Double Dipping on the Yen

You know how I love second helpings, especially when the sushi bar is involved. I especially like unagi, or cooked eel, which is said to be an oriental aphrodisiac.

I am going to take advantage of Japan?s fiscal year end book closing on March 30 to reenter my short position of the Japanese yen. This is the one time a year when Japanese corporations suddenly repatriate yen back to Japan to beef up the cash on their books for their annual reports. Every year, this creates a quick boost to the yen against the US dollar which fades away in the following weeks like so much smoke.

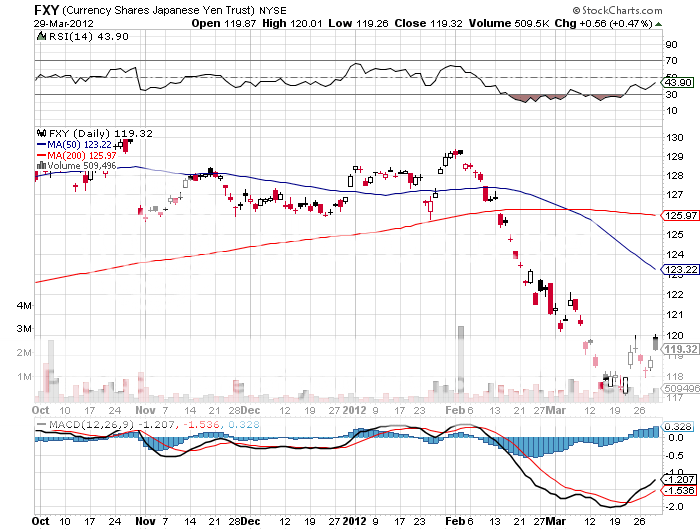

Like everything else this year, the yen has had a straight line move since I put out my last call to sell the yen at the end of January. So while I made a nice profit on the first trade, I was never given another chance to reenter on the way down. Now I have that opportunity.

Since the yen bottomed on March 21, it has given back 25% of the move. Sure, I would prefer to get back in on the traditional one third pull back. But there are so few attractive trading opportunities out there right now that I am happy to jump the gun. If the yen strengthens more from here I will simply double up the position. This is a trade that I?ll be happy to live with for a while.

I have hammered away at the structural weakness of the Japanese economy ad nauseum for the past year. The one liner is that buyers of the country?s 1% yielding ten year bonds are dying off in droves, it has the world?s worst debt to GDP ratio, and labors under an Armageddon like demographic burden. It doesn?t help that they haven?t invested anything new since Godzilla ate the big screen. Sony (SNE) should have become Apple (AAPL). For those who wish to undertake a refresher course, please read the research pieces listed below:

* ?Momentum is Building for the Yen Shorts? on March 26 at http://madhedgefundradio.com/momentum-is-building-for-the-yen-shorts/

*? ?Nikkei Shows the Yen Move is Real? on February 20 at http://madhedgefundradio.com/nikkei-shows-the-yen-move-is-real/

*? ?Global Trading Dispatch Hits 64%, 11 Day Home Run on Yen Short? on February 13 at

http://madhedgefundradio.com/global-trading-dispatch-hits-64-11-day-home-run-on-yen-short/

*? ?Rumblings in Tokyo? on February 5 at http://madhedgefundradio.com/rumblings-in-tokyo/

*? ?Is This the Chink in Japan?s Armor?? on January 29 at http://madhedgefundradio.com/is-this-the-chink-in-japans-armor/

My preferred instrument here is the Currency Shares Japanese Yen Trust ETF (FXY) , where I will be buying the June, 2012 puts. At the very least, the (FXY) should make it back down to $117 in the near future, a price we visited just a week ago, which should give you a quickie 70%? return on the June $120 puts.

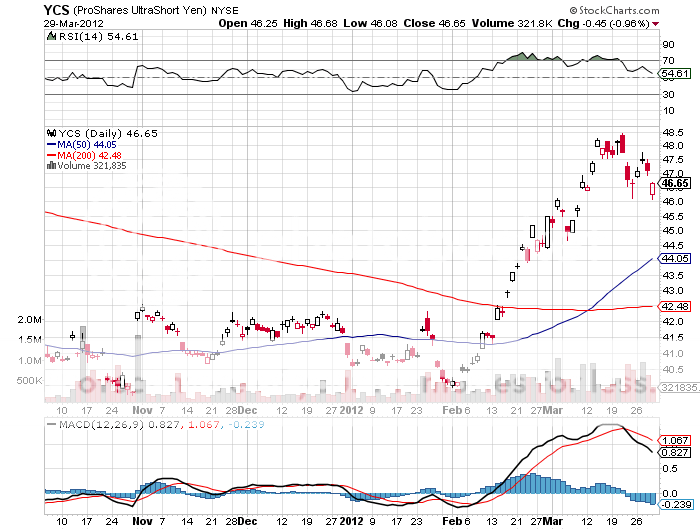

For those who are unwilling or unable to play in the options space, you can invest in the ProShares Ultra Yen Short ETF (YCS), a 2X leveraged bet that the yen falls against the dollar.

Do I hear Any Bids?

Japan?s Last Good Invention