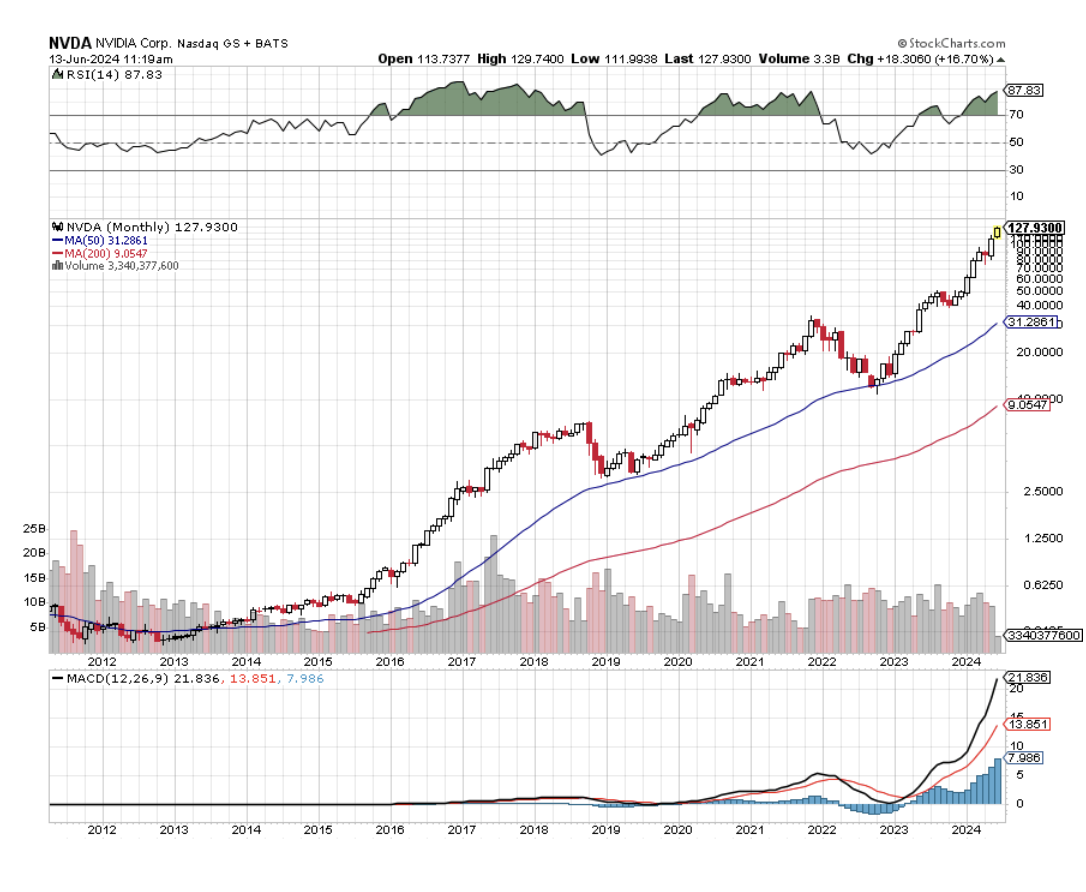

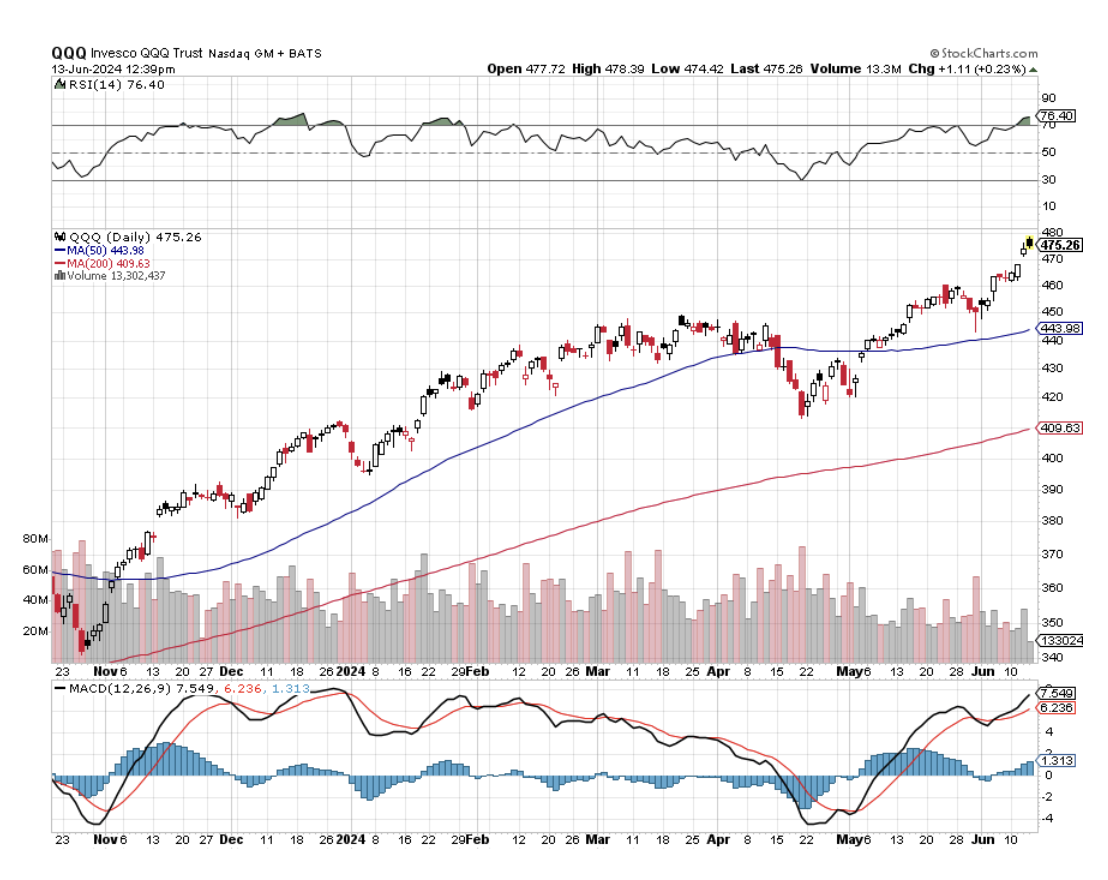

We have a three-horse race underway in the stock market right now between Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA). One day, one is the largest company in the world, another day a different company noses ahead.

And here’s the really good news: this race has no end. Sure, (NVDA) has far and away the most momentum and it should hit my long-term target of $1,400 this year, giving it a market capitalization of $3.44 trillion. (MSFT) and (AAPL) will have to stretch to make another 20% gain by year-end.

Who will really end this three-year race? You will, as the benefits of AI, hyper-accelerating technology, and deflation rains down upon you and your retirement portfolio.

Here is the reality of the situation. The Magnificent Seven has really shrunk to the Magnificent One: NVIDIA. (NVDA) alone has accounted for 32% of S&P 500 gains this year. There are now 400 ETFs where (NVDA) is the biggest holding, largely through share price appreciation. These dislocations in the market are grand. This will end in tears….but not yet.

Dow 240,000 here we come!

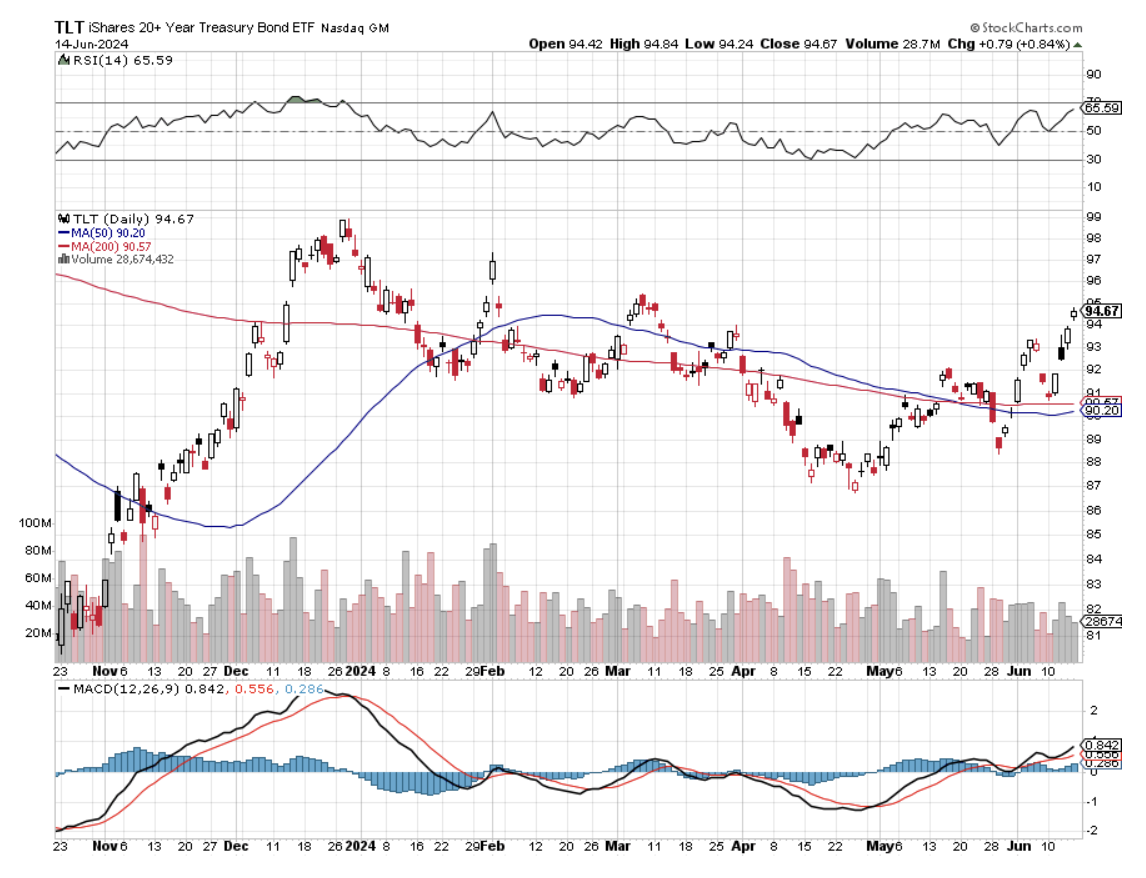

After six months of grief, pain, and suffering last week, my (TLT) LEAPS finally went into the money last week.

Remember the (TLT)?

On January 18, I bought the United States Treasury Bond Fund (TLT) January 17, 2025, $95-98 at-the-money vertical Bull Call spread LEAPS at $1.25 or best. On Friday, they nudged up to $1.35. But I kept averaging down with the $93-$96’s and the $90-$93’s which are now at a max profit.

We lost six months on this trade thanks to a hyper-conservative which is eternally fighting the last battle. A 9.2% peak certainly put the fear of God in them and they persist in thinking a return to higher inflation rates is just around the corner.

Markets, however, have a different view. They are now discounting a 25-basis point cut in September followed by another in December. That will easily take the (TLT) up to $100. This is why we go long-dated on LEAPS. There is plenty of room for error….lots of room, even room for the Fed’s error. If you wait long enough, everything goes up.

With THIS Fed fighting it seems to pay off. That is what happened when Jay Powell waited a full year until raising rates for a super-heated economy. He now risks tipping the US into recession by lowering rates too slowly, when virtually all data points are softening. I guess that’s what happens when you have a Political Science major as Fed governor.

And here is what the Fed is missing. AI is destroying jobs at a staggering rate, not just minimum wage ones but low-end programming ones as well. That’s what the 300,000 job losses over the last two years in Silicon Valley have been all about.

It’s unbelievable the rate at which AI is replacing real people in jobs. If you want a good example of that, I had to call Verizon (VZ) yesterday to buy an international plan, and I never even talked to a human once. They listed three international plans in a calm, even, convincing male voice, and I picked one.

Or go to McDonalds (MCD) where $500 machines are replacing $40,000 a year workers. This is going on everywhere at the same time at the fastest speed I have ever seen any new technology adopted. So buy stocks, that’s all I can say.

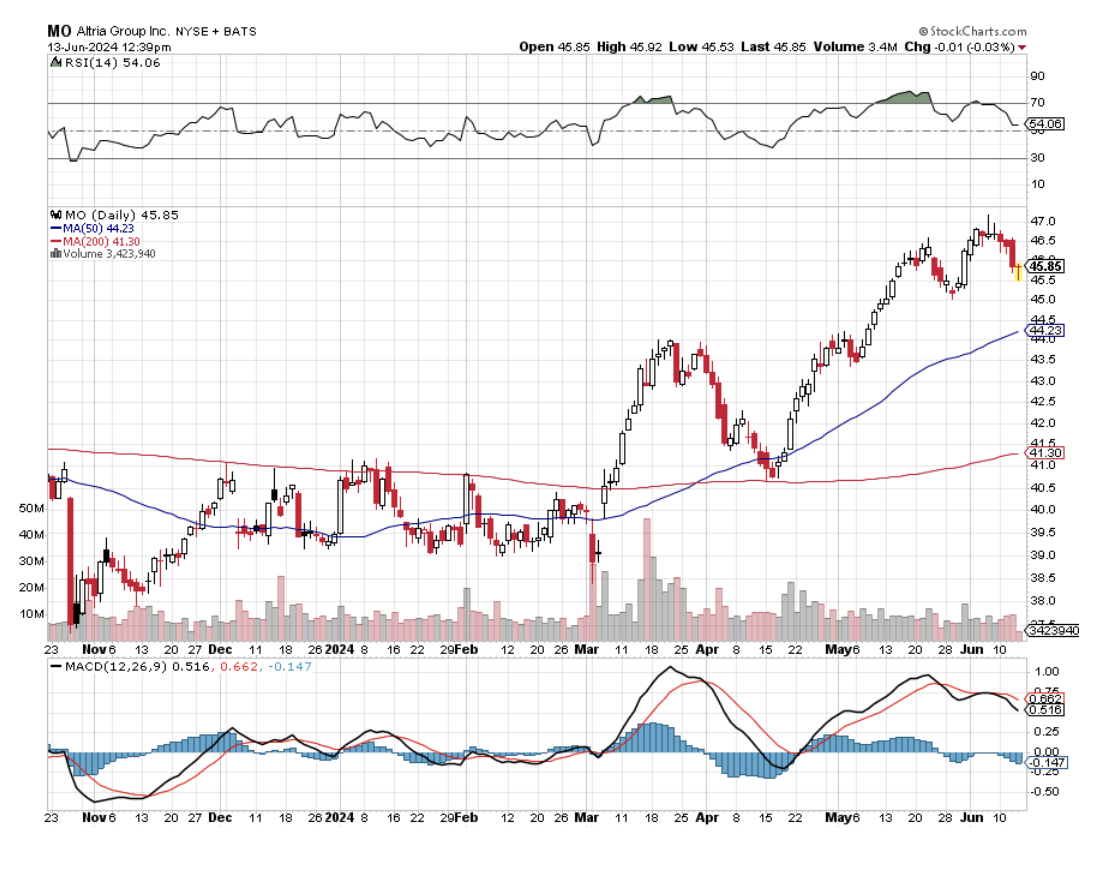

It is not just the (TLT) that is having a great month. The entire interest rate-sensitive sector has been on fire as well. My favorite cell phone tower REIT, Crown Castle International with its generous 6.28% dividend yield, has jumped 15%. Distressed lender Annaly Capital Management (NLY) with its spectacular 13.08% dividend, has appreciated by 11%.

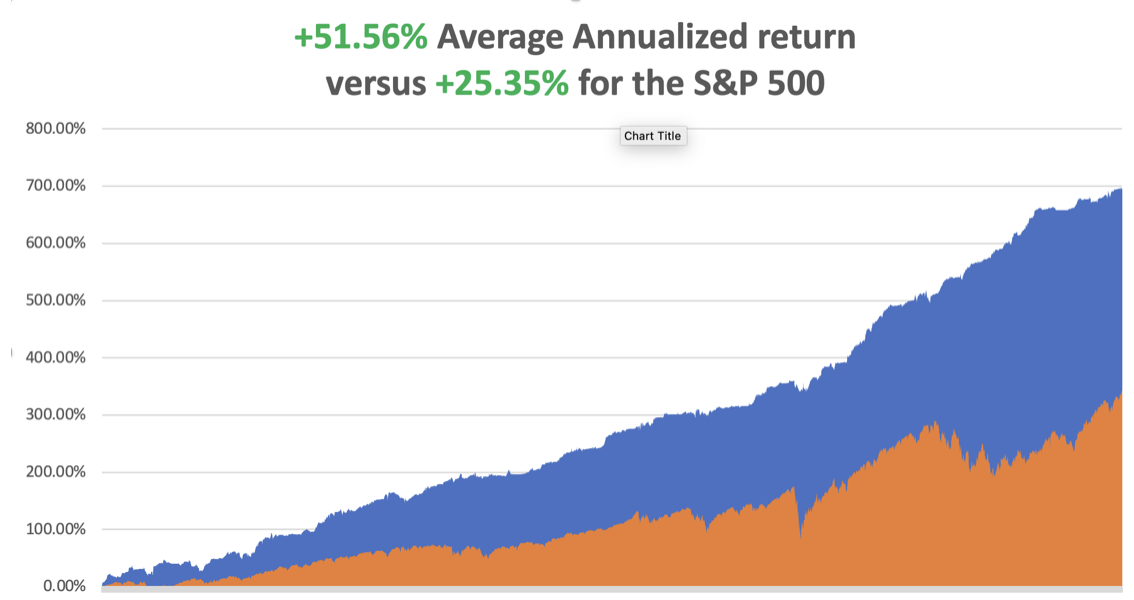

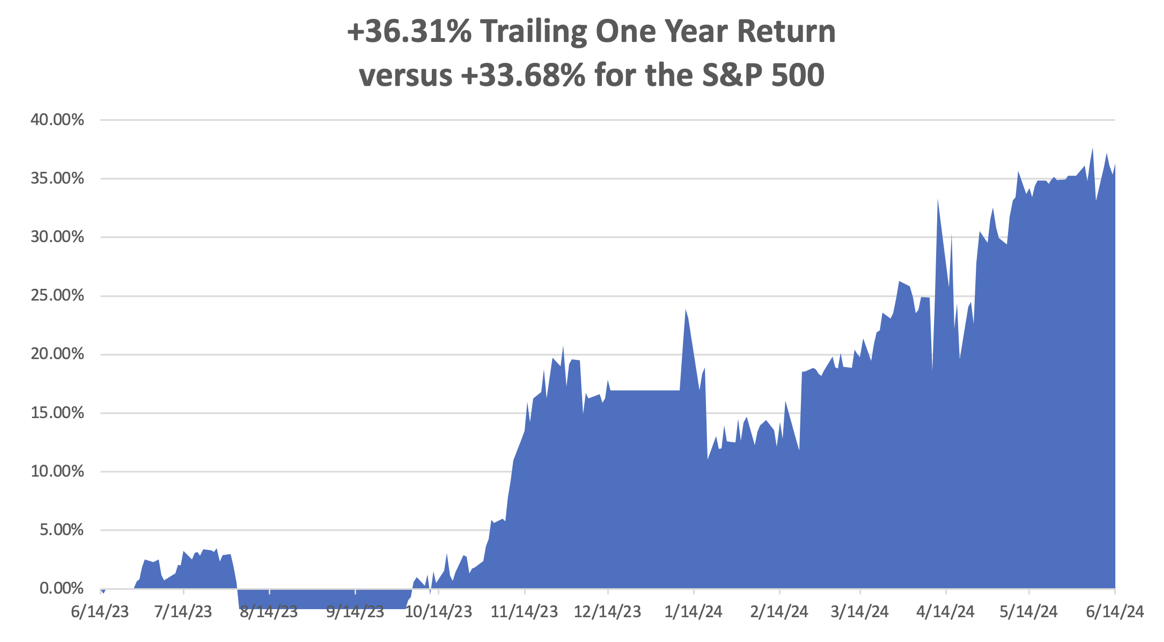

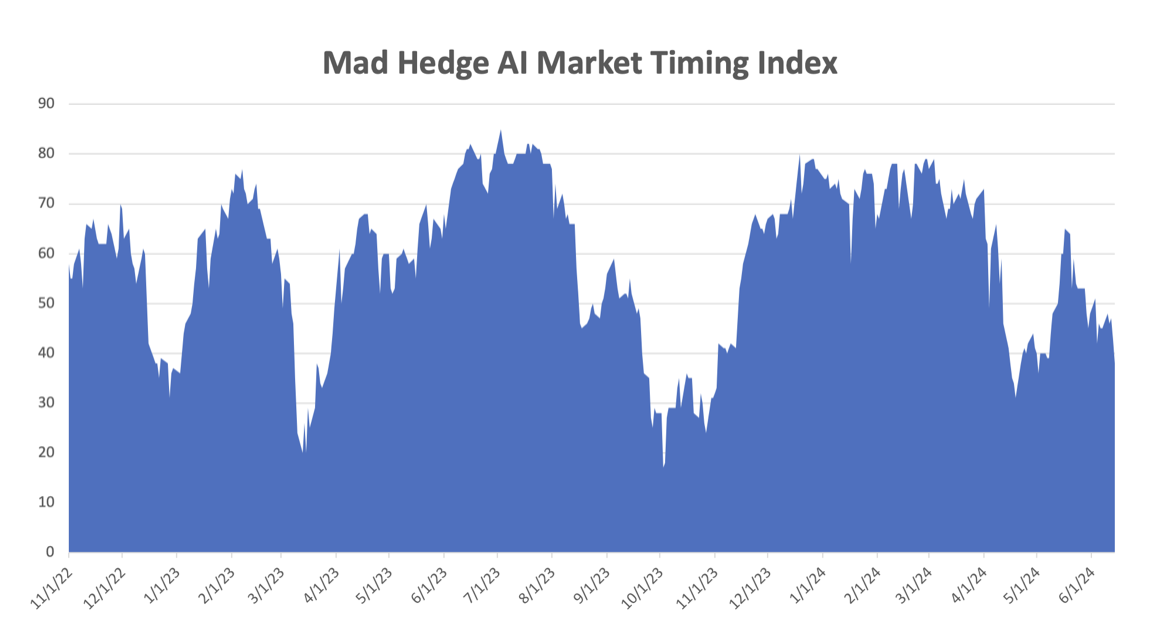

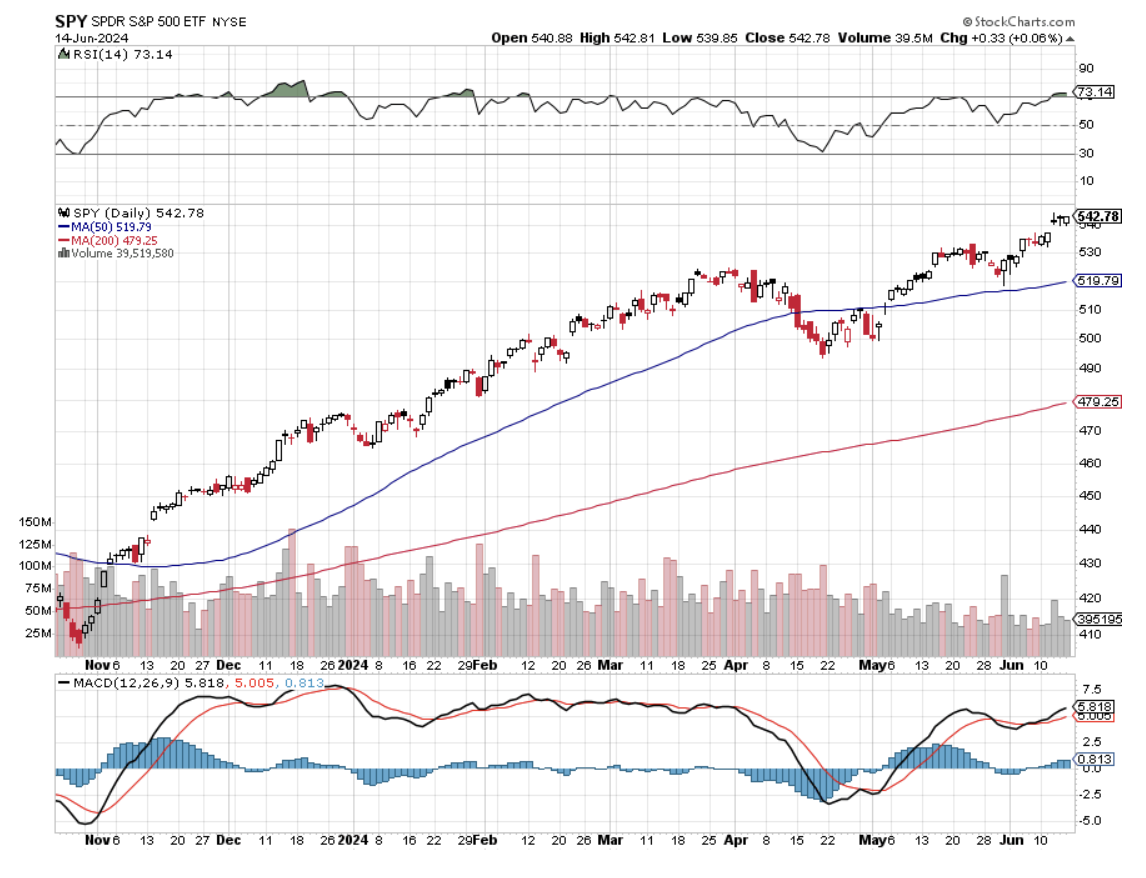

So far in June, we are up +1.04%. My 2024 year-to-date performance is at +19.39%. The S&P 500 (SPY) is up +13.83% so far in 2024. My trailing one-year return reached +36.31%.

That brings my 16-year total return to +696.02%. My average annualized return has recovered to +51.56%.

As the market reaches higher and higher, I continue to pare back risk in my portfolio. I stopped out of my near-money gold position (GLD) at close to breakeven because we were getting too close to the nearest strike price.

Some 63 of my 70 round trips were profitable in 2023. Some 29 of 38 trades have been profitable so far in 2024, and several of those losses were really break-even.

Fed Leaves Rates Unchanged at 5.25%-5.5% but reduces the cuts by March from three to one, citing an inflation rate that remains elevated. The projections were very hawkish, and the markets sold off on the news.

CPI Comes in Cool, unchanged MOM and 3.4% YOY. The May Nonfarm Payroll Report out Friday was an anomaly. It’s game on once again.

Europe Imposes Stiff Tariff on Chinese EVs, up to 38.1%. Daimler Benz, BMW, and Fiat have to be protected or they will go out of business.

The Gold Rush Will Continue through 2024, as much of Asia is still accumulating the yellow metal. Asia lacks the stock market we here in the US enjoy. A global monetary easing is at hand.

Broadcom (AVGO) Announces a 10:1 Split, and the shares explode to the upside. Earnings were also great. I actually predicted this in my newsletter last week and again at my Wednesday morning biweekly strategy webinar. The split takes place on July 15. Split fever continues. Buy (AVGO) on dips.

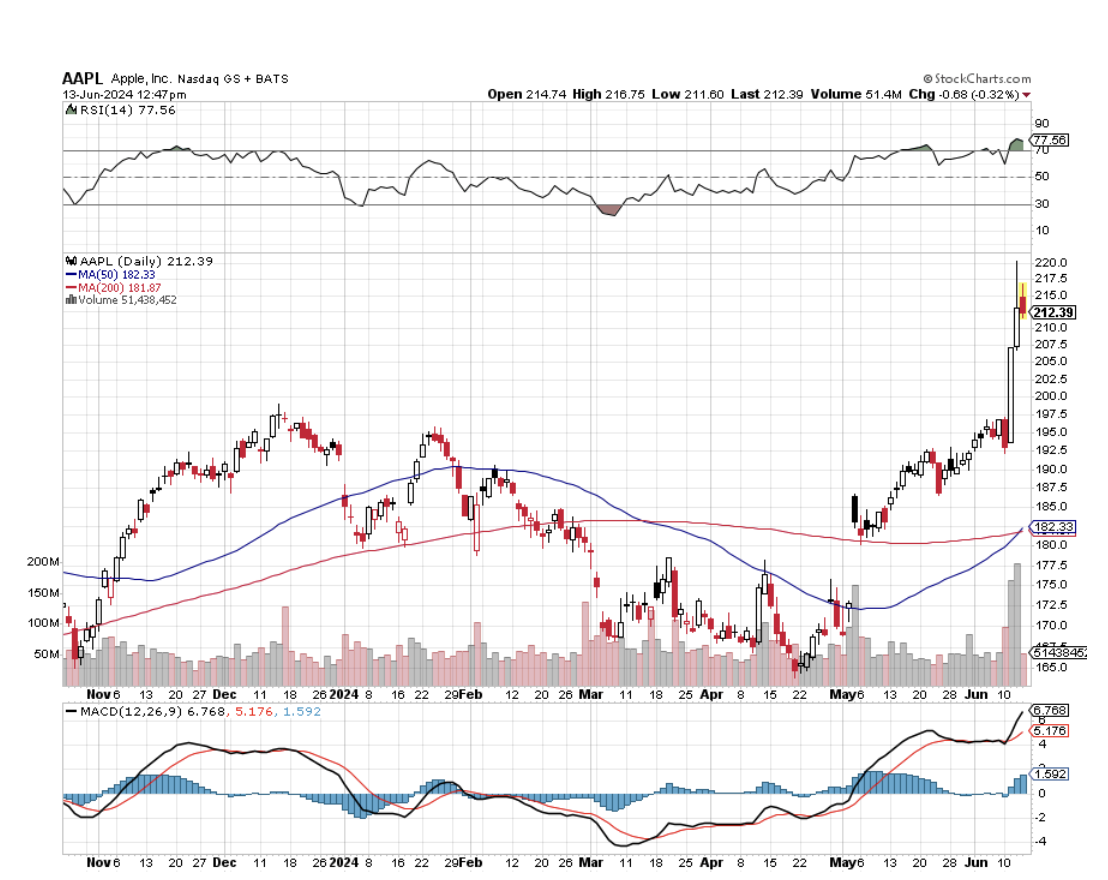

Apple (AAPL) Soars to New All-Time High, over $200 a share for the first time. However, it is now only the third largest company in the world, losing first place to (NVDA) and (MSFT). Analysts piled up the benefits of pitching AI to one billion preexisting customers. Just don’t tell Elon Musk.

Dollar Hits One Month High, on soaring interest rates spinning out from the super-hot May Nonfarm Payroll Report. This may be your last chance to sell at the highs. Never own a currency with falling interest rates. Just look at the Japanese yen.

Stock Buybacks Hit $242 Billion in Q1, but a new 1% tax may slow down the activity. The tax was passed as part of the Inflation Reduction Act in 2022 and is retroactive to January 1, 2023. (AAPL), (DIS), (CVX), (META), (GS), (WFC), and (NVDA) were the big buyers.

Home Equity Hits All-Time High at $17 Trillion according to CoreLogic. About 60% of homeowners have a mortgage. Their equity equals the home’s value minus outstanding debt. Total home equity for U.S. homeowners with and without a mortgage is $34 trillion. That is a lot of cash that could potentially end up in the stock market.

Home Prices to Keep Rising says Redfin CEO. While experts are forecasting more homes will be available, they said the boost in supply is not enough to solve affordability issues for buyers. Interest rates are expected to come down, but not by enough to counteract high prices.

Elon Musk Wins his $56 Billion Pay Package after a shareholder vote where retail investors came to his rescue. Institutional investors like CalPERS were overwhelmingly against it. It didn’t help that Elon moved Tesla to Texas. State pension funds always show a heavy bias in favor of local companies. Luck for California teachers includes (NVDA), (AAPL), (GOOGL), and (SMCI). (TSLA) rose 4% on the news.

The Gold Rush Will Continue through 2024, as much of Asia is still accumulating the yellow metal. Asia lacks the stock market we here in the US enjoy. A global monetary easing is at hand.

US Homes Sales Fall, down 1.7% month-over-month in May on a seasonally adjusted basis and dropped 2.9% from a year earlier. Median home sale price rose to a record high of $439,716, up 1.6% month-over-month and 5.1% year-over-year.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, June 17, the New York Empire State Manufacturing Index is released.

On Tuesday, June 18 at 7:00 AM EST, Retail Sales are published.

On Wednesday, June 19, the first-ever Juneteenth holiday where the stock market is closed. Juneteenth celebrates the date when the slaves in Texas were freed in 1866, the last to do so.

On Thursday, June 20 at 8:30 AM, the Weekly Jobless Claims are announced. We also get Building Permits.

On Friday, June 21 at 8:30 AM, the Existing Home Sales are announced.

At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, as I am about to embark on Cunard’s Queen Elisabeth from Vancouver Canada on the Mad Hedge Seminar at Sea, I thought I’d recall some memories from when I first visited there 54 years ago.

Upon graduation from high school in 1970, I received a plethora of scholarships, one of which was for the then astronomical sum of $300 in cash from the Arc Foundation, whoever they were.

By age 18, I had hitchhiked in every country in Europe and North Africa, more than 50. The frozen wasteland of the North and the Land of Jack London and the northern lights beckoned.

After all, it was only 4,000 miles away. How hard could it be? Besides, oil had just been discovered on the North Slope and there were stories of abundant high-paying jobs.

I started hitching to the Northwest, using my grandfather’s 1892 30-40 Krag & Jorgenson rifle to prop up my pack and keeping a Smith & Wesson .38 revolver in my coat pocket. Hitchhikers with firearms were common in those days and they always got rides. Drivers wanted the extra protection.

No trouble crossing the Canadian border either. I was just another hunter.

The Alcan Highway started in Dawson Creek, British Columbia, and was built by an all-black construction crew during the summer of 1942 to prevent the Japanese from invading Alaska. It had not yet been paved and was considered the great driving challenge in North America.

One 20-mile section of road was made out of coal, the only building material then available, and drivers turned black after transiting on a dusty day. I’ll never forget the scenery, vast mountains rising out of endless green forests, the color of the vegetation changing at every altitude.

The rain started almost immediately. The legendary size of the mosquitoes turned out to be true. Sometimes, it took a day to catch a ride. But the scenery was magnificent and pristine.

At one point a Grizzley bear approached me. I let loose a shot over his head at 100 yards and he just turned around and lumbered away. It was too beautiful to kill.

I passed through historic Dawson City in the Yukon, the terminus of the 1898 Gold Rush. There, abandoned steamboats lie rotting away on the banks, being reclaimed by nature. The movie theater was closed but years later was found to have hundreds of rare turn-of-the-century nitrate movie prints frozen in the basement, a true gold mine. Steven Spielberg paid for their restoration.

Eventually, I got a ride with a family returning to Anchorage hauling a big RV. I started out in the back of the truck in the rain, but when I came down with pneumonia, they were kind enough to let me move inside. Their kids sang “Raindrops keep falling on my head” the entire way, driving me nuts. In Anchorage they allowed me to camp out in their garage.

Once in Alaska, there were no jobs. The permits required to start the big pipeline project wouldn’t be granted for four more years. There were 10,000 unemployed.

The big event that year was the opening of the first McDonald’s in Alaska. To promote the event, the company said they would drop dollar bills from a helicopter. Thousands of homesick showed up and a riot broke out, causing the stand to burn down. It was rumored their burgers were made of much cheaper moose meat anyway.

I made it all the way to Fairbanks to catch my first sighting of the wispy green contrails of the northern lights, impressive indeed. Then began the long trip back.

I lucked out by catching an Alaska Airlines promotional truck headed for Seattle. That got me free ferry rides through the inside passage. The driver wanted the extra protection as well. The gaudy, polished cruise destinations of today were back then pretty rough ports inhabited by tough, deeply tanned commercial fishermen and loggers who were heavy drinkers and always short of money. Alcohol features large in the history of Alaska.

From Seattle, it was just a quick 24-hour hop down to LA. I still treasure this trip. The Alaska of 1970 no longer exists, as it is now overrun with summer tourists. It now has 27 McDonald’s stands.

And with runaway global warming the climate is starting to resemble that of California than the polar experience it once was. Permafrost frozen for thousands of years is melting, causing the buildings among them to sink back into the earth.

It was all part of life’s rich tapestry.

The Alcan Highway Midpoint

The Alaska-Yukon Border in 1970

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader