(WILL THE RESERVE BANK OF AUSTRALIA CUT RATES OR HOLD THIS WEEK?

February 18, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY FEB. 17

9:30 a.m. Philadelphia Reserve Bank President Harker speaks in “Global Interdependence Centre Central Banking Series Conference” with the University of the Bahamas.

10:30 p.m. Australia Rate Decision

Previous: 4.35%

Forecast: 4.10%

Markets closed for President’s Day Holiday.

TUESDAY FEB. 18

8:30 a.m. Empire State Index (February)

8:30 a.m. Canada Inflation Rate

Previous: 1.8%

Forecast: 1.8%

10 a.m. NAHB Housing Market Index (February)

Earnings: Arista Networks, Occidental Petroleum, Cadence Design Systems, International Flavors & Fragrances, Devon Energy, CoStar Group, Vulcan Materials

WEDNESDAY FEB. 19

2:00 a.m. UK Inflation Rate

Previous: 2.5%

Forecast: 2.4%

8:30 a.m. Building Permits preliminary (January)

8:30 a.m. Housing Starts (January)

2:00 p.m. FOMC Minutes

Earnings: CF Industries, Analog Devices, Trimble

THURSDAY FEB. 20

8:30 a.m. Continuing Jobless Claims (02/08)

8:30 a.m. Initial Claims (02/15)

8:30 a.m. Philadelphia Fed Index (February)

10:00 a.m. Leading Indicators (January)

6:30 p.m. Japan Inflation Rate

Previous: 3.6%

Forecast: 3.7%

Earnings: Live Nation Entertainment, Insulet, Booking Holdings, Akamai Technologies, Walmart, Hasbro, EPAM Systems, Quanta Services

FRIDAY FEB. 21

9:45 a.m. PMI Composite preliminary (February)

9:45 a.m. S&P PMI Manufacturing preliminary (February)

9:45 a.m. S&P PMI Services preliminary (February)

10:00 a.m. Existing Home Sales (January)

10:00 a.m. Michigan Sentiment final (February)

The market will tell us when the chaos turns “real”.

This year the market seems to be propped up every time it drops sharply.

Is that designed to suck everyone into the market before it well and truly peaks out?

Probably.

Is the market walking through all the noise Trump is making around tariffs, etc?

Yes, because it all seems like bluff and bluster.

Will the word chaos continue?

Yes.

And then, something will break, something will become real.

What it will be, I don’t know.

But I’m sure the media will explain it and how a field day after it happens.

Grok 3 is being launched by Elon Musk’s xAI in 24 hours

What is Grok 3?

Apparently, it is the ‘smartest AI on Earth. ’

It is said to have impressive speed and accuracy, with much better instruction-following capacity.

We shall wait for the demo.

The Reserve Bank of Australia is expected to cut interest rates this week

A cut would bring relief to mortgage holders, who have been waiting for this move since 2020.

But, a series of cuts is probably off the table because of concerns about inflation and the fallout from Donald Trump’s tariffs.

The broader market is pricing in a 90% chance of a cut on Tuesday. By that count, you would think it is almost a given. But many economists think this optimism is too extreme and is not getting carried away until the number is in.

If the Reserve Bank holds on Tuesday, it would be a shock to the market.

Star Entertainment Group may be bailed out by Oaktree Capital

Oaktree Capital has offered 65c in the dollar to buy The Star Entertainment Group’s debt as its future is looking more unsteady by the day.

Oaktree would be willing to provide a total of $650m in two debt facilities with a term of five years.

Star, which owns casinos in Sydney, the Gold Coast, and Brisbane, is exploring various options, including asset sales and raising further equity, as the company has doubt whether it can continue as a going concern.

MARKET UPDATE

S&P500

Choppy movement in the market and no sign yet of a peak.

Support = ~$6015/25

Resistance = ~$6145/55

GOLD

Gold is consolidating from its recent march up to $2943.

Will be looking for any slowing momentum to indicate a shift in this rally.

Support = ~$2,880/$2850/$2525

Resistance = ~$2909/$2940/$2975

BITCOIN

More of the same. More ranging, as we have seen over the last few months.

Support = ~$91k area. Support further down = ~$86/$86.50 area.

Resistance = ~$110/$110.70k area.

QI CORNER

Callum Thomas

Chart of the Week - MEEGA

Make European Equities Great Again... a new cyclical bull market is beginning.

If you’ve been fixated on the news flow around tariffs and stuck on the old narrative that Europe is doomed and can only regulate vs innovate, then you might have missed the fact that European equities are up over +10% YTD.

Change is in the air, a key set of breakouts and improving technical serve as a timely prompt to consider whether there’s more to this —and more left in the move…

What’s driving the strength in European Equities:

1. Valuations: unlike expensive US stocks, European stocks are still cheap/reasonably priced and trade at a record low valuation discount vs US. The thing I always emphasize is that when valuations reach such extremes, they have a habit of speaking for themselves; the rubber band eventually snaps back.

2. Monetary Policy: The European Central Bank began rate cuts earlier (June 2024) than the Fed and cut by a larger amount (from 4.5% to 2.9%); a tailwind for the economy and markets.

3. Geopolitics: Odds are the Russia/Ukraine conflict is going to be put on hold soon, and hopefully, an enduring and constructive peace deal can be reached. This will remove war-related costs, decrease uncertainty, take tail-risks of wider spillover off the table, and maybe even help Europe’s economy through rebuilding.

4. Politics: Germany is looking likely to see a shift in government from left to right in its upcoming elections (echoing the global trend as the pendulum swings). This will likely see a more growth/business-friendly regime, with the prospect of infrastructure investment, lower energy costs, and tax cuts. This positive shift will boost sentiment, and if pro-growth policies eventuate, it will be good for the rest of Europe as its largest economy accelerates.

5. Reforms: There is at least the intention to improve competitiveness, e.g., the Draghi report (400-page report on how to boost innovation and competitiveness; there is a strong likelihood at least some of the ideas get implemented) and moves toward greater focus on shareholder returns.

6. China: as I have noted, China’s economy is starting to turn up from recession and prolonged property market downturn, helped by incremental steps up in stimulus — this will be a boost for Europe’s luxury goods companies, and wider export demand (particularly if US tariffs prompt more trading between non-US countries).

As you can probably gather, some of these are somewhat short-term or already in the price, e.g., monetary policy easing and (geo)politics, but most of them are more medium/longer-term (enduring). So, in other words, I would say it looks like the rally and breakout in European equities is a sign of more things to come.

Basically, it’s time to discard the old narratives and biases on European equities as a new bull market gets underway…

Key point: European equities are breaking out and have ample room to run.

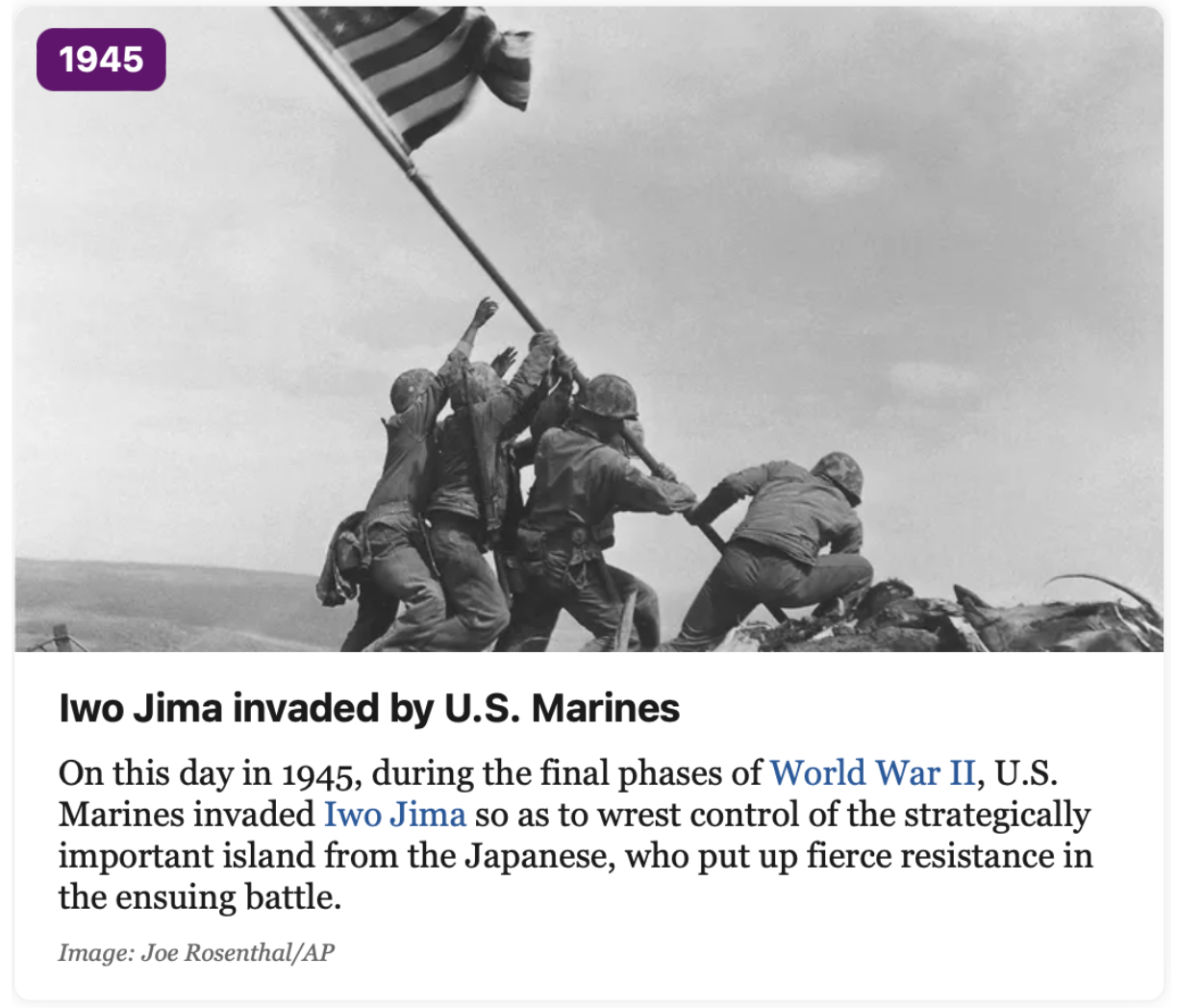

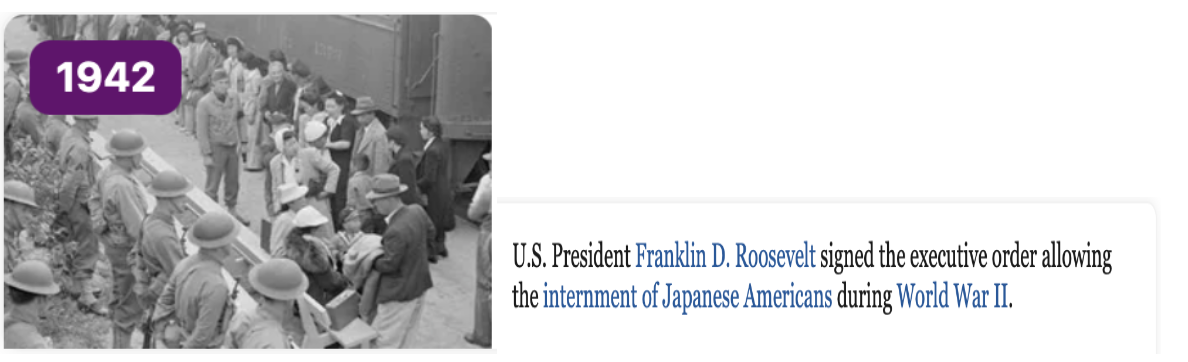

HISTORY CORNER

On this day

WORD OF THE WEEK

Bumfuzzle (derived from Old English – Dumfoozle)

Refers to being confused, flustered, bewildered, disoriented, or to cause confusion.

Are you bumfuzzled about the political landscape right now?

OR

Did the IKEA instructions to put a bed together completely bumfuzzle you?

SOMETHING TO THINK ABOUT

Cheers

Jacquie