?At these prices, bonds should have warning labels on them,? said Doug Kass of Seabreeze Partners.

Due to overwhelming demand, I have improved and expanded my 2012 schedule of strategy luncheons. The Phoenix lunch got moved to Scottsdale to access a more stylish hotel. The French said they would start mailing me frog legs if I didn?t come to France, so my European Tour now includes a Paris lunch.

The Swiss threatened to they would cancel my invitation to the Davos conference next year, so I have added a seminar in Zermatt. But you will have to climb the Matterhorn to get there. Don?t forget your pitons, crampons, karabiners, ropes, and GPS in case you get buried in an avalanche. I don?t mind visiting the Alps again. Last year, my short in the Swiss franc was my best performing trade, so it should be considerably cheaper this time around.

April 20 San Francisco

May 3 Scottsdale

June 11 Beverly Hills

June 29 Chicago

July 5 New York

July 6-13 Queen Mary II

New York to Southampton

July 16 London

July 17 Paris

July 18 Frankfurt

July 27 Zermatt

October 26 San Francisco

November 8 Orlando

January 3, 2013 Chicago

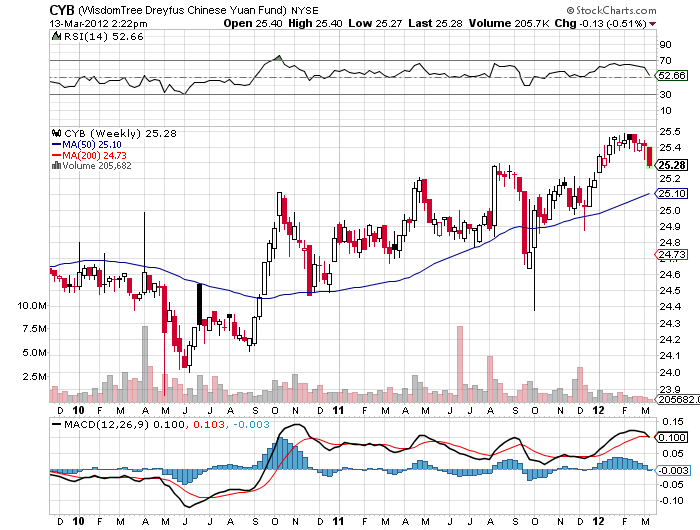

Long time readers of this letter are well aware of my advice to hold cash in the Chinese Yuan ETF (CYB) for the past four years. Those who followed my advice profited nicely.

The Yuan to you and me is known domestically in China as the ?renminbi?, or people?s currency. China has a quasi-fixed exchange rate against the US dollar that limits movement to just a couple of percent a year.

Since the People?s Bank of China removed a decade long dollar peg in 2005, it allowed a very gradual rise in this band of 2-3% a year. That is a vastly superior return compared to the zero interest Americans currently earn from money market funds, cash management accounts, or through buying Treasury notes with up to two year maturities.

This week, rumors roiled the marketplace that the government might slow, or even stop, this drip by drip appreciation. The trigger was a shocking $$31.5 billion February trade deficit, the largest monthly figure since 1998, primarily caused by the recession in Europe, its largest export market. The (CYB) reacted by plunging nearly 1% overnight.

One thing is certain. A free floating Yuan would be at least 50% higher than it is today, and possibly 100%. I can say this in confidence having watched the Japanese yen appreciate from ?360 to the dollar to ?75 while running a trade surplus of similar magnitude for the past 40 years, an increase of almost 400%.

In fact, the desire to prevent foreign hedge funds and speculators from making a killing in the market is a not a small factor in Beijing?s thinking to keep its currency artificially undervalued. The Chinese Central bank governor, Zhou Xiaochuan, says he won?t entertain a revaluation for the foreseeable future. He is no doubt thinking about the millions of Chinese workers who would lose their jobs if their exporting employers? razor thin profit margins are vaporized by a stronger currency.

The Americans say they need a stronger Yuan now. And now the matter has become a campaign issue, with candidate Mitt Romney saying he would label China a ?currency manipulator? on day one in office, not a nice thing to say to the country that is supposed to fund the bulk of his promised tax cuts. Obama has responded in kind, filing a WTO complaint on Chinese export restrictions of rare earth metals essential for our manufacture of electric cars.

I think you could see continued weakness in the Yuan as long as Europe is in the penalty box, slowing the Middle Kingdom?s economic growth. But this is merely a short term dip in a long term trend.

Buy the Yuan ETF on weakness. Just think of it as a cash management tool with an attached lottery ticket. If the Chinese continue to stonewall liberalization of their currency, you will get the token 2%-4% annual revaluation the swaps have been discounting. Given the massive $250 billion annual trade surplus the Middle Kingdom is now running with the US, the chances of a prolonged fall in the Yuan against the dollar are minimal. If they cave, then you could be in for a home run.

Is China a Good Parking Place for Cash?

?I don?t pay any attention to the GDP forecasts of economists?, said Oracle of Omaha Warren Buffet,

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950?s, and which I still remember fondly. This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, and economics. The implications for your investment portfolio will be huge.

What I call ?intergenerational arbitrage? will be the principal impetus. The main reason that we are now enduring two ?lost decades? is that 80 million baby boomers are retiring to be followed by only 65 million ?gen Xer?s. When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and ?RISK ON? assets like equities, and more buyers of assisted living facilities, health care, and ?RISK OFF? assets like bonds. The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward ten years when the reverse happens and the baby boomers are out of the economic, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home. That is when you have 65 million gen Xer?s being chased by 85 million of the ?millennial? generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage hikes. The middle class standard of living will reverse a then 40 year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990?s.

The stock market rockets in this scenario. Share prices may rise gradually for the rest of the teens as long as growth stagnates. A 5% annual gain takes the Dow to 20,000 by 2020. After that, we could see the same fourfold return we saw during the Clinton administration, taking the Dow to 80,000 by 2030. Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well. The 100 year supply of natural gas (UNG) we have recently discovered through the new ?fracking? technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oil fields is also unlocking vast new supplies. That?s why oil is now $70 a barrel in North Dakota versus $100 in Oklahoma 1,000 miles to the South.

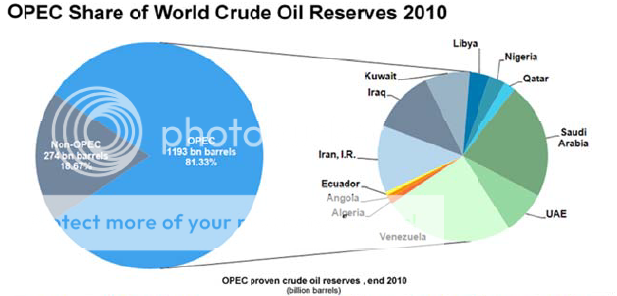

Since 1995, the US Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC?s share of global reserves is collapsing. This is all happening while automobile efficiencies are rapidly improving and the use of public transportation soars.? Mileage for the average US car has jumped from 23 to 24.7 miles per gallon in the last couple of years. Total gasoline consumption is now at a five year low.

Alternative energy technologies will also contribute in an important way in states like California, accounting for 30% of total electric power generation. In two years, my own vehicles will be all electric, with a Nissan Leaf (NSANY) and a Tesla (TSLA) Model X plugged in in my garage, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It will also flip the US from a net importer to an exporter of energy, with hugely positive implications for America?s balance of payments. Eliminating our largest import and adding an important export is very dollar bullish for the long term. That sets up a multiyear short for the world?s big energy consuming currencies, especially the Japanese yen (FXY) and the Euro (FXE). A strong greenback further reinforces the bull case for stocks.

Accelerating technology will bring another continuing positive. Of course, it?s great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos. But at the enterprise level this is enabling speedy improvements in productivity that is filtering down to every business in the US.

This is why corporate earnings have been outperforming the economy as a whole by a large margin. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development. When the winners emerge they will have a big cross leveraged effect on economy.

New health care breakthroughs will make serious disease a thing of the past, which are also being spearheaded in the San Francisco Bay area. I tell my kids they will never be afflicted by my maladies. When they get cancer in 40 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday. What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver?s seat on these innovations? The USA.

There is a political element to the new Golden Age as well. Gridlock in Washington can?t last forever. Eventually, one side or another will prevail with a clear majority. This will allow them to push through needed long term structural reforms, the solution of which everyone agrees on now, but nobody wants to be blamed for. That means raising the retirement age from 66 to 77 where it belongs, the age at which 50% of the population dies, and means testing recipients. Billionaires don?t need the $30,156 annual supplement.

The ending of our foreign wars and the elimination of extravagant unneeded weapons systems cuts defense spending from $800 billion a year to $400 billion, or back to the 2000, pre-9/11 level. Guess what happens when we cut defense spending? So does everyone else. I can tell you from personal experience that staying friendly with someone is far cheaper than blowing them up. A Pax Americana would ensue.

Medicare also needs to be reformed. How is it that the world?s most efficient economy has the least efficient health care system? This is going to be a decade long workout and I can?t guess how it will end. Trim back the government?s participation in the credit markets and you make the numerous miracles above more likely. The national debt comes under control, and we don?t end up like Greece. The long awaited Treasury bond (TLT) crash never happens.

Sure, this is all very long term stuff. But you can expect the financial markets to start discounting a few years hence, even though the main drivers won?t kick in for another decade. But some individual industries and companies will start to discount this rosy scenario now. Perhaps this is what the nonstop rally since October in technology, energy, and health care stocks has been trying to tell us.

Dow Average 1970-2012

Is Another American Golden Age Coming?

?We got competing against cheap labor. What we didn?t get is competing against cheap genius, and that?s what we are doing now with china and India,? said Tom Friedman in his newest book, ?That Used to Be Us.?

The S&P 500 is now at 1,370, and most strategist forecasts for 2012 hover around 1,400, plus or minus some spare change. So the next nine months are going to be incredibly boring. Or they won?t.

Even in a bull market, one expects to see pullbacks of at least one third of the recent gain. Apply that logic towards the 317 points the (SPX) has tacked on since the October low, and that adds up to a 106 point, 7.7% correction down to 1,270.

Given the massive liquidity in the system, the underweight positions of many institutions, and the incredibly low level of interest rates, we are likely to see a rolling type market top that unfolds over the next several weeks or months. That is in contrast to a spike top which you can spot on a chart without your glasses from 20 feet away. These tops can be devilishly difficult to trade, with the limits defined more by time than price.

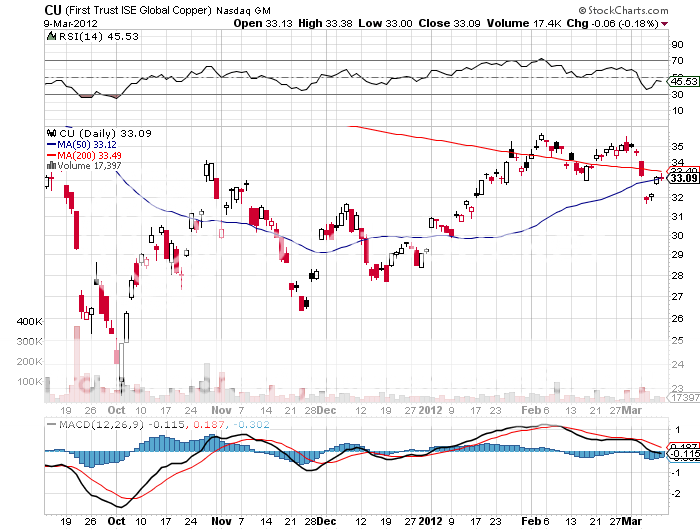

If you want to see what such a rolling top looks like, take a peek at the chart for my old friend, Dr. Copper, that great prognosticator of future economic activity. He shows that we have already been putting in a rolling top for the last two months. This no doubt reflects the slowing economy and the building copper inventories in China, where the red metal is widely used as a monetary instrument. China, in effect, is on a copper standard. In 2011, the peak in copper preceded the one for the (SPX) by exactly 12 weeks.

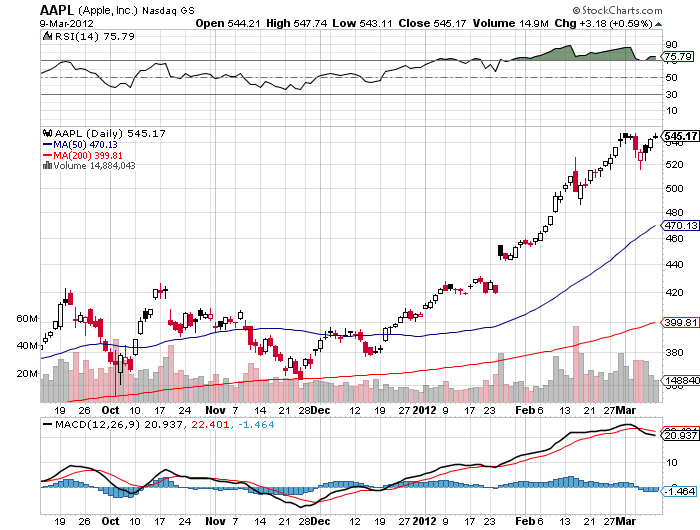

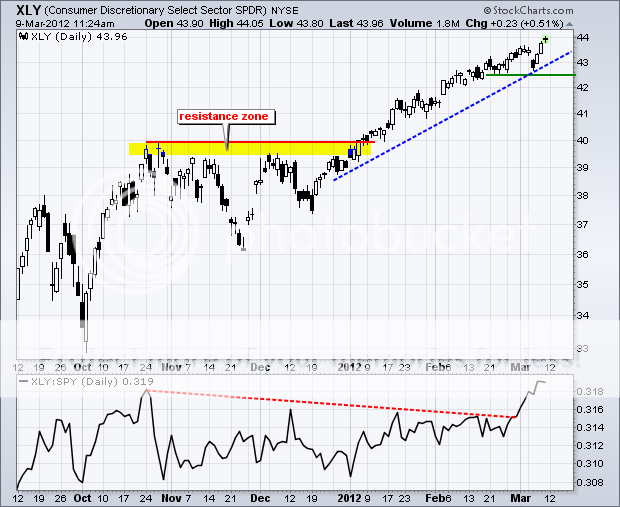

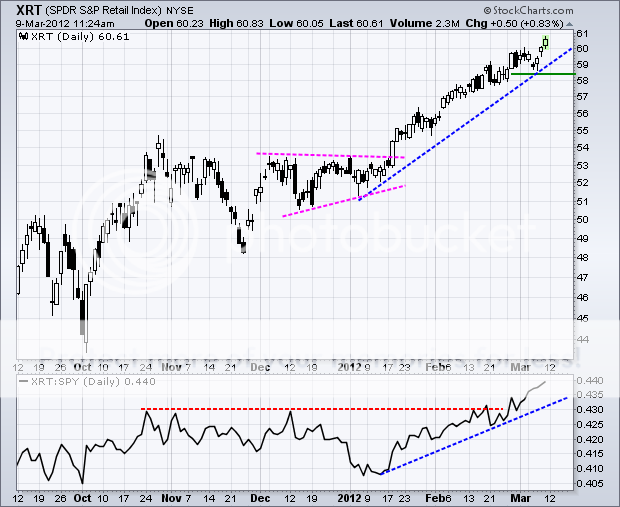

While the broader indexes are likely to deliver a rolling top, that is not the case with individual sectors and stocks. That means you can use these individual spikes to assist in your timing of the overall market. Let me give you three of my favorites with their charts below. Apple (AAPL) is the lead right now. Not only does it dominate NASDAQ (QQQ), it often leads the daily value traded of all stocks worldwide. It is tough to see global rally in risk assets surviving any substantial selloff in Apple.

The consumer discretionary and retail sectors are two additional pathfinder sectors, the most economically sensitive in the market. As long as consumers are packing McDonalds (MCD), Home Depot (HD), and Target (TGT), or burning up their Comcast (CMCSA) broadband connections buying stuff from Amazon (AMZN), you won?t see appreciable market weakness.

Financials are another important sector to watch. They were far and away the best performers during January, with lead stocks like Bank of America (BAC) rising as much as 55%. (BAC) is a dog of the Dow on steroids. But they have stalled since then, providing a major drag on the index. If investors see the glass half full instead of half empty, any upside breakout by banks will take the broader market to new highs for the year. If they don?t, it could roll over like a dead duck.

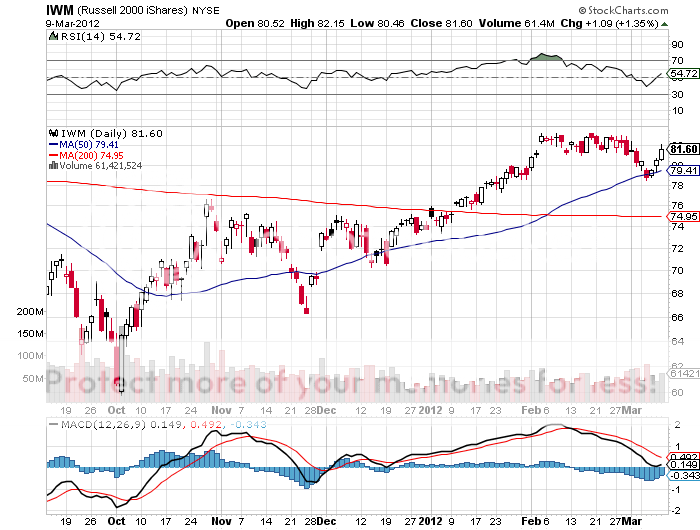

Finally, there is another class of stocks that may lead the charge on the downside, and that is small caps. Look at the chart below for the ETF for the Russell 2000 (IWM). Small companies are always hardest hit in any slowdown because they are more highly leveraged and have less access to external financing, like bank loans and equity floatation?s. I made a bundle last year shorting the (IWM), and plan to do so again this year.

What could drive the final stake through the heart of this bull move? Greece has finally defaulted, and the credit default swaps have been triggered, so the garlic eaters are out of the picture for the time being. Slowing emerging market economies, which account for 75% of global GDP growth, is the 800 pound gorilla sitting in the room that no one wants to acknowledge.

Rising oil prices and the threat of $5/gallon gasoline are his twin brother. War with Iran, or an Israeli air strike there, is the second cousin in the waiting room out front. And quantitative easing, which has been powering risk assets mightily for five years, is about to become an extinct species.

I?ll tell you what worries me the most. The principal driver of the three year bull market has been rapidly rising corporate earnings. They are now starting to slow dramatically. All of the increase in share prices this year has been based on rising multiples, from 13X to 14X, not expanding profits. That is not a healthy bull market to inhabit. Shall you bet the ranch on 15X? I think not.

So how is the genius, aggressive hedge fund trader going to deal with these opaque markets? Bet that the market is going to stay in a broad range for a few more months. We aren?t going to the moon, nor are we going to crash. We are more likely to die of ice than fire.

There are several ways to play this kind of market. If you have a plain vanilla stock portfolio, you should be executing buy writes against your existing holdings to take in extra premium income. With the bull move five months old, call options are trading at historically rich levels. This low risk, high return strategy involves selling short call options against existing stock positions. If your stock gets called away, you just say ?thank you very much? and buy it back on the way down.

For the more aggressive, you can add naked short sales of deep out of the money calls one month out. Last week, I sold April expiration Apple calls 20% out of the money, and they have already dropped in value by 65%. When the April?s expire, I?ll role out to the May?s. You don?t get rich with a strategy like this, but you earn a living. Don?t leverage up too much on this one. It is the surest way to go out of business that I know of.

What To Do With Four 800 Pound Gorillas in the Room?

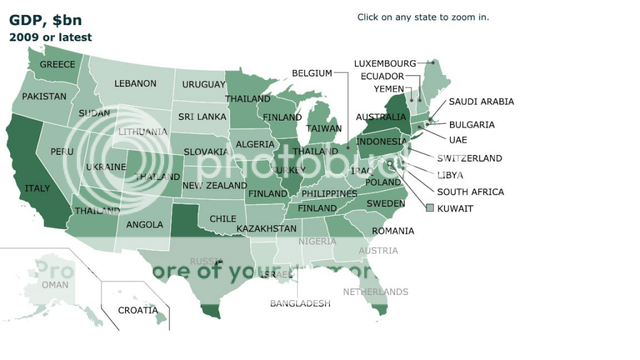

My mother lives in Pakistan, my daughter in Greece, and I have a ski chalet in in Peru. What's more, I have strategy luncheons planned for Australia, Thailand, and Turkey. At least these would be my conclusions after looking at a map prepared by my esteemed former employer, The Economist magazine, of the United States, renaming each state with its international equivalent in GDP.

There are other tongue-in-cheek comparisons to be made. Texas is portrayed by Russia, which makes sense, as both are oil exporters. Ditto for Alaska, which is represented by Oman. As for Hawaii? It is renamed Croatia. Now that would really give president Obama birth certificate problems!

I worked for this August publication for a decade during the seventies, and have been reading the best business magazine in the world for nearly over four decades. They never cease to inform, entertain, and titillate. An April 1 issue once did a full page survey on a fictitious country off the coast on India called San Serif. It noted that if the West coast kept eroding, and the East coast continued silting up, the country would eventually run into the subcontinent, creating serious geopolitical problems.

It wasn't until someone figured out that the country, the prime minister, and every town on the map was named after a type font that the hoax was uncovered. This was way back, in the pre-Microsoft Word era, when no one outside the typesetters union knew what 'Times Roman' meant.

?The December, 1999 Green Book, the internal forecasting paper of the Federal Reserve, has a disclaimer which said ?not to be used externally, and harmful if swallowed?, said president of the Dallas Fed, Richard Fisher.

We received another raft of data this morning confirming my suspicion that the economic data is slowly turning over from modestly positive to mixed.

The Challenger, Grey, & Christmas report showed that there were 51,758 job cuts in February, down 3% from January. But the first two months of 2012 revealed that layoffs announced by private companies are up 18% YOY. Consumer products, transportations, and retail showed the greatest losses.? They are seeing temps are being turned into full timers, creating no net gain in employment. Government job cuts are starting to wane as well. This is definitely a mixed bag, at best.

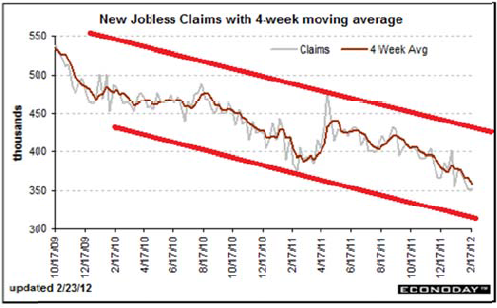

The Department of Labor weekly jobless claims showed a modest increase, moving from 354,000, up to 8,000 to 362,000. There was a slight uptick in four week moving average which most economists prefer to track. Continuing claims rose from 3.406 million to 3.416 million. There are still a hefty 7.5 million unemployed receiving benefits. Some analysts are blaming the uptick on the end of the early spring and the return to normal winter weather.

The reason that I am regurgitating all of these numbers in excruciating detail is that this is the type of metamorphosing data flow you see before a rounding top in the stock market. Such tops spawn from data that flip from clear to muddled, putting the risk of an economic slowdown squarely on the table, and can take a few months to unfold.

The recent numbers from China, Europe, and Brazil are already screaming at us that this is the case. But hedge fund traders can be a dull lot, and sometimes must be hit in the head with a hammer several times before they get the message.

Of course, we get the big kahuna tomorrow, the February nonfarm payroll, the most closely watched economic indicator by the market. It is safe to say that the market is priced for perfection here. If it comes in line at 200,000, you could get a snore. But even the slightest disappointment could bring a repeat of Tuesday?s 200 point swoon. Check in at 8:30 EST to see if I?m right.

You Said What?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.