Follow Up to Trade Alert - (GILD) February 4, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Follow Up to Trade Alert - (GILD) UPDATE

Buy the Gilead Sciences (GILD) February, 2015 $87.50 - $92.50 deep in-the-money vertical bull call spread at $4.40 or best

Opening Trade

2-4-2015

expiration date: February 20, 2015

Portfolio weighting: 10%

Number of Contracts =23 contracts

This is a stock that could double by the end of 2015.

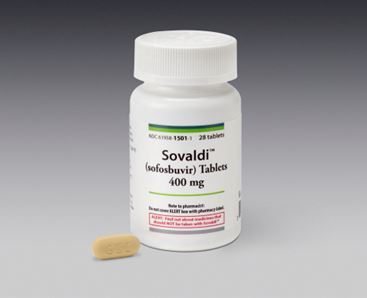

Buy a great performing stock in the best performing sector on a 10% dip. The stock has over reacted to an earnings report that was fantastic; but carried conservative forward guidance, based on expected future pricing pressure on its blockbuster Hepatitis C drugs, Sovaldi and Harvini.

You can buy the Gilead Sciences (GILD) February, 2014 $87.50-$92.50 deep in-the-money vertical bull call spread all the way up to $4.60 and still clock a nice two week profit for the February 20 expiration.

I am giving a nod to the current high risk, high volatility environment and being very cautious here buy going with strike prices for the options that are well below the 200-day moving average. A very short, 11 trading day expiration gives us some extra protection.

This position should be able to weather some pretty fierce storms.

If you want to be more aggressive and take a longer view, buy the (GILD) April, 2015 $110 calls at $2.20 or better. If we break to a new all time high by the April 17 expiration, as I expect, you could score a 3-5 bagger for these options.

If you don?t do options, just buy the shares and sit on them for the rest of the year.

I spoke to a friend of mine the other day who works for a health care venture capital firm, and I thought I?d pass through a few tidbits.

Gilead Sciences (GILD) is basking in the glow of the most profitable drug launch in history. It?s blockbuster Sofobuvir treatment for hepatitis C, launched in 2013, inhibits the RNA polymerase that the hepatitis C virus (HCV) uses to replicate its RNA. It traders? parlance, it kills the bug.

(GILD) has taken in $5.7 billion in sales of Sofobuvir during the first half of 2014, and could sell as much as $10-$12 billion for the full year.

The drug is so revolutionary, that it on the scale of medical miracles of decades past, such as Salk vaccine immunizations for polio and penicillin treatments for bacterial infections. So far, Sofobuvir has cured a breathtaking 90% of patients.

Now the company is using various drug combinations that produce even higher success rates with fewer side effects, and may be expended to treat other life threatening diseases. These could take Sofobuvir sales as high as $15-$18 billion in 2015.

A big controversy regarding Sofobuvir has been its immense cost, which works out to $84,000-$135,000 per patient. This has become a bigger issue with the advent of Obamacare, now that the government is picking up much of the tab.

But, that?s a bargain compared to full treatment of the disease, which can run as high as $350,000 per patient. That is, unless you don?t care if you die.

Partly in response to these complaints, the company is making the drug available at deep discounts in 91 emerging nations that account for 50% of all Hepatitis C cases globally. What it loses on margins there it will make back in volume.

With any luck, we may see hepatitis C wipe out in my lifetime, as I have already seen with smallpox (I saw some of the last few live cases in kids in Nepal in 1976).

All of this makes the stock appear a bargain at its current $99.05 price. At a multiple of a subterranean 11X earnings, the stock should hit $140 next year.

You all know that health care is one of my three core industries to bet on for the long term (there others are energy and technology).

The short-term driver of the share price for (GILD) is obviously whether the health care sector is in, or out of vogue. But for the long term Gilead looks like a good bet to me. And I don?t even have hepatitis, or Ebola.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit.

Keep in mind that these are ballpark prices only. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 23 X February, 2015 (GILD) $87.50 calls at?????$11.90

Sell short 23 X February, 2015 (GILD) $92.50 calls at..??.$7.50

Net Cost:??????????????????.....$4.40

Potential Profit at expiration: $5.00 - $4.40 = $0.60

(23 X 100 X $0.62) = $1,380 or 1.38% profit for the notional $100,000 portfolio.