February 28, 2011 - Goldcorp Coins it in the Gold Trade

Featured Trades: (GOLDCORP COINS IT IN THE GOLD TRADE)

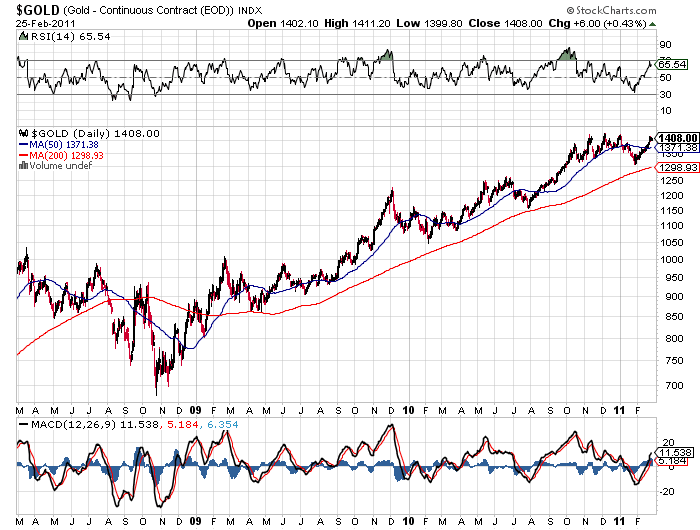

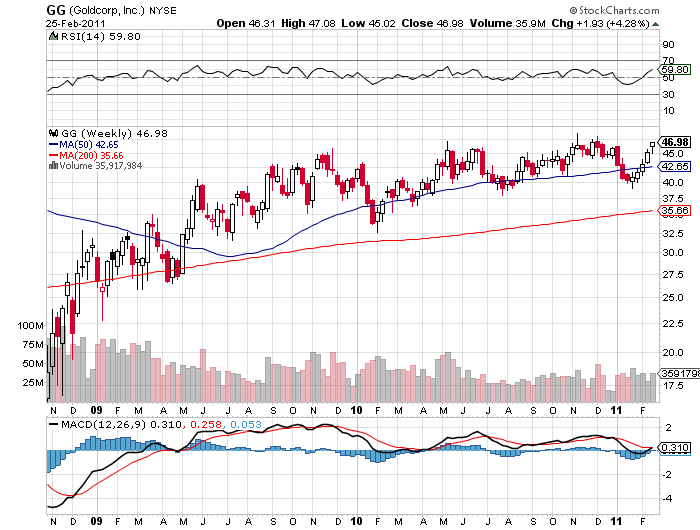

3) Goldcorp Coins it in the Gold Trade. I managed to touch base with Canadian miner Goldcorp's CEO, Charles Jeannes, who's stock I have been shamelessly pushing for the last three years (click here). When I last spoke to him two and a half years ago, back when the yellow metal was trading at $950, he made the then outrageous claim that gold would soon break $1,050 to make an all-time high.

Some $450 later, and you never saw a happier man. The company has been aggressively cutting costs, making acquisitions, and disposing of non core assets. This will lead to a production increase of 60% to 4 million ounces a year over the next five years.? Goldcorp is currently extracting the barbarous relic in Canada, the Dominican Republic, Guatemala, Mexico, Argentina, and the US. Both physical and investment demand are soaring. This will continue, as all the gold and gold backed instruments in the world only add up to 1% of global financial assets.

Goldcorp's average cost is $274/ounce, giving it elephantine profit margins that enabled it to bring in a net $791 million in profits last year. Costs are growing at 6% a year, well below the 15% industry average. The company just doubled its dividend. Talk about a license to print money.

I have been a huge bull on gold since I put out my call to buy it more than three years ago at $800. While I continue to believe that we will steadily appreciate in coming years to the old inflation adjusted high of $2,300, I also think the glory days are behind us. We'll probably only see single digit, or small double digit annual returns getting us there. My only trading play this year was on the short side, which proved immediately profitable. That is on par with high yield junk bonds or distressed muni bonds, but nothing like last year's blistering 28% appreciation.

-

-

No Need to Massage the Profits Here