February 8, 2010

February 8, 2010Featured Trades: (JANUARY NONFARM PAYROLL),

(TBF), (TBT), (ASML), (CSCO), (JDSU), (MU), (JNPR), (SNDK)

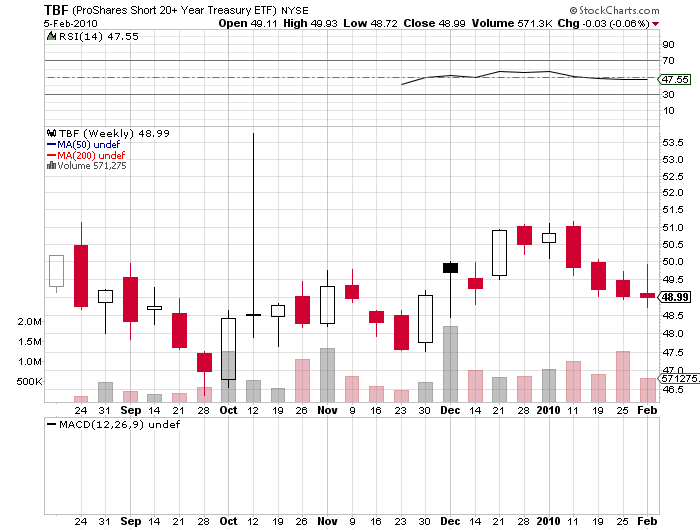

2) I hate to sound like Chicken Little predicting that the sky is falling, but there is a disaster of monumental proportions setting up in the Treasury bond market. Last year investors fleeing the terror of the financial markets poured some $375 billion into bond mutual funds and virtually nothing into equity funds. It makes you wonder who bought all those stocks that drove the S&P 500 up 60% last year. My guess? Hedge funds, day traders, and hot money punters who will puke at the drop of a hat. The flight to quality since mid January has only accelerated the flow into fixed income funds. Treasury bonds, already the world?s more overvalued asset class, are getting more expensive. This will only end in tears, with the retail end investor, once again, left holding the bag. Use this strength to build a core short in the 30 year T-bond, either through the futures market, ETF?s ( TBF for the 100% short and TBT for the 200% short), our outright borrows. I still think this will be the trade of the decade.

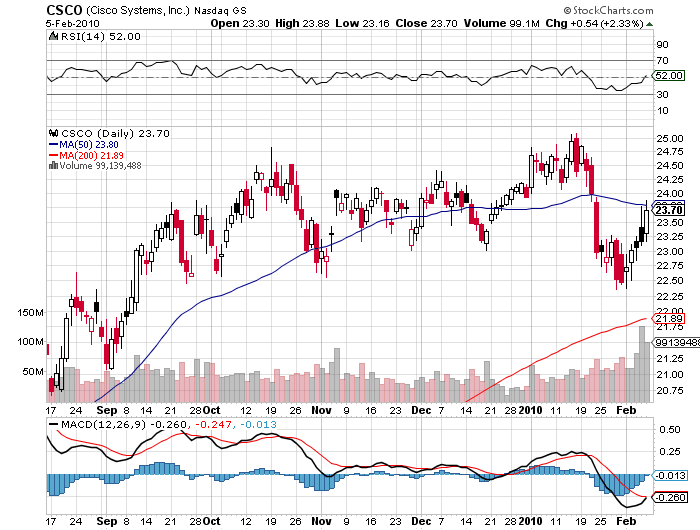

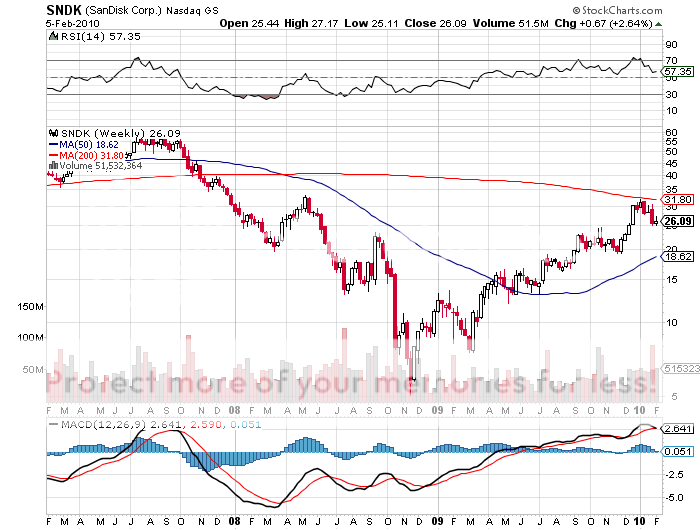

3)When the current risk reversal ends, there is one sector that I am going to jump into with both of my size 14 boots. After the dotcom bust of 2000, technology stocks spent nearly a decade in the penalty box, shunned by the investing world as the poster boys for wild excess. During this time, cash balances doubled, free cash flows soared, outstanding shares shrank, and multiples fell to a tenth of their bubblicious peaks. I started recommending this group at the absolute bottom of the market last March (click here for the call ), and it was no surprise to me when they outperformed almost every sector on the upside. With 60%-80% of their earnings coming from abroad, primarily Asia, I saw them really as foreign stocks wearing cowboy hats, pearl snap buttoned shirts, and Ray Ban aviator sunglasses. They were great weak dollar plays. They did not need banks, as they are almost entirely self financed, didn?t have derivatives books, and had minimal real estate exposure. While their customers here were getting poorer, many more overseas were getting richer. The industry represents the last, best hope that America has for competing globally, as it is our only means of staying on top of the international value added chain. It seems that in addition to bulk commodities like corn, wheat, soybeans, coal and timber, aircraft, weapons, and movies, tech companies are among the few that make things foreigners want to buy. The lessons of the bubble made them ultra conservative in their capital spending which will lead to product shortages and much higher prices in any recovery. Memory, for example, has seen no capex at all for three years. They are surfing the wave of innovation, and will cash in big time from the mobile computing revolution, cloud computing, and the virtualization of data centers. During the last tech bubble the industry did not have the global market that it does today. Now, demand from the rising emerging market middle class is kicking in, as it is for commodities. The nine month tech rally we saw in 2009 could? just be the down payment of a decade long bull market in these stocks which will end with another bubble. When John Chambers, a first class manager, discussed Cisco?s (CSCO) outlook after announcing blowout Q4 earnings, he was so effusive he sounded like he was on ecstasy. Take a look at Juniper Networks (JNPR), JDS Uniphase, (JDSU), Sandisk (SNDK), Micron Technology (MU), and lithography toolmaker (ASML). Long dated call spreads in all of these make sense on a decent dip.

?People that have complete disdain for government intervention in the economy and markets of the West have complete faith in nine guys in a room being able to figure out the very complex and rapidly growing Chinese economy,? said hedge fund manager Jim Chanos of Kynikos Associates, about foreign investors? unlimited faith in the Middle Kingdom?s politburo.