Emergency Strategy Reversal.

I think that Ben Bernanke?s QE3 is such a game changer, that we have to throw all existing strategies into the trash and start all over again from scratch. ?Suddenly, investors and traders have to face the prospect of adding $500 billion to $1 trillion to the Fed?s balance sheet, taking it to a record $3.7 trillion. ?All of this new money will go into risk assets.

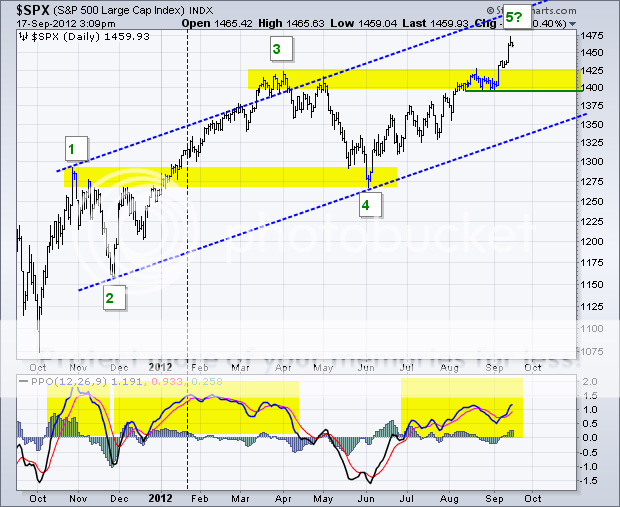

This demands that I radically change my approach to the market. ?You can kiss the big September correction I was expecting goodbye and the ones for October, November, and December goodbye as well. ?The markets might even continue up for the rest of 2012.

In December, 1944, General George S. Patton accomplished one of the greatest feats in military history by wrenching the focus of his Third Army?s attack on Germany by 90 degrees to the North on three days? notice in the midst of a blinding snow storm with minimal supplies. ?The result was the relief of the besieged 101 Airborne Division at Bastogne and victory in the Battle of the Bulge. ?It is time for such a move in the markets.

Don?t try to apply any kind of fundamental analysis to this. ?You might overthink your way out of a job. ?This is a pure liquidity play. ?It means buying stocks solely on an anticipated multiple expansion from 14.5X today to a 15X or 15.5X multiple. ?Actual corporate earnings in the upcoming quarterly earnings cycle will be flat to down small.

I am not calling for the market to go ballistic here. ?I think a rise of 50 to 100 S&P 500 points to 1,500 or 1,550 is in the cards here. ?Why didn?t the market continue to rocket after the first day of QE3? ?I believe that there is a ?deer in the headlights? effect going on here. ?Everyone is so stunned from the magnitude of the Fed action that they have gone catatonic. ?Trading desks are awaiting a big dip to buy that isn?t happening.

I am not a person who is accustomed to buying market tops. ?I am the ultimate bargain seeker. ?I?m the guy who goes to garage sales in poor neighborhoods so I can find a full case of prime Japanese sake for $5, as I have done. ?But you don?t get a quantitative easing with these implications dumped on you very often either.

This augurs for an index that doesn?t crash, or doesn?t even have a substantial correction. ?It just continues to grind up slowly. ?There is too much cash sitting on the sidelines to allow otherwise. ?The most hated rally in stock market history is about to become even more despised. ?Best case, we add 7% by year end. ?Worst case, we continue to chop sideways and finish 2012 around these levels.

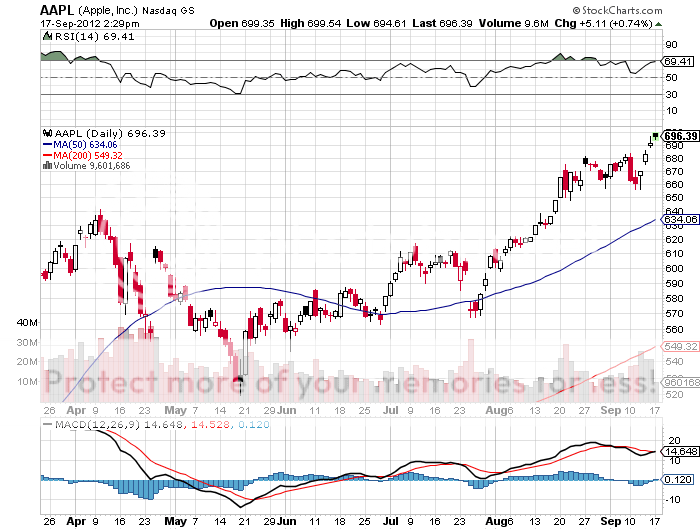

There is one stock that is certainly not going to announce an earnings disappointment, and that is Apple (AAPL). ?The roll out of the iPhone 5 is occurring faster than previous models. ?It will be offered for sale in 100 countries by yearend compared to only 53 for the iPhone 4s during the same period. ?So unit sales could reach 8 million by the end of Q3 and 49 million by Q4. ?This will create an unprecedented surge in Apple?s reported quarterly earnings. ?Those waiting to buy on the next big dip could end up missing one of the most impressive multi decade growth stories in history. ?This will impact the entire market sentiment, as it did in Q1.

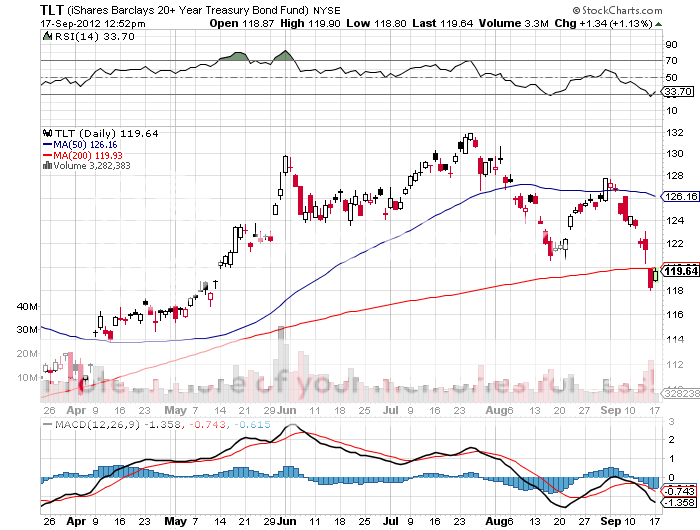

On top of this, there is a serious reallocation trade going on whereby institutions are shifting money out of Treasury bonds and into the entire risk spectrum. ?This is why the Treasury bond ETF (TLT) has been hammered yet again, taking it down to a four month low. ?So the amount of money about to pour into risk assets will be a multiple of the $1 trillion mentioned above.

I?m not expecting any contribution to the economy from housing. ?So many millions of homes still suffer from negative equity that the Fed could take the 30-year conventional fixed rate mortgage rate to zero and it still will not generate much new construction where it can most-positively affect the economy. ?But from a market point of view, we don?t need their help for the time being.

What could go wrong with this scenario? ?Israel could attack Iran. ?There is no doubt that there is a partial mobilization of armed forces going on in Israel as I write this. ?I am getting frantic emails every day now from friends there about movement of troops, cancelled vacations, reserve call ups, and senior staff put on notice. ?When generals don?t return my phone calls, something is up.

But my Mossad friends tell me they aren?t going to pull the trigger. ?Prime Minister Benjamin Netanyahu is just reacting to the collapse of the Romney campaign in the U.S. presidential election. ?He has realized in the past two weeks that he is going to have to rattle his own sword from now on instead of counting on Romney to do it for him after November. ?Even if Israel does act, the impact on financial markets is likely to be brief and largely confined to the price of oil.

The other risk is that Romney could win the election. ?When Bernanke?s current term expires in January, 2014 he would be replaced by an austerity oriented, anti-quantitative easing hardliner. ?In that case, goodbye QE3, hello Dow 6,000. ?But at this point, this is an extreme outlier. ?You don?t see the Intrade betting on an Obama win surge from 57% to 66.3% very often, as it has done in the past week (click here for their site). ?If nothing else, Bernanke?s move on QE3 has certainly deep sixed any chance Romney had of winning.

What about the ?fiscal cliff?? ?It all boils down to the election. ?The Senate is now a Democratic lock, thanks to Mr. Todd Aiken of Missouri. ?There is a 50% chance that the Democrats retake the House on the coattails of the Romney crash. ?If they do, the fiscal cliff will disappear weeks after the election to be followed by another $1 trillion reflationary package entirely focused on infrastructure.

If the Republicans hold on, you can bet on Congress to weasel out of the mid-December deadline by kicking it forward two months. ?By then, recalcitrant losing Tea Party members will be flushed out of their seats, making the party much more manageable for the leadership and paving the way towards a real final agreement. ?Either way, we don?t go over the cliff, extending the present bull run for equities until Q2, 2013.

Taking all the above into consideration, I think the way to play here is through deep in the money call spreads in risk assets with December expirations. ?The strikes should be pegged 10% to 20% out-of-the-money so you could handle a 5% market correction without sweating it. ?The December expiration will allow you to wimp out just before the November 7 election and still keep a substantial portion of your profit.

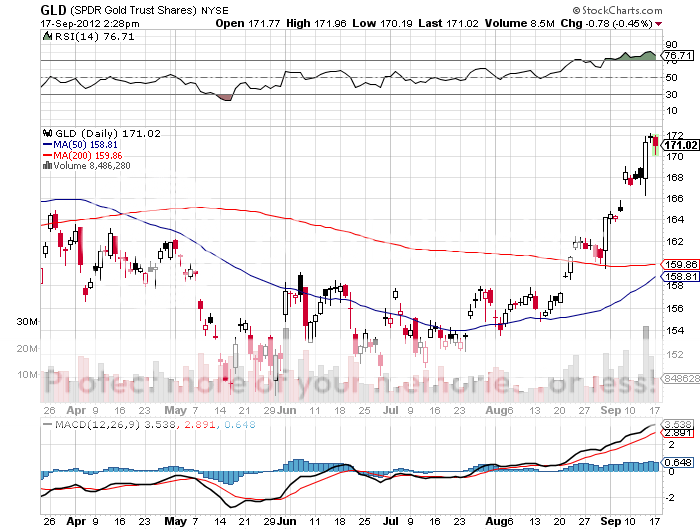

The names I will be focusing on will be gold (GLD), silver (SLV) Apple, (AAPL), Google (GOOG), Qualcomm (QCOM), and Disney (DIS). ?I will attempt to scale into this portfolio and will send you urgent trade alerts when I see entry points. ?If the market goes down small, sideways, or up, as I expect, this should enable you to add 25% to the value of your portfolio by yearend.

Call me cautious, but you don?t get to be old by being incautious. ?In flight school there is a favorite saying: ?There are old pilots and bold pilots, but there are no old, bold pilots.?

Think of this as our ?bulge? moment. ?Isn?t life interesting? ?Oh, and thanks Uncle Al for the Bastogne angle, and sorry about the two toes you lost to frostbite there. At least you got a decent Veterans Administration disability check out of it.

Our "Battle of the Bulge" Moment.