If you can pick up any emerging market with a multiple of less than 20, it is a great long term investment,? said professor Jeremy Siegel at the University of Pennsylvania Wharton School of Business.

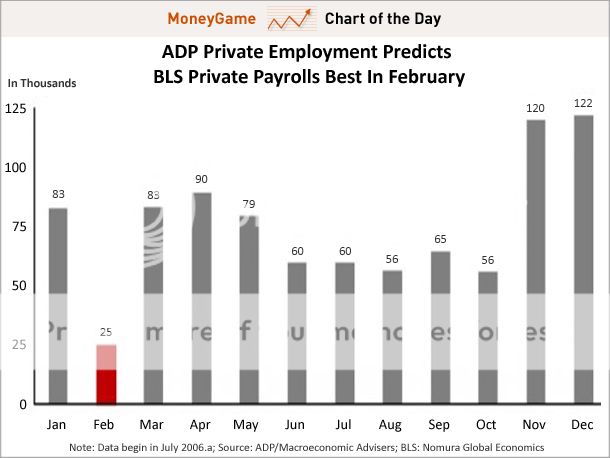

Don?t expect much market volatility until we get the February nonfarm payroll report on Friday at 8:30 EST. Consensus has them coming in at around 200,000. However, we may have just gotten a valuable preview to those figures.

According to the Japanese broker, Nomura Securities, the ADP National Employment Report, a monthly analysis of the hiring trends of 344,000 private businesses, is most aligned with the official jobs report in February. Since 2006, the average February gap is only 25,000, which is less than half of the gap of other months.

The ADP came in this morning at 216,000, and the market yawned. That presages that the Friday consensus expectation could be right. While a good number, especially coming on a series of positive monthly reports, it won?t exactly set the markets on fire. That could pave the way for a further downside test in the equity markets, as well as other risk assets, especially gold, silver, and the other metals.

You don?t want to bet the ranch on historic correlations. Still, I thought you?d like to know.

Once, an Extinct Species

?We?ve had several false starts in this recovery. People jump on the train just before it runs off the tracks. You have to be wary about that,? said a well-known economist.

My friend was having a hard time finding someone to attend a reception who was knowledgeable about financial markets, White House intrigue, international politics, and nuclear weapons.

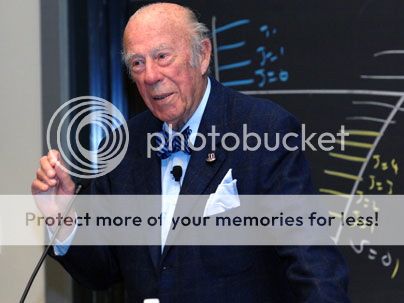

I asked who was coming. She said Reagan?s Treasury Secretary George Shultz, Clinton?s Defense Secretary William Perry, and Senate Armed Services Chairman Sam Nunn. I said I?d be there wearing my darkest suit, cleanest shirt, and would be on my best behavior, to boot.

When I arrived at San Francisco?s Mark Hopkins Hotel, I was expecting the usual mob scene. I was shocked when I saw the three senior statesmen making small talk with their wives and a handful of others.

It was a rare opportunity to grill high level officials on a range of top secret issues that I would have killed for during my days as a journalist for The Economist magazine. I guess arms control is not exactly a hot button issue these days. I moved in for the kill.

I have known George Shultz for decades, back when he was the CEO of the San Francisco based heavy engineering company, Bechtel Corp. I saluted him as ?Captain Schultz?, his WWII Marine Corp rank, which has been our inside joke for years. Since the Marine Corps didn?t know what to do with a PhD in economics from MIT, they put him in charge of an anti-aircraft unit in the South Pacific, as he already was familiar with ballistics, trajectories, and apogees.

I asked him why Reagan was so obsessed with Nicaragua, and if he really believed that if we didn?t fight them there, we would be fighting them in the streets of Los Angeles. He replied that the socialist regime had granted the Soviets bases for listening posts that would be used to monitor US West Coast military movements in exchange for free arms supplies. Closing those bases was the true motivation for the entire Nicaragua policy. To his credit, George was the only senior official to threaten resignation when he learned of the Iran-contra scandal.

I asked his reaction when he met Soviet premier Mikhail Gorbachev in Reykjavik in 1986 when he proposed total nuclear disarmament. Shultz said he knew the breakthrough was coming because the KGB analyzed a Reagan speech in which he had made just such a proposal.

Reagan had in fact pursued this as a lifetime goal, wanting to return the world to the pre nuclear age he knew in the 1930?s, although he never mentioned this in any election campaign. As a result of the Reykjavik Treaty, the number of nuclear warheads in the world has dropped from 70,000 to under 10,000. The Soviets then sold their excess plutonium to the US, which today generates 10% of the total US electric power generation.

Shultz argued that nuclear weapons were not all they were cracked up to be. Despite the US being armed to the teeth, they did nothing to stop the invasions of Korea, Hungary, Vietnam, Afghanistan, and Kuwait.

I had not met Bob Perry since the late nineties when I bumped into his delegation at Tokyo?s Okura Hotel during defense negotiations with the Japanese. He told me that the world was far closer to an accidental Armageddon than people realized.

Twice during his term as Defense Secretary he was awoken in the middle of the night by officers at the NORAD early warning system to be told that there were 200 nuclear missiles inbound from the Soviet Union. He was given five minutes to recommend to the president to launch a counterstrike. Four minutes later, they called back to tell him that there were no missiles, that it was just a computer glitch.

When the US bombed Belgrade in 1999, Russian president, Boris Yeltsin, in a drunken rage, ordered a full scale nuclear alert, which would have triggered an immediate American counter response. Fortunately, his generals ignored him.

Perry said the only reason that Israel hadn?t attacked Iran yet, was because the US was making aggressive efforts to collapse the economy there with its oil embargo. Enlisting the aid of Russia and China was key, but difficult since Iran is a major weapons buyer from these two countries. His argument was that the economic shock that a serious crisis would bring would damage their economies more than any benefits they could hope to gain from their existing Iranian trade.

I told Perry that I doubted Iran had the depth of engineering talent needed to run a full scale nuclear program of any substance. He said that aid from North Korea and past contributions from the AQ Khan network in Pakistan had helped them address this shortfall.

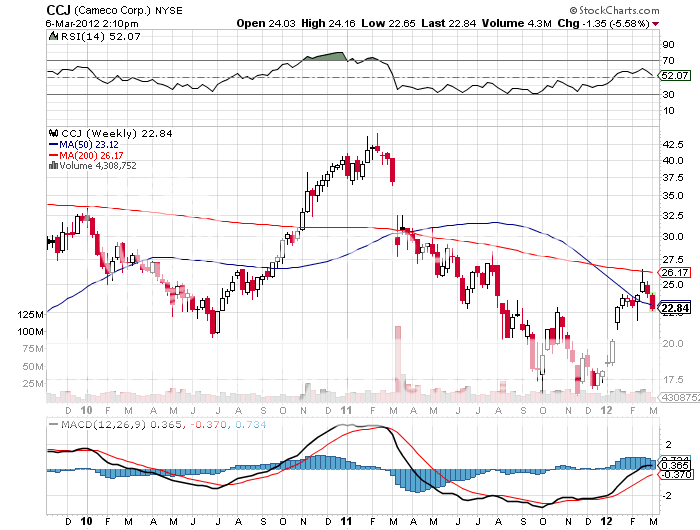

Ever in search of the profitable trade, I asked Perry if there was an? opportunity in nuclear the plays, like the Market Vectors Uranium and Nuclear Energy ETF (NLR) and Cameco Corp. (CCR), that have been severely beaten down by the Fukushima nuclear disaster. He said there definitely was. In fact, he personally was going to lead efforts to restart the moribund US nuclear industry. The key here is to promote 5th generation technology that uses small, modular designs, and alternative low risk fuels like thorium.

I had never met Senator Sam Nunn and had long been an antagonist, as he played a major role in ramping up the Vietnam War. Thanks to his efforts, the Air Force, at great expense, now has more C-130 Hercules transport planes that it could ever fly because they were assembled in his home state of Georgia. Still, I tried to be diplomatic.

Nunn believes that the most likely nuclear war will occur between India and Pakistan. Islamic terrorists are planning another attack on Mumbai. This time India will retaliate by invading Pakistan. The Pakistanis plan on wiping out this army by dropping an atomic bomb on their own territory, not expecting retaliation in kind. But India will escalate and go nuclear too. Over 100 million would die from the initial exchange. But when you add in unforeseen factors, like the broader environmental effects and crop failures (CORN), (WEAT), (SOYB), (DBA), that number could rise to 1-2 billion. This could happen as early as 2013.

Nunn applauded current administration efforts to cripple the Iranian economy which has caused their currency to fall 30% in the past six months. The strategy should be continued, even if innocents are hurt. He argued that further arms control talks with the Russians could be tough. They value these weapons more than we do, because that?s all they have left. Nunn delivered a stunner in telling me that Warren Buffet had contributed $50 million of his own money to enhance security at nuclear power plants in emerging markets. I hadn?t heard that.

As the event drew to a close, I returned to Secretary Shultz to grill him some more about the details of the Reykjavik conference held some 26 years ago. He responded with incredible detail about names, numbers, and negotiating postures. I then asked him how old he was. He said he was 91. I responded ?I want to be like you when I grow up?. He answered that I was ?a promising young man.? It was the best 60th birthday gift I could have received.

Oops, Wrong Number

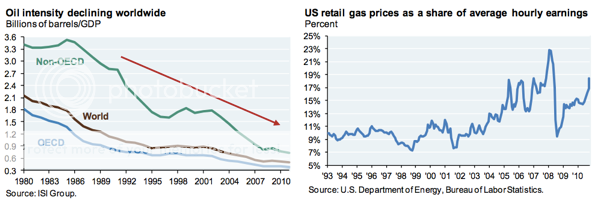

Virtually every analyst has been puzzled by the seeming immunity of stock markets to soaring oil prices this year. In fact, stocks and crude have been tracking almost one to one on the upside. The charts below a friend at JP Morgan sent me a long way towards explaining this apparent dichotomy.

The first shows the number of barrels of oil needed to generate a unit of GDP, which has been steady declining for 30 years. The second reveals the percentage of hourly earnings required to buy a gallon of gasoline in the US, which has been mostly flat for three decades, although it has recently started to spike upwards.

The bottom line is that conservation, the roll out of more fuel efficient vehicles and hybrids, and the growth of alternatives, are all having their desired effect. Developed countries are getting six times more GDP growth per unit of oil than in the past, while emerging economies are getting a fourfold improvement. The world is gradually weaning itself off of the oil economy. But the operative word here is 'gradually', and it will probably take another two decades before we can bid farewell to Texas tea, at least for transportation purposes.

But the Mileage is Great!

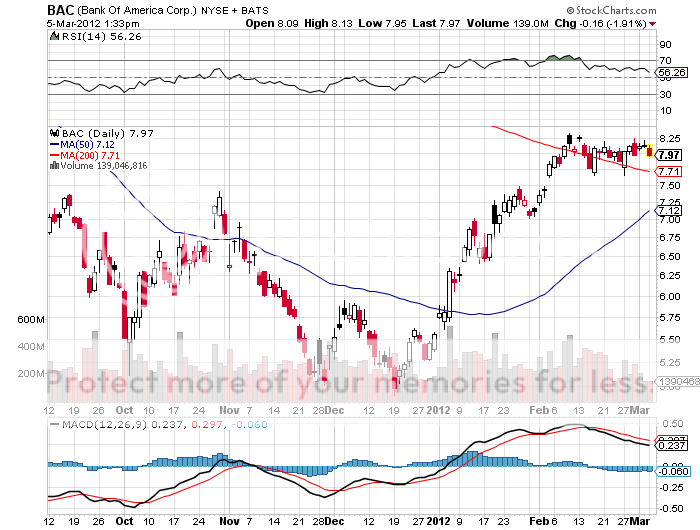

I am going to use the weakness in Bank of America shares today to cover my short position through selling my existing position in the (BAC) May, 2012 $7 puts at $0.24 cents or best. There is such minimal volatility in the market these days that when a little bit comes along, you have to grab it with both hands.

The poor performance of these puts illustrates well the general malaise of the market. Despite catching a five cent drop in the share price, the value of these April puts fell from 40 cents to 24 cents. This is what happens when option time decay is added in with falling market volatility. This is why many option strategies are failing to work now.

When I recognized that this could become a prolonged problem, I responded with a rash of short volatility positions which have proved highly profitable. These include running deep in the money bull call spreads in Microsoft (MSFT) and Apple (AAPL), and naked sales of deep out of the money Apple calls.

I could have sold the (BAC) puts twice over the last 19 days for a profit as high as 30%. I held on both times hoping that the long overdue downward momentum would develop. That never materialized. The shares only made it down to $7.66, well short of my $7 target. The lesson here is that in these market conditions you have to keep your time frames as short as possible. Taking the money and running is the winning approach.

There are other reasons to punt on this position. The February non-farm payroll that comes out this Friday is expected to be good, possibly over 200,000. That could trigger another rally in (BAC) shares. Weekly jobless claims are at new lows for this cycle.

New housing sales are also showing a glimmer of life. Any good news on real estate is also positive for banks, no matter how ephemeral it might be, because it suggests that their bad loan portfolios may recover a bit. So it is better to sit on the sidelines on this one and take advantage of better entry points that may come along higher up.

?What?s very different today is that when dividend yields are much higher than interest rates, you don?t need as much earnings growth and capital gains to have a great investment,? said professor Jeremy Siegel at the University of Pennsylvania Wharton School of Business.

That is certainly the conclusion of the financial markets. When Federal Reserve chairman, Ben Bernanke, failed to mention the magic words in his House Humphrey Hawkins testimony on Wednesday, risk assets were sent into a tailspin. Gold suffered a $100 move plunge in hours, the futures market seeing an almost instantaneous liquidation of $1.3 billion worth of contracts. Silver dropped 10%. Oil gave up $3 in a heartbeat.

What was truly impressive was the collapse of the Treasury bond market, which saw yields for the ten year leap from 1.92% to 2.05%. When a single order to sell 100,000 bond futures contracts worth $10 billion hit the market, many thought that a major firm had committed a grievous ?fat finger? error. But the ?cancel and correct? never came, and the trade stood. Clearly, a major hedge fund was betting that the 30 year bull market in bonds had peaked and moved to add some serious downside exposure.

The reason that I missed the extent of the serious rally in risk assets this year is that the current wave of quantitative easing was so paltry. One ?500 billion tranche in December followed by a second on February 29 is only a fraction of the tsunami sized liquidity the Fed?s previous QE1 and QE2 unleashed on the markets.

In any case, most of this cash stayed in Europe, with the banks bidding up sovereign bonds in a frenzied manner to captures a massive positive carry. Italian ten year yields collapsed from over 8% to under 5% in weeks. As expected, none of the dosh made it into the real economy where it could do some actual good. But traders have developed a Pavlovian response to the words ?quantitative easing?, which instantly triggers a rush of buying of all assets everywhere, as it has done in past cycles.

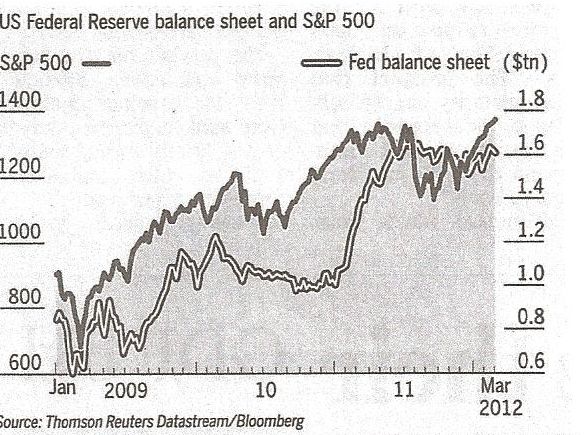

Never mind that the big liquidity surge wasn?t actually there. If you don?t believe me, take a look at the chart below showing the growth of the Fed balance sheet and its correlation with the S&P 500. When US central bank launched QE1 in early 2008, its assets soared from $600 billion to an amazing $1.7 trillion. Since mid-December when the ECB initiated its LTRO, it has climbed from $1.4 trillion to $1.8 trillion, a modest $400 billion, and represents only a recovery of its June 2010 high. That is only 36% of the earlier balance sheet expansion.

Since the onset of quantitative easing five years ago, this aggressive monetary policy tool has created anywhere from $3 trillion to $10 trillion in broader global liquidity. If you take away the punch bowl, the effect on risk assets could be dire. For a preview, take a look at what happened when we were in between QE waves from the end of the last Fed program in June to the European foreign language sequel in December. The S&P 500 collapsed by 25%, gold surrendered $400, and silver cratered nearly 50%, and $40 evaporated off of the price of oil.

I never believed that the Fed would follow up with a QE3, and I am sticking to my guns. None of the money from earlier easings made it into the sectors of the economy that they were attempting to target, like housing and construction. All it did was create bubbles in liquid and fungible global asset prices.

I think the Fed has figured this out by now. If a policy fails twice, then why repeat it a third time? If quantitative easing is truly well and done for good, how will the risk markets respond when they figure this out? The mother of all hangovers could be a safe bet.

Since we?re talking about Europe, good job on the Oscars, France! With Jean du Jardin in ?The Artist?, you won best picture and best actor. It is perhaps ironic that it was for a silent film. Is The Academy trying to tell you something, or what? Sorry, but I can?t resist a good cheap shot, especially when a foreigner takes away the prizes from California?s most illustrious industry. If my amphibious followers want to throw rotten tomatoes at me in person, please buy tickets to my July 17 Paris strategy lunch by clicking here.

Well Said, France!

Paid up subscribers to Global Trading Dispatch and the Diary of a Mad Hedge Fund Trader newsletter are entitled to a password that gives them access to my premium content. Without it you will be unable to access the best parts of the new website, including my daily real time trading portfolio, trade alert tutorial and user?s manual, my Review of 2011, 2012 Outlook, and live biweekly strategy webinars. If you still have not received your password, or have lost it, please email us at support@madhedgefundtrader.com . A new password will be issued promptly.

For those who are yet to have their investment returns enhanced beyond their wildest imagination by Global Trading Dispatch, please sign up for the newsletter only for $500 a quarter. If you like what you see, then you can upgrade later to the full service for $3,000 a year and we will give you a full credit for what you already spent.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011. The service includes my Trade Alert Service, daily newsletter, real time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

?If you?re not busy being born, you?re busy dying,? said folk singer, Bob Dillon.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.