Europe?s Big Problem

Europe has a big problem. No, it is not the continuing sovereign debt crisis, the lack of leadership, or the possible departure of up to a quarter of its membership, although these are all major worries.? Nor is it the Euro, the currency that everyone loves that has been declining for the last two years. No, the problem I am talking about is much worse than that. It is in fact so extreme that the union may not survive unless it is dealt with soon.

A Big Mac hamburger in Milan, Italy?s downtown Galleria cost me $7.50 on Monday. No, that is not for the entire meal, which includes the supersized Coke and French fries. That is just for the burger alone. This compares to $3.50 back home in the USA and only $3.00 in China.

And I can tell you that there is absolutely no difference between these three heart attacks on a plate, because I have eaten all three of them over the past year. The only real benefit of buying the Italian version is that they also had this cool espresso machine so you could wash down your lunch with a cappuccino or caf? latte.

I have written many times in the past about the Big Mac?s usefulness in measuring the relative value of foreign currencies using the theory of purchasing power parity. It is, after all, one of the few products sold in almost every country in the world which is uniformly identical. Thank American management for that, along with the world?s largest food logistics operation.

I have followed this indicator in earnest since my old employer, The Economist magazine in London, wrote it up as an April 1 spoof during the 1970?s. To their shock, their own arguments carried some merit and achieved a life of their own.

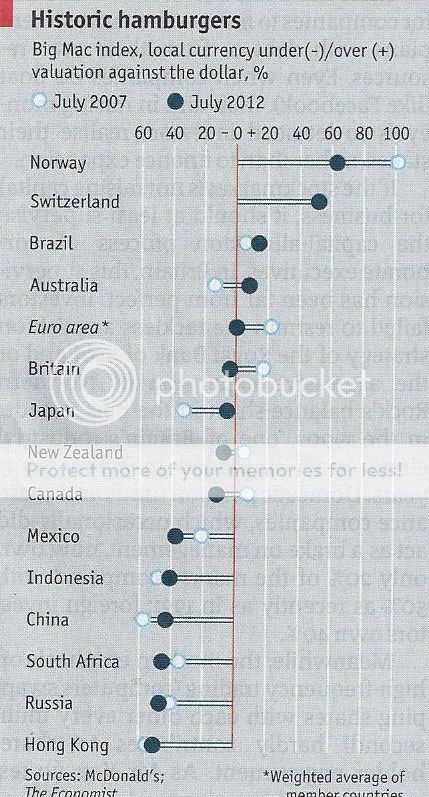

Last week, The Economist updated their closely watched indicator. It showed that the Norwegian kroner is 60% overvalued, fueled by its huge oil exports. The Hong Kong dollar sits at the bottom with a 50% undervaluation, gaining an edge from the cheap cost of labor and a low tax regime.

In the good old days, Italy could simply devalue the lira to make its Big Macs, and everything else it produces, internationally competitive. But since 1999, it has been trapped inside the European Monetary System, making this kind of instant cost cutting impossible. As long as Italy is pricing its Big Macs in Euro?s, it might as well be pricing them in in the old Deutchemarks. The same is true for Spain, Portugal, Ireland, and Greece. This does not bode well for the future of Europe.

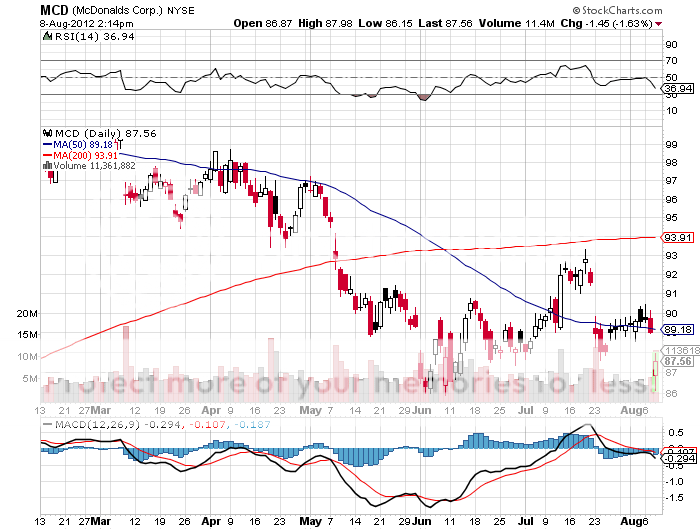

Of course, if the Euro continues to fall, Italy might get some respite. But even if the Euro plunges to its old all-time low of 88 cents, down 28% from here, it would still have one of the world?s most expensive hamburgers. Maybe it?s time for Italians to become vegetarians. Maybe that is what is knocking the stuffing out of McDonalds (MCD) shares today.