have been paying negative real interest rates for years now, is overwhelming. If the (TBT) pulls back 10% from here, I will happily double up.

If you want to read about Treasury bonds, warts and all, please refer to last week?s piece, ?The Structural Bear Case for Treasury Bonds? by clicking here.

There are many reasons why the markets are behaving like this. Volumes are low. Conviction is low. The big volume generators, like the high frequency traders, have departed for friendlier climes, like the foreign exchange and oil markets. Hedge fund traders are out until their models start working again. Individual investors are still back at the station waiting for the next train, having spent the last decade unloading stocks.

The markets aren?t rising because of a new surge of cash coming into the market. Rather, a lack of sellers is the cause, as almost everyone is underweight equities. It only takes a small amount of money coming in from performance chasers to cause the indexes to rise.

It is impossible to say how long the markets will last like this. They will continue until they don?t. There is no quantifying human emotion. Until then, I will keep my book relatively small. I can tell you that when the geniuses look like idiots and the idiots look like geniuses, markets can be very dangerous.