Entering the Quiet Time

I?ll let you in on my top secret investment strategy that has brought me blockbuster results over the past six years.

Listen to the Wharton Business School?s professor, Jeremy Siegel.

The good doctor has been unremittingly bullish year in and year out, nearly pegging the stock index performance annually.

So, when he says that the Dow Average is going to rise to 20,000 by the end of 2015, that?s good enough for me. In fact Siegel thinks that at current price earnings multiple of 17 times, the bull market has years to run.

It would not be until we hit nosebleed levels of 25X or 30X earnings that he would get worried. And the current ultra low level of interest might even make these high multiple numbers justifiable.

So for the foreseeable future, we are going to see long periods of tedious range trading, followed by frenetic rounds of buying, once the market decides that it is time to discount the next rise in corporate earnings.

We happen to be in one of those range-trading periods right now, which my partner, Mad Day Trader Jim Parker, thinks could last all the way until September.

Actually, it is a little more complicated than that.

There is good reason for the stock market to go to sleep over the next two weeks.

Do you hear that great sucking sound? That is the noise of 170 million tax payers writing checks to the US Internal Revenue Service.

Foreign readers may not realize this, but tax payments are due in the United States on April 15 every year. I would ask for your sympathy, but I know all of you pay far more in taxes than we do. I know, because I used to pay them myself when I lived abroad for 23 years.

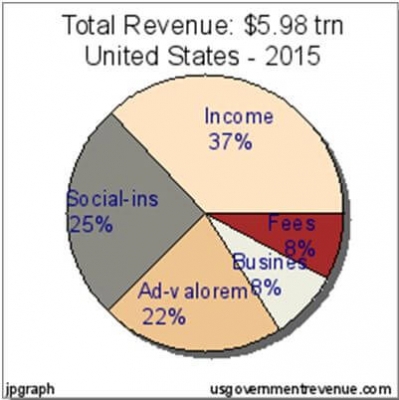

Of the $6 trillion in revenues from all sources due to Uncle Sam in 2015, 37%, or $2.2 trillion will come in the form of individual income taxes. That is a big hit for the financial system. That means for the next two weeks there won?t be any extra money lying around to put into the stock market.

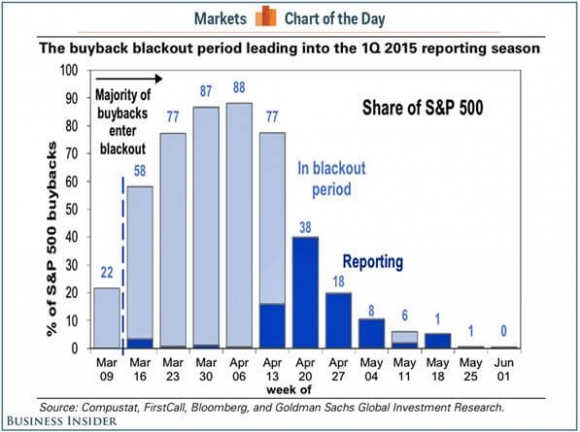

There is another reason why the stock indexes are stagnating here. The Q1, 2015 corporate earnings reporting season kicks off when Alcoa (AA) reports on April 8, or in six trading days. Until then, we are in the quiet period, and companies are not allowed the buy back their own stock.

This is a big deal, since companies buying back their own shares have provided major support for the stock market for many years. Possibly a quarter of all the net cash flow pouring into stocks since 2009 has come from this source.

Take it away, even for a short period, and the most bullish thing the market can do is move sideways, which is exactly what it has been doing for the past two months.

What happens when the tax payment deadline passes and the quiet period ends? Stocks take off like a bat out of hell. That will take us to the spring interim peak.

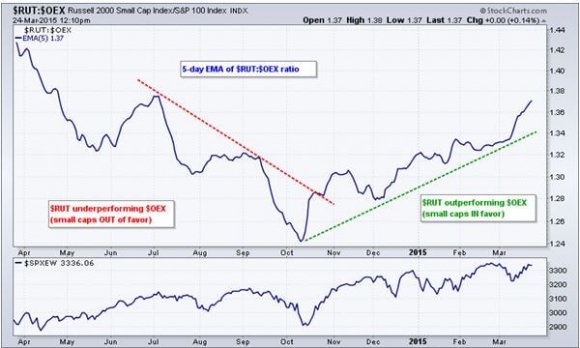

This is why I strapped on three new ?RISK ON? positions last Friday, longs in the Russell 2000 (IWM) and Goldman Sachs (GS) and a short in the euro (FXE).