Feds Knock The Wind Out Of Tech

The U.S. Federal government just took the air out of the tech market rally in the short term.

Good thing the market usually has a short memory.

Mr. Market did not expect the US Justice Department to barge in and subpoena Nvidia (NVDA).

Nvidia is the gem of the tech industry and the leader of the cutting-edge generative artificial intelligence sub-sector.

To take out Nvidia and destroy it, the tech market would be valued at significantly less than it is today.

Not to mention we are just 2 months away from the U.S. election, this sounds and feels like a bold political move behind the scenes.

Why not wait until after the election?

As it stands, the timing is pretty terrible for tech stocks as the amount of catalysts to take us to new highs has disappeared.

The past earnings seasons were nothing stellar and many tech companies sold off on poor forward guidance.

It is no joke that we have been waiting for over 4 years for the recession that still hasn’t come.

However, it seriously looks like we won’t be able to kick the can down the road anymore and the job market is starting to fall apart to the point where we will need rate cuts.

The DOJ believes Nvidia is too dominant and appears to look like a monopoly and the government is inching closer to filing a formal complaint.

Antitrust officials are concerned that Nvidia is making it harder to switch to other suppliers and penalizes buyers that don’t exclusively use its artificial intelligence chips.

Nvidia has drawn regulatory scrutiny since becoming the world’s most valuable chipmaker and a key beneficiary of the AI spending boom. Sales have been more than doubling each quarter.

Regulators also are digging into whether Nvidia gives preferential supply and pricing to customers who use its technology exclusively or buy its complete systems.

Nvidia Chief Executive Officer Jensen Huang said he prioritizes customers who can make use of his products in ready-to-go data centers as soon as he provides them, a policy designed to prevent stockpiling and speed up the broader adoption of AI.

Microsoft (MSFT) and Meta (META) spend more than 40% of their budget on hardware on the chipmaker’s gear. During the peak of shortages of Nvidia’s H100 accelerator, individual components were retailing for as much as $90,000 each.

There also are broader regulatory questions about Nvidia’s practices. Access to AI capabilities has become a key focus for governments around the world, with the technology becoming increasingly vital to economic strength and national security.

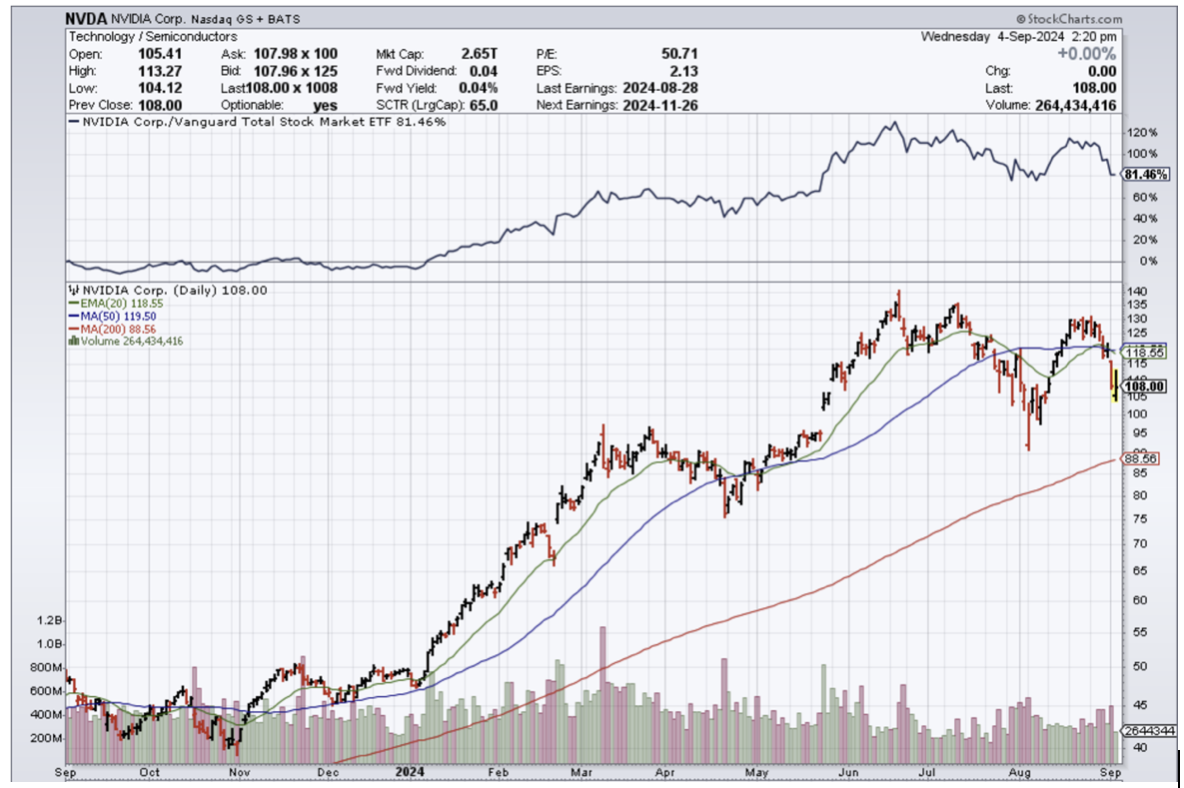

If NVDA shares drop to anything close to the $100 level, I do believe that is a great entry point to add to shares.

Much of the bad news has been priced in and at the end of the day, even if NVDA is broken up, it will happen 10 years later.

As for the larger tech story, September could be a weak month for tech stocks and it is a seasonably slow month.

However, the infrastructure build for AI data centers relentlessly continues, and from my channel checks, I see tech firms increasing their purchases of Nvidia AI chips.

This bodes well for the future and explains why sales keep doubling and doubling like it never ends.