February 18, 2010

Global Market Comments

February 18, 2010

Featured Trades: (USO), (CRUDE), (SILVER),

(FOREIGN TREASURY HOLDINGS),

(TBT), (TBF), (HEDGE FUND RADIO)

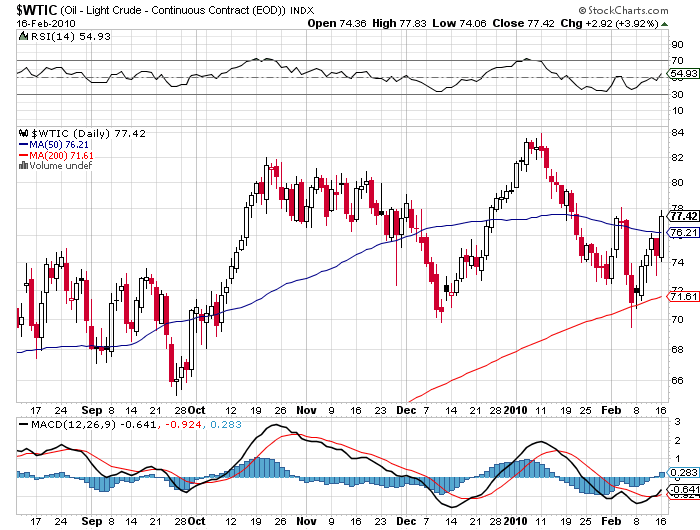

1) I?m not buying the $8 rally in crude (USO) this week because the contango which has been supporting prices in the face of lukewarm demand for the past year has been rapidly disappearing. Contango involves buying crude on the spot market, taking delivery, storing it in leased supertankers, and reselling it in the forward market for returns that at times have exceeded a non leveraged 100%. This enabled the US hedge fund community to effectively operate the world?s second largest navy, keeping so many ships bulging with Texas tea you could almost walk across the Caribbean without getting your ankles wet. At the peak, there were thought to be over 100 ships slow steaming in circles to conserve fuel, creating enough demand to support charter rates globally. By my calculation, the annualized contango return has recently shrunk to a mere 7.12%, not much more than you can get with investment grade corporate bonds. That means when the current crop of forward contracts expire, they won?t be rolled over, dumping vast amounts of crude on the open market. Another factor cutting the knees out from under crude has been the recently strong dollar. Many managers last year found a barrel of oil a much more desirable hard currency than our flaccid greenback. That monetary demand now seems to be on hold. Don?t buy any more oil at these prices than you can use in your salad dressing. If the economy does slow in the second half, as many are predicting, it will be nice to buy your own tankers full of crude at lower prices.

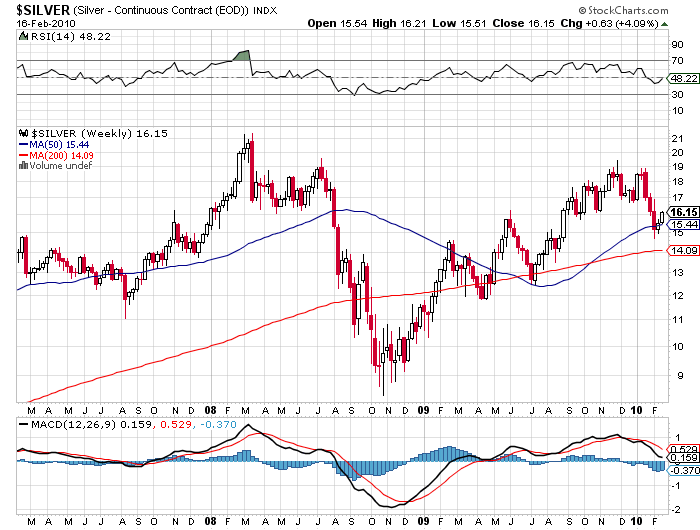

2) If you missed the great run up in silver last year that saw prices run up 95%, you are being offered a second bite at the apple. The latest round of risk reduction by global hedge fund has bashed the white metal, knocking $5 off of the $19.50 high seen in the heady days of November. Today we are at $16.15, and it looks like the 200 day moving average at $14.09 will hold. The metal is at the bottom end of its historic valuation relative to gold, which has ranged between 12:1 (Remember the Hunt Brothers?) and 70:1. Geologically, silver is 17 times more common than the yellow metal. All of the gold ever mined is still around, from King Solomon?s mine, to Nazi gold bars in Swiss bank vaults, and would fill two Olympic sized swimming pools. But most of the silver mined has been consumed in various industrial processes, and is sitting at the bottom of toxic waste dumps. Silver did take a multiyear hit when the world shifted from silver based films to digital photography during the nineties. Now rising standards of living in emerging countries are increasing the demand for silver, especially in areas where there is a strong cultural preference for the jewelry, as in Latin America. That means we are setting up for a classic supply demand squeeze. I think we could run to the old high of $50/ounce in the next economic cycle, if another monetary crisis doesn?t get us there first. Since silver can trade with double the volatility of gold, this forecast could prove conservative.? You can buy the futures, where a 5,000 ounce contract worth $80,700 on the COMEX carries a margin requirement of only $6,750. You can also buy one ounce American silver eagle .9993% pure coins, but make sure you have a big safe to accumulate a serious position.

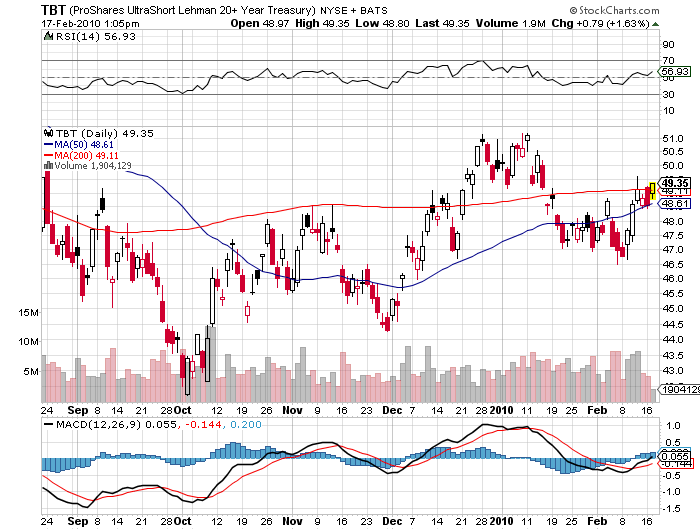

3) Make my sushi order a double. The latest figures from the Treasury Department for December show that Japan is now the largest holder of US government debt. China slipped to the number two position after unloading $34.2 billion in paper in December, paring its holdings to a mere $755.4 billion. This is an ominous development for several reasons. Japan has the world?s worst demographic outlook, with the number or retirees skyrocketing relative to the number of wage earners. Soon the country will have to start drawing down its substantial savings to offset falling contributions from a shrinking workforce. Today?s firm hands will become tomorrow?s loose ones, as Japan inevitably flips from a buyer to a seller of American debt. Chinese liquidation of its holdings also does not bode well for future sales, and could become the lead up to our first failed Treasury auction. I have been warning about such a possibility for months now, and see it as the triggering event for a cataclysmic collapse of the bond market, and the spike up in yields. If this comes to pass, you can kiss that recovery goodbye. Keep trading the (TBF) and the (TBT) from the long side, and explore some outright shorts in the 30 bond futures contract.

4) My guest on Hedge Fund Radio this week is Peter Schiff, president of Euro Pacific Capital, one of the country?s leading international fund managers. Peter obtained his degree in finance from the University of California at Berkeley in 1987. In 1996 he set up Euro-Pacific Capital, a firm that has successfully focused on investing in foreign stocks, bonds, gold, and commodities. Peter was the economic advisor to libertarian Ron Paul?s 2008 presidential campaign. Today Peter is running for the US senate seat in Connecticut that will soon be vacated by the retiring senator Chris Dodd. Peter is a man of strong beliefs and opinions, which he will be more than happy to share with us. We will be talking about investment strategies to survive the coming debacle, and of course, politics. Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com , click on ?Listen Live!?, and click on ?Houston 1180 AM KGOL.?? For archives of past Hedge Fund Radio shows, please go to my website by clicking here

QUOTE OF THE DAY

?We are no longer the locomotive in the world economy. We?re the passenger, and occasionally the caboose,? said Clark Winter, CIO at SK Investment Partners, about the Chinese flag hanging outside the New York Stock Exchange last week.