February Nonfarm Payroll Roasts the Shorts

Sure, I was expecting a strong, 200K plus print for the February nonfarm payroll report from the Department of Labor on early Friday morning.

But 242,000? And another 30,000 in upward revisions for December and January? It boggles the mind.

The market hesitated for a few minutes and then it was off to the races. Those running premature short positions in stocks were roasted, dissected, fricasseed, and French-fried.

And that would include me.

As of today, I am up 5% on the year. I can?t remember ever having to work this hard to get such a pitiful return. And this is for the guy who nailed the bottom in gold, oil, and stocks, all in the right order.

At least I?m not hedge fund titan Bill Ackman, who is underwater by 20% already this year, in a market that is close to unchanged, and on the heels of humongous losses last year.

Thank goodness for small mercies.

Make a mistake in this market, and you are punished severely. One bad trade wipes out ten good ones.

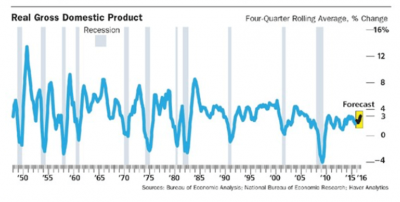

Of course, the nonfarm figures completely take a recession off the table.

As you recall, it was never there for me. I spent much of early February pleading with big clients not to sell stocks, right when the many talking heads were then urging them to do exactly that.

Dow 15,000, 12,000, 10,000, 3,000? Why not? There was an arms race underway where the Cassandras all tried to out-Cassandra each other, as they always do.

I told them instead to not look at stock prices, and to take a long cruise instead. It always works.

Let me tell you what?s going on here. After my friend, Federal Reserve Chairman Janet Yellen, raised interest rates by 25 basis points in December, the market then fully discounted an astonishing seven more such hikes.

That gave us an instant 10% selloff in stocks. Then when the S&P 500 (SPY) hit $181, and a 15X stock multiple safety net came within view right below them, traders suddenly realized that the risk of a bear market meant that there would be NO interest rate rises in 2016.

It also helped that the global commodity space hit bottom and started to bounce only a few days earlier, the nanosecond I sent out my Trade Alert to buy call options on oil (USO) on February 9, with Texas tea trading at $26.

Look at the nonfarm numbers closer, and they are nothing less than eye-popping.

The headline number unemployment stayed nailed to a 4.9% eight year low. The U-6 broader ?discouraged? worker rate fell to a new low at 9.7%.

Health care and private assistance, among the fastest growing sectors of the economy, jumped by 57,000.

Food & drink were up 40,000, and construction gained 19,000. As usual, mining fell by 19,000.

It all confirms a trading scenario that I neatly laid out for you at the beginning of the year. You are going to make all of your equity performance this year buying the 15% New Year dip.

The month we just completed in February was a picture perfect copy of the October price action.

After a ferocious bounce, we will spend the next six months building a giant sideways wedge formation. We will reach an apex by August, and them begin a blastoff to a new high that neatly coincides with the presidential election.

Trade around these moves, and you should be able to bring in a decent double-digit return in 2016.

And the heavy lifting is already behind you.