Diving Back into the Mouse House

Walt Disney (DIS) shares have just suffered a 6% dive on the news they will buy the assets of 20th Century Fox in one of the largest entertainment takeovers in history. The new combined mega-company will dominate Hollywood and content production in general.

In fact, the new acquisition will enable the company to go from strength, enabling it to become the most powerful media company in well….the universe, to borrow from one of its many franchises.

This gives us a rare entry point to get into. Disney is just about to launch its own streaming service which will allow them to take a generous share of the Netflix and Amazon businesses.

Disney is spending a staggering $12 billion on new content this year. The parks are all packed to the gills. They already launch so many blockbuster movies that they have to be rationed awards at the Oscars.

It really is a company that is firing on all cylinders, as long as its erstwhile CEO Bob Iger doesn’t run for president in 2020.

I am therefore buying the Walt Disney Corp (DIS).

I’ll never forget the first time I met Walt Disney. There he was smiling at the entrance on opening day of the first Disneyland in Anaheim, Calif., in 1955 on Main Street, shaking the hand of every visitor as they came in. My dad sold the company truck trailers and managed to score free tickets for the family.

At 100 degrees on that eventful day, it was so hot that the asphalt streets melted. Most of the drinking rooms and bathrooms didn’t work. And ticket counterfeiters made sure that 100,000 jammed the relatively small park. But we loved it anyway. The bandleader handed me his baton and I was allowed to direct the musicians in the most ill-tempoed fashion possible.

After Disney took a vacation to my home away from home in Zermatt, Switzerland, he decided to build a roller-coaster based on bobsleds running down the Matterhorn on a 1:100 scale. In those days, each ride required its own ticket, and the Matterhorn needed an “E-ticket,” the most expensive. It was the first tubular steel roller coaster ever built.

Walt Disney shares have been on anything but a roller-coaster ride for the past four years. In fact, they have absolutely gone nowhere.

The main reason has been the drain on the company presented by the sports cable channel ESPN. Once the most valuable cable franchise, the company is now suffering on multiple fronts, including the acceleration of cord-cutting, the demise of traditional cable, the move to online streaming, and the demographic abandonment of traditional sports such as football.

However, ESPN’s contribution to Walt Disney earnings is now so small that it is no longer a factor.

In the meantime, a lot has gone right with Walt Disney. The parks are going gangbusters. With two teenage girls in tow, I have hit three in the past two years (Anaheim, Orlando, Paris).

The movie franchise is going from strength to strength. Pixar has Frozen 2 and Toy Story 4 in the pipeline. Look for Lucasfilm to bring out a new trilogy of Star Wars films, even though Solo: A Star Wars Story was a dud. Its online strategy is one of the best in the business. And it’s just a matter of time before they hit us with another princess. How many is it now? Nine?

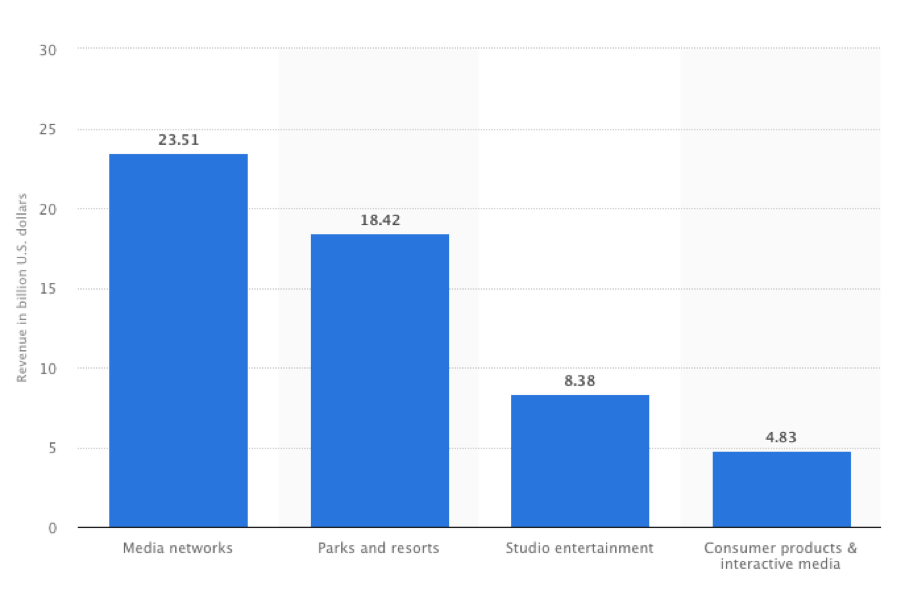

It is about to expand its presence in media networks with the acquisition of 21st Century Fox (FOX) assets, already its largest source of earnings. It will join the ABC Television Group, the Disney Channel, and the aforementioned ESPN.

It has notified Netflix (NFLX) that it may no longer show Disney films, so it can offer them for sale on its own streaming service. Walt Disney is about to become one of a handful of giant media companies with a near monopoly.

What do you buy in an expensive market? Cheap stuff, especially quality laggards. Walt Disney totally fits the bill.

As for old Walt Disney himself, he died of lung cancer in 1966, just when he was in the planning stages for the Orlando Disney World. All that chain smoking finally got to him. He used to start out every TV show with a non-filter Luck Strike in his hand.

My own grandfather died the same way from the same brand, the one who fought in the trenches of WWI where Euro Disney sits today. It is a small world after all.

Despite that grandfatherly appearance on the Wonderful World of Color weekly TV show, friends tell me he was a complete bastard to work for.