February 3, 2011 - Ringing in the Year of the Rabbit

Featured Trades: (THE YEAR OF THE RABBIT), (FXI), (SSEC), (CYB)

1) Ringing in the Year of the Rabbit. An invitation to the Chinese consulate for their New Year's party is always one of the most sought after invitations in the Lilliputan diplomatic community of San Francisco. Welcoming the Year of the Rabbit were true Mandarins bedecked in elegant silk brocade, rubbing shoulders with true proletarians wearing blue jeans and running shoes. The elite of the city's Chinese business community were there, celebrating a trade surplus with the US that exceeded $200 billion last year, taking out generous margins along the way.

Out of 500 guests, I was one of a handful on non-Chinese visitors. I have long been accorded VIP status here, being one of the few Americans still living who survived the Cultural Revolution, and having interviewed such luminaries as Deng Xiaoping and Zhou Enlai. It's like attending a Tea Party rally and telling people you used to pall around with Thomas Jefferson and Alexander Hamilton.

There was enough food to feed the entire Chinese army, which vaporized in minutes. After covering the country on the ground for 40 years, I still can only identify half of what I am eating. The trick is to never ask what it is because you might find out that it is disgusting (Chicken feet? Cock's comb?). One mysterious purple jellyfish like substance my hosts could only describe as 'fungus', which they scarfed down in great quantities.

The bar went mostly ignored, there being few takers of Great Wall merlot, attendees maintaining their allegiance to nearby Napa Valley. So I quaffed a couple of bottles of my favorite Tsing Tao beer. It was always healthier than the local water, both ours and theirs, although the benzene blended in to assure longevity during hot, humid summers, always gave me a headache.

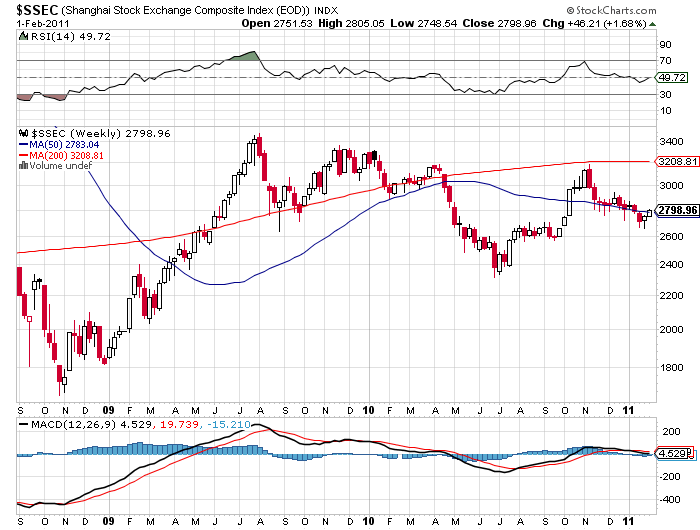

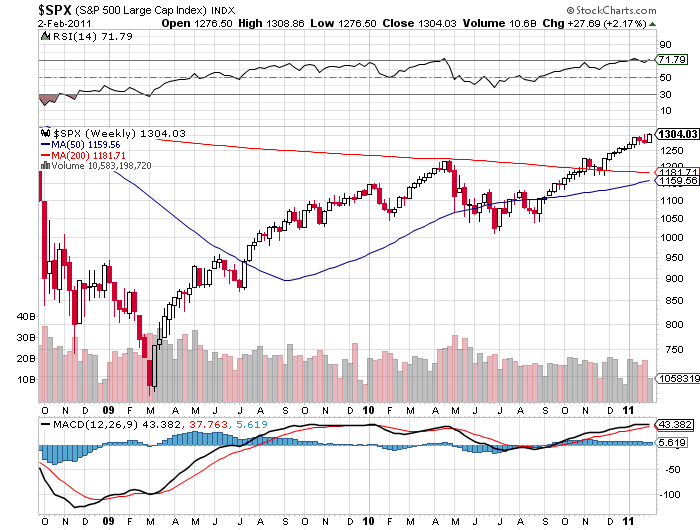

I managed to buttonhole a visiting senior official from the Ministry of Finance and asked him what gives with the Chinese stock market (FXI)? With GDP up 9.9% in the latest quarter, and a global bull market in full flower, how come the Shanghai Index ($SSEC) was down by 13% in 2010? Even the enfeebled dying capitalist nation of America saw its market up 9%, despite an enormous budget deficit, ballooning national debt, bankrupt states and cities, and a hopelessly incurable unemployment problem.

He said things were a little complicated. Inflation is getting to be a real problem in the Middle Kingdom. The challenge for the government is to cool of the inflationary parts of the economy, predominantly real estate, without killing off the rest. So far measures taken by the People's Bank of China have been targeted at speculative land purchases, to the extent that is possible. This is why the focus has been on increasing bank reserve requirements, which have been tightened seven times in the past year. Soon China's banking system will be as deleveraged as Canada's (5:1).

I told him that was nice, but that this would do nothing to address imported commodity inflation from abroad. The price of oil, coal, food, copper, and other essential raw materials were about to head up a lot more. I argued that the only means of dealing with this problem was to let the Yuan float (CYB), thus cutting the cost of imports in local currency terms. I was about to get into China's nationalization of several rare earth exporting firms when the Consul General motioned for him to join him on the other side of the room.

As I was explaining to my plumber the other day, if China is growing at 10% and we're growing at 2%, where do you want to own stock for the long term? You don't get a divergence like a stock market falling 13% while the economy is growing 10%, lasting forever, so it appears like there is a screaming 'BUY' setting up here. But given what I heard at the party, it is clear that the answer is an overwhelming 'Not Yet!' Jim Chanos, you may be right about a China crash, but you're early by a decade!

And what is the Chinese element for the New Year? Metal. Good thing I covered my short in gold.

Where's My Bull Market?

-

-

-