Follow Up to Trade Alert - (DAL) October 15, 2014

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Further Update to: Trade Alert - (DAL)

Buy the Delta Airlines (DAL) November, 2014 $25-$27 in-the-money vertical bull call spread at $1.60 or best

Opening Trade

10-15-2014

expiration date: November 21, 2014

Portfolio weighting: 10%

Number of Contracts = 63 contracts

When I was a young, clueless investment banker at Morgan Stanley 30 years ago, the head of equity sales took me aside to give me some fatherly advice. Never touch the airlines.

The profitability of this industry was totally dependent on fuel costs, interest rates and the state of the economy, and management hadn't the slightest idea of what any of these were going to do. If I were ever tempted to buy an airline stock, I should lie down and take a long nap first.

At the time, the industry had just been deregulated, and was still dominated by giants like Pan Am, TWA, Eastern Air, Western, Laker, Braniff, and a new low cost upstart called People Express. None of these companies exist today. It was the best investment advice that I ever got.

If you total up the P&L's of all of the US airlines that ever existed since Orville and Wilber Wright first flew in 1903 (their pictures are on my new anti-terrorism edition commercial pilots license), it is a giant negative number, well in excess of $100 billion. This is despite the massive government subsidies that have prevailed for much of the industry's existence.

The sector today is hugely leveraged, capital intensive, heavily regulated, highly unionized, offers customers terrible service, and is constantly flirting with, or is in bankruptcy. Its track record is horrendous. It is a prime terrorist target. A worse nightmare of an industry never existed.

I became all too aware of the travails of this business while operating my own charter airline in Europe as a sideline to my investment business during the 1980?s.

The amount of paperwork involved in a single international flight was excruciating. Every country piled on fees and taxes wherever possible. The French air traffic controllers were always on strike, the Swiss were arrogant, and the Italians unintelligible and out of fuel.

The Greek military controllers once lost me over the Aegean Sea for two hours, while the Yugoslavs sent out two MIG fighter jets to intercept me. As for the US? Did you know that every rivet going into an American built aircraft must first be inspected by the government and painted yellow before it can be used in manufacture?

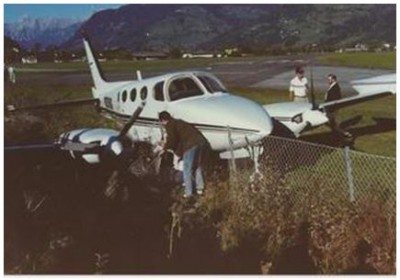

While flying a Red Cross mission into Croatia, I got shot down by the Serbians, crash landed at a small Austrian Alpine river, and lost a disc in my back. I had to make a $300 donation to the Zell Am Zee fire department Christmas fund to get their crane to lift my damaged aircraft out of the river (see picture below). Talk about killing the competition!

Anyway, I diverge.

So you may be shocked to hear that I think there is a great opportunity here in airline stocks. A Darwinian weeding out has taken place over the last 30 years that has concentrated the industry so much that it would attract the interest of antitrust lawyers, if consumers weren?t such huge beneficiaries.

With the American-US Air (AAL) deal done, the top four carriers (along with United-Continental (UAL), Delta (DAL), and Southwest (LUV) will control 90% of the market.

That is up from 60% only five years ago. The industry has fewer seats than in 1982; while inflation adjusted fares are down 40%. Analysts are referring to this as the industry?s new ?oligopoly advantage.?

Any surprise bump up in oil prices is met with a blizzard of higher fares, baggage fees, and fuel surcharges. I can't remember the last time I saw an empty seat on a plane, and I travel a lot. Lost luggage rates are near all time lows because so few now check in bags. Interest rates staying at zero don?t hurt either.

The real kicker here is that stock in an airline is, in effect, a free undated put on the price of oil. If the price of oil stays in the $80 handle for a prolonged period of time, which it should, or continues to fall, airline stocks will rocket. This is on top of a $27 plunge in the price of Texas tea, the largest single cost item for the airline industry.

If you are looking for another indirect play, look at the bond market. With a new Boeing 787 Dreamliner costing up to $300 million each, airlines are massive borrowers of capital. With interest rates at all time lows, another huge source of costs have just been lifted off the airlines? backs.

The Ebola virus is an additional sweetener (if you could use such a term for a deadly disease), because it is enabling us to buy the stock down 30% than it would be otherwise. Delta Airlines (DAL) just so happened to be the airline that brought the first Ebola carrier to the US, so it has suffered the most. As frightening as this disease is (I studied it in my Army bacteriological warfare days), I doubt we will see more than a dozen cases in the US.

At least we are finally getting something for our $120 billion investment in Homeland Security since 2002. How much do you want to bet that they don?t cut the budget for the Center for Disease Control (CDC) this year, as they have for the past dozen!

On top of the massive fuel savings, a recovering US economy should boost profitability, given its recent maniacal pursuit of controlling costs. Some airlines have become so cost conscious that they are no longer painting their planes to gain fuel savings from carrying 100 pounds less weight! Just the missing pretzels alone should be worth a few cents a share in earnings.

This is not just a US development, but an international one. The International Air Transport Association (IATA) has just raised its forecast of member earnings from $7.6 billion in 2012 to $10.6 billion in 2013, a gain of 40%. The biggest earnings are based in Asia (China Southern Airlines, China Eastern Airlines, Air China), followed by those in the US, with $3.6 billion in profits.

Add all this together, and the conclusion is clear. The checklist is complete, the IFR clearance is in hand, and it is now time to push the throttles to the firewall for the airline stocks and get this bird off the ground.

And no, I didn't get free frequent flier points for writing this piece.

You can buy this spread anywhere in a $1.60-$1.75 range and have a reasonable expectation of making good money on this trade. The upper strike is 10% below today?s low.

If you are unable to do option spreads buy the stock outright at market prices.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit.

Keep in mind that these are ballpark prices only. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 63 November, 2014 (DAL) $25 calls at?????$7.45

Sell short 63 November, 2014 (DAL) $27 calls at..??.$5.85

Net Cost:??????????????????.....$1.60

Potential Profit at expiration: $2.00 - $1.60 = $0.40

(63 X 100 X $0.40) = $2,520 or 2.52% profit for the notional $100,000 portfolio.

Maybe I Should Try Hedge Fund Trading?

Maybe I Should Try Hedge Fund Trading?