The Anywhere Economy

DocuSign (DOCU) is a U.S. cloud company providing e-signature solutions that enable businesses to digitally prepare, execute, and act on agreements and DocuSign’s CEO Dan Springer has described the current state of the economy by calling it the “anywhere economy.”

What does this mean?

Ultimately, now and over the coming years, he believes the trend will continue toward the option of doing anything from anywhere.

Springer has labelled the products and services supporting this trend the “anywhere economy”.

He believes the company he runs, DocuSign, is a critical piece to this anywhere economy, and it's only just beginning.

Springer wants investors to know that we are just in the first period of this hockey match and there’s a lot of ice time left.

The first period has been pretty good to DOCU and last year validated that by DOCU signing off 2020 nearly 50% bigger than they were in 2019 with almost $1.5 billion in revenue.

They gained new customers, expanded their existing relationship with others, and experienced a surge in adoption of DOCU products as accelerating digital trends already underway literally caught on fire.

The digital transformation of agreements is still fluid and progressing and this transformation not only allows agreements to be prepared, signed, act on, and managed from anywhere. It also allows greater speed and efficiency than manual paper-based processes.

Ultimately, DOCU's premium e-signing tools will force companies to never go back to paper even after the pandemic ameliorates.

DOCU also does not believe life will go back to the way it was before.

Of course, many in-person activities will be welcomed back.

But when consumers discovered optimal solutions during the pandemic, DOCU believes those will continue and flourish unfettered, whether it's total or partial work from home, virtual visits to medical professionals, or getting a document notarized remotely.

People aren't going back to paper.

They're not going back to manual processing.

What is the real question then?

The thing to ask now is whether the rate of new people coming to DOCU will change with the reopening of the society, economy, and the world?

This could possibly pull back the momentum in the demand environment, but DOCU has telegraphed to investors that a potential drawback would be temporary before the digital transformation reignites.

And let me get straight at this point, yes, DOCU hasn't seen a change yet and demand is following through greasing the revenue machine as we speak.

How is performance at DOCU?

Revenue growth of 57% and billings growth of 46% year over year.

DOCU onboarded more than 70,000 new customers last year, bringing the total to nearly 892,000 customers worldwide.

Their customers even displayed the robustness of their wallet with DOCU experiencing their strongest expansion and up-sell rates yet, driving their dollar net retention to a record 123%.

New customers were tripping over themselves to join DOCU with DOCU experiencing a customer addition rate more than double that of fiscal '20, edging them ever closer to the 1 million customer mark.

The use cases for DOCUs e-signature services are growing and it’s not just HR, procurement, customer service, and in-branch onboarding needs, there is way more left in the pipeline.

DOCU transactions took less than a minute to complete on average, delivering a rapid ROI.

And DocuSign went from a crisis response solution last year to a business-as-usual solution today.

One of DOCUs pipeline is international and last year just scratched the surface with international revenue increasing a head-turning 83% year over year to $89 million in the fourth quarter.

For the full year, international revenue grew over 67% to $287 million, reflecting accelerated expansion across geographies.

To give you a sense of the magnitude of DOCUs overperformance last year, they added nearly the same number of customers this past year as they had in total at the time they went public.

As part of that, DOCU added 11,000 new direct customers in Q4 for a total of over 50,000 for the year.

A first quarter guide follows much of the same rhetoric of explosive growth and DOCU expects total revenue of $432 million to $436 million in Q1 or growth of 45% to 47% year over year.

At the end of the day, all I hear from CIOs (Chief Investment Officers) are they've got a backlog of things they need to get done because the pandemic made it very difficult for them to get certain projects done.

And at the same time, they acknowledge their achievement last year couldn’t be possible without the blind digital transformation they undertook, and they want more of it with DOCU at its core.

So as I write this tech letter, I do predict another re-acceleration of the digital transformation story once the novelty of normalizing the world takes place.

And this normalization doesn’t even need to take place for a considerable cross and up-sell opportunity this year, and those incremental customers, significant customer new additions that drive DOCU's bottom line.

Many renewals will come up after the first year of DOCUs offerings, and I believe not only should it be a great cross-sell opportunity, but they will be happy to renew DOCU's products in full without question.

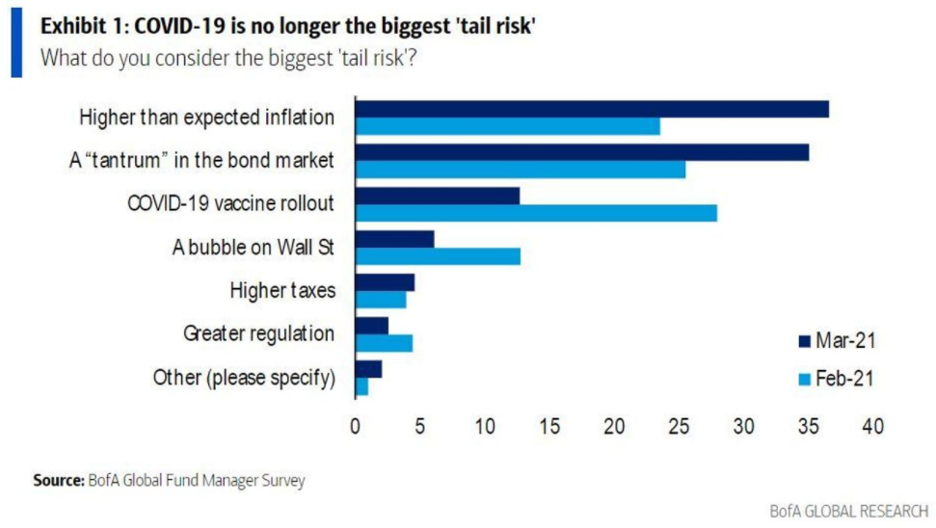

Long term, this is a great tech company to buy and hold, but the tech sector is near all-time highs and trying to digest higher interest rates and higher inflation expectations.

After we absorb this, the next move is up.