February 26, 2025

(THE CHANGING LANDSCAPE OF THE MARKET)

February 26, 2025

Hello everyone

Tesla stock is plunging.

Why?

Worldwide criticism for his role in the U.S. DOGE service cancelling contracts and slashing staff in the U.S. government. And the way he has gone about this - slash and burn approach – has raised the ire of the population. Furthermore, his activity on X has been disturbing to say the least. Championing polarizing far-right world figures has raised some eyebrows, and that’s putting it mildly.

Leading up to Germany’s election last Sunday, Musk magnified the far-right, anti-immigrant Alternative for Germany party on X, post about the party and its leader more than 70 times to his 218 million followers.

Musk has also published opinion columns praising the party, and has spoken at party rallies, where he reportedly told Germans to move beyond “past guilt” over Nazi history.

The country’s conservative Christian Democrats won Sunday’s election.

But are Musk’s ideas and actions the only reason for Tesla’s slide?

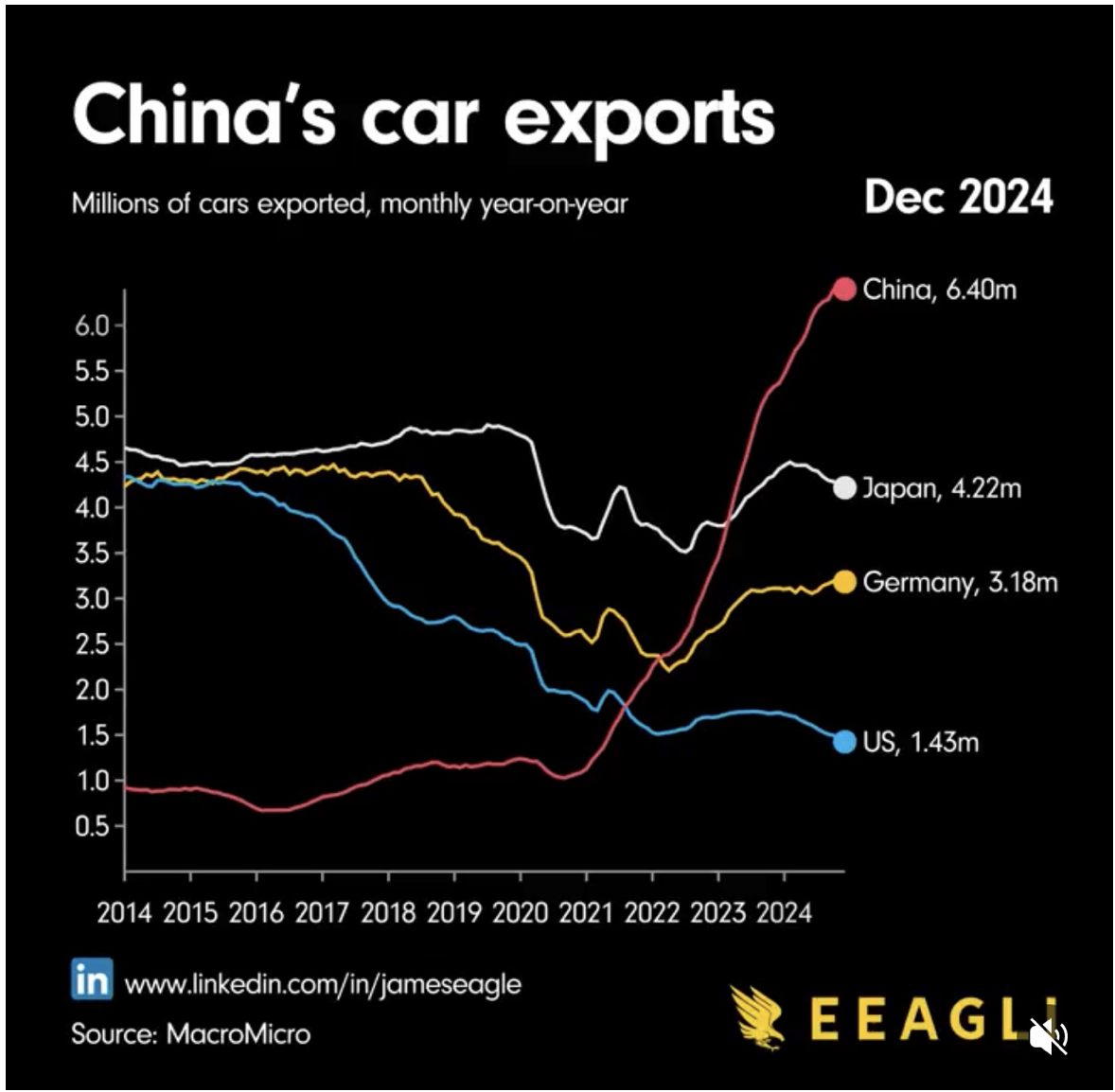

We can actually point to a confluence of factors. There is rising competition in the electric vehicle market, and we are also seeing a slowdown in the rate at which electric vehicle sales are rising.

Chinese automaker SAIC Motor sold 22, 994 cars last month in the E.U., U.K, and EFTA, compared with Tesla’s 9,945.

Will the decline in Tesla be permanent? It is too early to tell, but Musk’s political involvement and his blatant association with the far right is unlikely to be considered a positive for Tesla.

Has Musk damaged the Tesla brand?

Maybe.

Some of his Tesla employees and investors have indicated that the company would be better off if Musk resigned.

David Bailey, a business economics professor at the University of Birmingham in the United Kingdom, said Musk is now seen by some consumers as “toxic.”

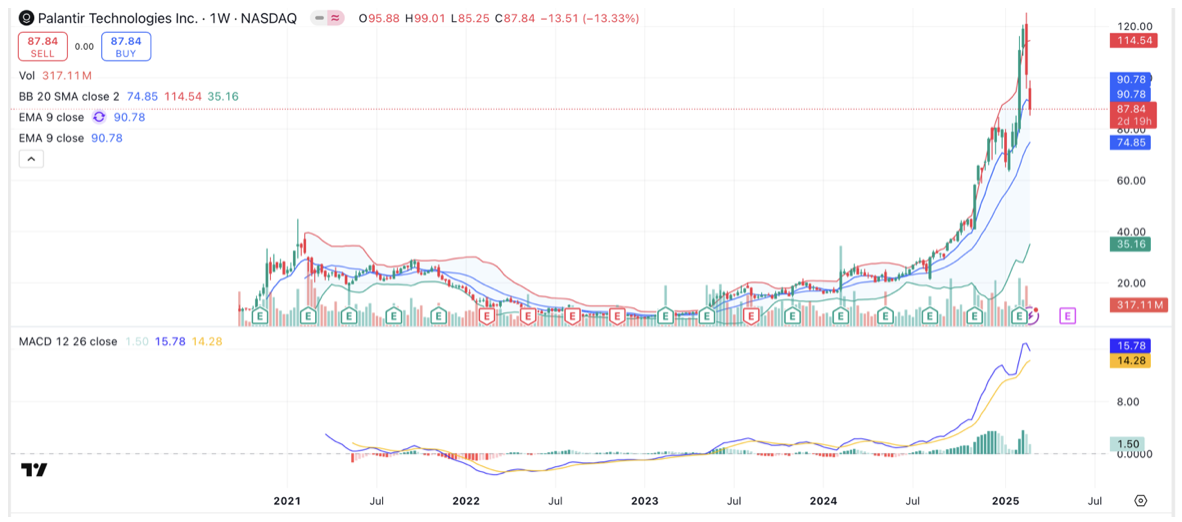

Palantir has collapsed after a huge rally.

Palantir had a very strong rally in 2024 that stretched in early February 2025. But after that momentous climb, the stock has crashed down to earth, losing 30% in less than two weeks.

At its peak on February 18, Palantir shares had surged 65% in 2025 alone, with a 23% single-day jump following the company’s blockbuster earnings report on February 3. However, a confluence of events changed the mood. News that the company’s chief executive sold $1 billion worth of stock and warnings about cutbacks in government spending (on which the firm heavily relies), sent shares sharply lower.

After its big decline the stock is trading in fairly valued territory, however it would be advisable to tread with caution around Palantir, as the stock could continue to be subject to wide swings as investors continue to assess the market for Palantir’s analytical software products.

Palantir may find a floor around $73 before its volatility retreats.

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie