Don't Compromise

A fresh analysis from the C-suite at the top 1,000 U.S. companies by revenue offers us critical insight into the direction of tech management.

It’s important to keep our finger on the pulse of what’s happening at the higher level of tech companies because these are the key people that drive the game-changing decisions.

It’s no surprise that the banking and financial services industry has the oldest average CEO age at 60, and the technology and energy sectors have the youngest CEOs at an average age of 57.

Technology companies harness new technologies that can lead to new businesses so that would usually trend younger.

Compared to other industries, tech companies also have a boom-bust element to them because technologies go extinct quicker, and refreshing a CEO is always on the table if the bust element creeps in.

Interestingly, the current tenure is down from an average of 8 years to 6 years, meaning that the leash for tech CEOs is getting shorter and shorter.

Much like highly paid professional athletes these days, there’s no learning on the job type of mentality. It’s overperform now or face the sack.

This mentality emphasizes short-term performance which revolves around the quarterly earnings report and stock-based compensation to employees.

Then add in the wild card of forced lockdowns and China’s increasingly aggressive attitude to politics and it’s simple to understand that boards need to quickly change management if they believe they cannot navigate these herculean tasks.

Just a few instances where critical decisions are being made can be seen in Apple when CEO Tim Cook yanked China production and moved factories to Vietnam.

Vietnam is becoming the new factory of the world for tech companies because costs and political risks associated with China are accelerating.

Now, throw in the Taiwan situation after top U.S. government officials chose to visit the island and tech companies are now worrying about their supply of Taiwan chips needed to harness artificial intelligence.

CFOs are usually the second most important person in a company behind the CEO because they guard the balance sheet and usually possess a strong accounting background.

Yet they can be disposed of quickly for bad performance which is why tech CFOs only tenure 4.1 years if we compare with other more stable industries.

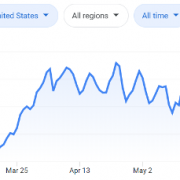

The key findings here is that tech management has never been so prone to high turnover.

Due to the internet, competition has supercharged the fight for highly paid positions and data can be calculated in real time because of superior analytic platforms.

Management won’t be able to hide poor performance because of the close tracking.

As much as it’s difficult to make a famous name as a C-suite manager, tech CEOs with a proven track record can expect elevated attention which is why if guys who have built successful tech firms like Jack Dorsey reach out to investors, they will get whatever starting funds they need.

This builds on the winning take mentality in technology which has a few outsized winners among the crowd.

On the trading front, I would hesitate to buy tech stocks from management that is unproven.

I would urge traders to go into long-term bets on guys like Tim Cook, Sundar Pichai, and Elon Musk and don’t compromise on the quality of tech management because it makes a big difference in the future price of the stock.