February 4, 2011 - Solar Energy is Poised to Achieve Cost Parity

Featured Trades: (SOLAR ENERGY PARITY), (FSLR)

3) Solar Energy is Poised to Achieve Cost Parity. After two years of relentless cost, the solar industry is about to reach the Holy Grail of parity with the cost of conventional power sources at around 10 cents per kilowatt hour, paving the way for and exponential growth in profitability.

For those of us who have been cheerleading this industry from the sidelines since the 1973 oil shock, it has been a long and tedious wait. We have traveled the long and winding road from primitive roof mounted water pre heaters to advanced thin film technology, with endless political battles along the way against frequently hostile and tight fisted administrations in Washington.

You can thank Germany, a country that ironically often lacks sunlight, where individuals and local utilities alike are putting the pedal to the metal to cash in on generous government subsidies. The goal is to push the Fatherland's alternative energy supplies from the current 12.5% of total generation to 20% by 2020. Local sources tell me that installed rooftop solar panels are expected to double this year.

Several US states have similar mandates. California, which has the lofty goal of 30% for alternative power, has just approved the building of a massive solar facility in the Mohave Desert just North of Los Angeles.

The net net is higher volumes and prices than the solar industry was expecting only six months ago. This will enable the big players in this space to wean themselves off of subsidies, stand on their own feet, attract more private capital, and shrink costs further through economies of scale.

Part of the economization story for American companies involved the offshoring of a substantial part of its manufacturing to China. It didn't hurt that the Middle Kingdom signed a contract with First Solar (FSLR) to build an enormous one square mile plant in the Western part of their country, which looks an awful lot like our Southwestern desert, to gain advanced technology. They no doubt also sought to defuse the threat of anti-dumping actions in the US against their own manufacturers.

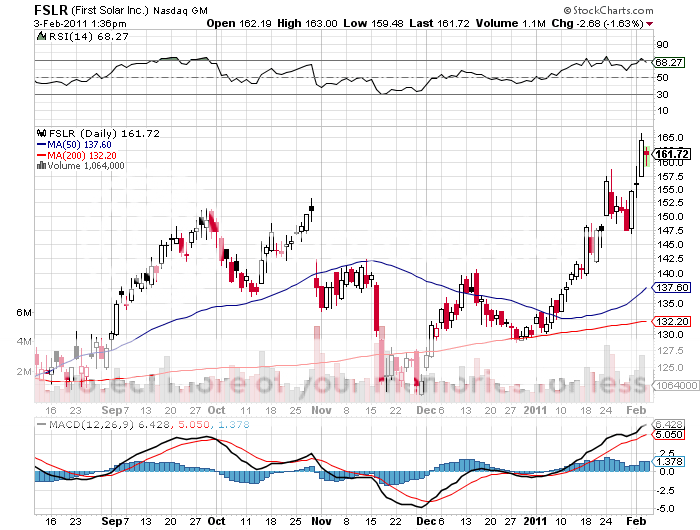

I think the earnings leverage in this industry is now huge, and any upturn in oil prices, which I expect over the long term, will act on profitability like a shot of steroids. Equity investors have recently figured this out and have broken (FSLR) out of its recent range to the upside. Buy (FSLR), which has lived in my long term model portfolio for some time, on any serious dip.

-