It has been a long wait for 'peak oilers,' whose passionate belief is that the world will run out of oil in coming years, sending prices through the roof.

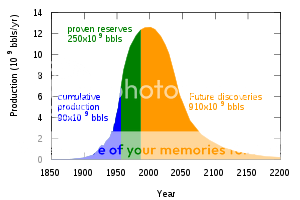

This splinter religion came into being in 1956 when M. King Hubbert produced some simple supply/demand charts showing that US reserves of Texas tea would dry up by 1965-70, forcing a heavy reliance on imports with which we have become all too familiar. This was later expanded globally, implying that Western civilization would come to a grinding halt.

It all seemed very prescient, when in 1973 OPEC raised prices from $3/barrel to $12 in the wake of the Yom Kippur war, and the resulting boycott caused enormous lines at American gas stations. It happened again in 1979 with the fall of the Shah of Iran, taking crude from $12 to $40. Then Saudi overproduction kicked in big time, bring 20 years of falling prices, all the way down to $8. At the 1998 low, oil was selling for less than the barrel that contained it.

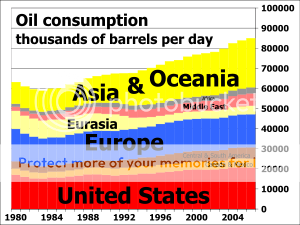

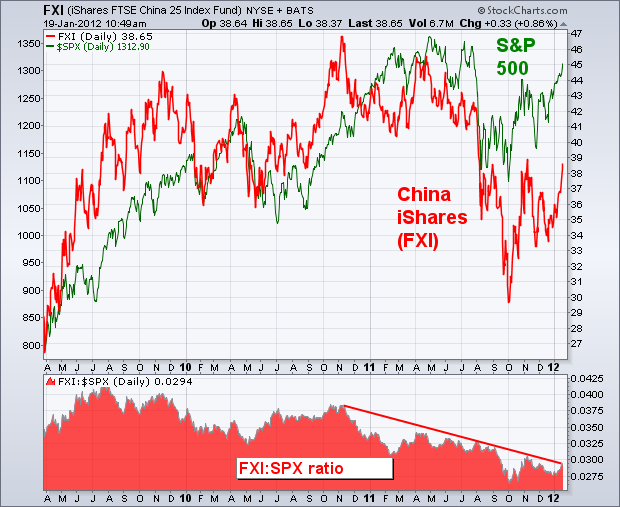

Then came China and the commodities boom, which suddenly sent the value of all things 'hard' skyward. Virtually overnight, the Middle Kingdom became the world's largest marginal consumer of not only oil, but all energy sources. By 2008, peak oilers had the second coming in sight, with prices soaring to $150/barrel.

Enter the Great Recession. The real damage this caused was not the temporary collapse of prices down to $28/barrel and the wiping out of many industry participants. It was the two year freeze on the financing of new exploration and development, a byproduct of the Wall Street crash. BP's Gulf oil spill didn't help matters either. These events have combined to create a bubble in the energy pipeline, the implications of which we may only just now be seeing.

Now the Middle East is blowing up. With populations exploding, per capita incomes plunging, and a religion that mires them in the 14th century, this sort of viral, grass roots revolution could have, and should have happened any time over the last 40 years. It took cell phones, social media, and the Internet to provide the spark. At first, the world didn't care, as Egypt and Tunisia produce little oil, and are non-factors in the global economy.

Then came Libya, an entirely different kettle of fish. Having dealt with the Libyan government myself since 1968 when Muammar Khadafi overthrew the government and kicked me out of the country, I can only say this couldn't happen to a nicer guy. I missed the Pan Am flight he blew up over Lockerbie, Scotland by a week and lost a few friends. Justice finally came when he was dragged out of a storm drain and shot at close range.

The revolution there raised broader, far more concerning questions. If it can happen in Libya, why not in Saudi Arabia, where the government is still essentially tribal in nature and will not be winning any prizes for their human rights record anytime soon. Women are still not allowed to drive. Take their 12 million barrels/day off the market, even for a few days, and the geopolitical implications are large.

Which brings me back to peak oil. After a quiet, long term downsizing, the US now only imports 2 million barrels a day from the Middle East. Canada is now our largest foreign supplier, followed by Mexico and Venezuela. But oil is a globally traded commodity, and if you prick the supply line in one place we all have to pay. Remove Saudi Arabia from the picture, and the results could be catastrophic, for China first, but for ourselves as well.

Even without these Armageddon scenarios, we are still facing a huge

problem. World oil production today is 83-84 million barrels/day. There is probably another 5 million barrels/day in reserve. By 2015, an additional 3 million barrels/ day in will come on stream that was financed prior to the Wall Street melt down. After that, new supplies become very problematic.

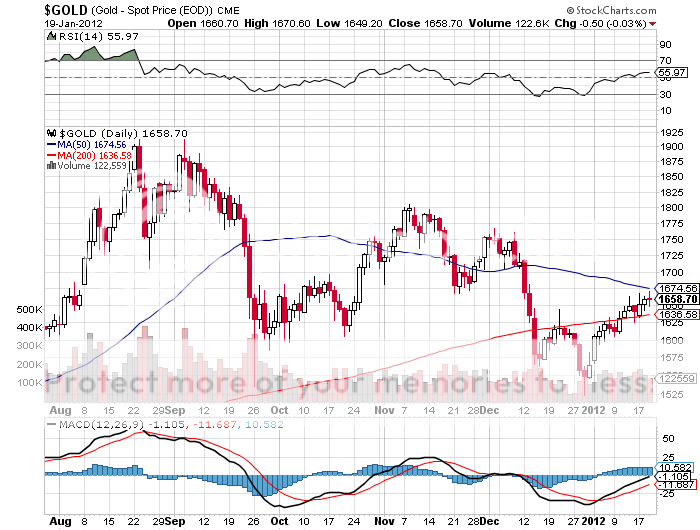

Even if the US can keep its own demand relatively flat through modest economic growth, conservation, new efficiencies, alternatives, and switching to natural gas, China promises to eat up all of this increase. That's when the sushi hits the fan. I think oil could hit $300/barrel by 2020, or $225 in today's prices. If you are wondering why I have become so cautious about investing lately, this is a major reason why.

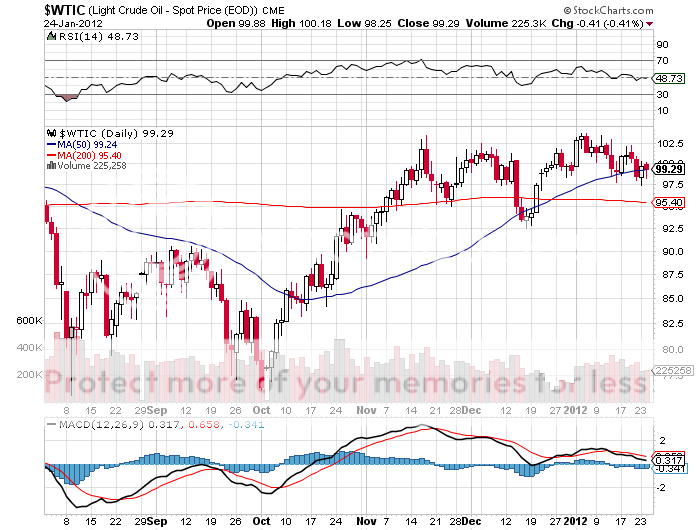

Which leads us all to the bigger question of how do we make a buck out of all of this? Brent crude, which trades in Europe, is already at $110/barrel, an $11/barrel premium to our own West Texas intermediate. Prices here have stayed low because of a shortage of storage facilities. My buddies in the field also tell me there is some elaborate conspiracy to keep West Texas artificially low, because the prices for Middle Eastern imports are priced off of that highly manipulated benchmark. It is far more likely that West Texas trades up to Brent than the other way around.

I missed the window to get in last week at $85/barrel. But if you believe it's going substantially higher, it is not too late to get involved with long term portfolios. For a start, do not buy the oil ETF (USO). The tracking error caused by the contango will kill you, assuring that you will take all of the risk but get few of the benefits.

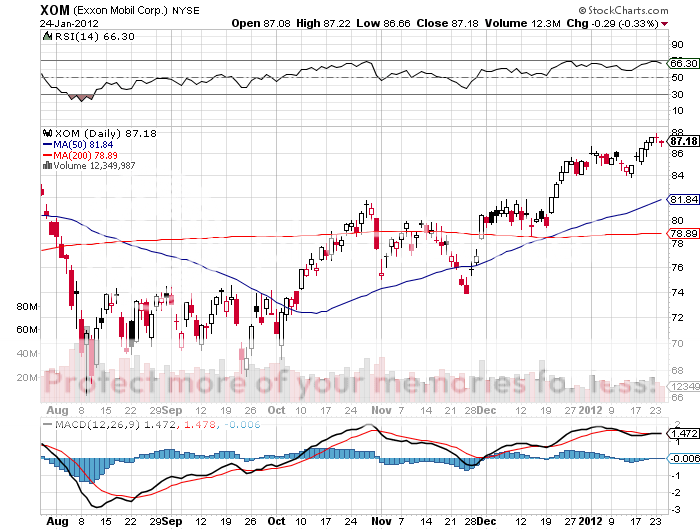

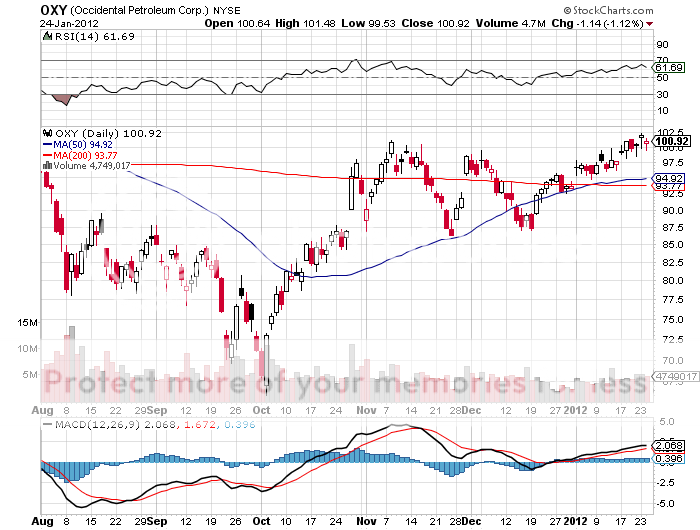

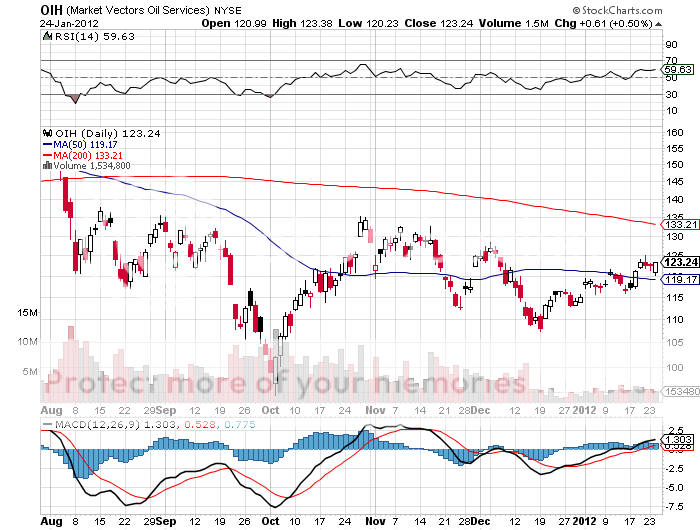

Individual oil major stocks that I have been recommending, like ExxonMobil (XOM), BP (BP), and ConocoPhillips (COP) are great vehicles. A simple alternative is to pick up the double long oil majors ETF (DIG). These guys have massive supplies in the pipeline that are about to be revalued by higher prices. So are independents like Occidental Petroleum (OXY). You can throw oil service companies into the mix as well through the ETF (OIH).

As (OXY) founder, Dr. Armand Hammer, told me when I was a kid, 'Keep your eye on oil, because everything stems from that.' Some 40 years later, and I think the old man is still right.