Why I?m Pulling the Plug On My Euro Shorts

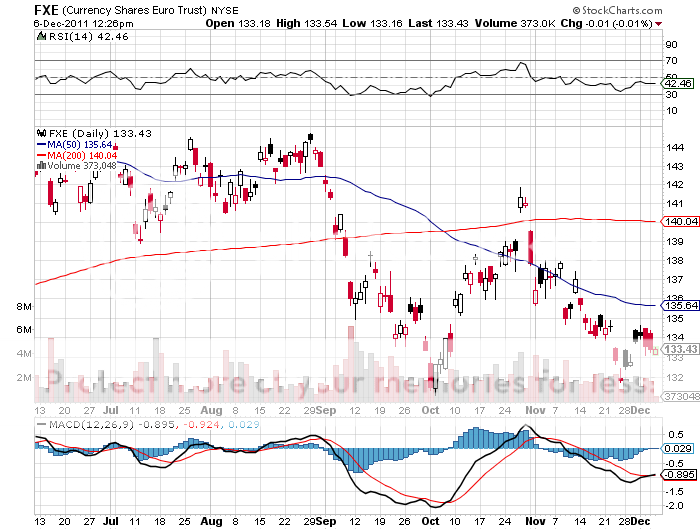

I am pulling the plug on my short position in the Euro here, selling my Euro ETF (FXE) January, 2012 $134 puts at cost.

It?s not that I have suddenly fallen in love with the beer drinkers and the garlic eaters. This is an option driven decision. With market volatility falling across all asset classes, the short dated options are eroding away faster than the underlying is moving in my favor.

Time decay is also taking its toll, accelerating into the January 19, 2012 expiration. This continues even while the markets are closed over the holidays. In fact, Christmas and New Years are the best time of the year to run a volatility short. So while I managed to catch a two cent move down in the (FXE) since I added this position on November 18, the options are trading at my cost. There is nothing worse than being right and not getting rewarded for it. All work and no pay makes the Mad Hedge Fund Trader an irritable boy.

On my last four trade alerts the options quickly rose substantially, only to give back all the profits within days. That happened with Jeffries (JEF), the Euro (FXE), silver (SLV), and the S&P 500 (SPY). The time frame that markets allow traders to make money has suddenly shortened. The lesson here is to take the money and run.

By going neutral on the Euro here, I now have dry powder to sell it again on the next short lived ?feel good? rally to $1.3550 or higher. The headline risk going into this weekend is also large. I can roll into the next strike in February to partially sidestep the holiday time decay. With the (FXE) bang in the middle of its recent $1.3180-$1.3550 range, this is no time to let positions grow hair on them.

Live on the fight another day.