Follow Up to Trade Alert - (BAC) December 9, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (BAC) - UPDATE

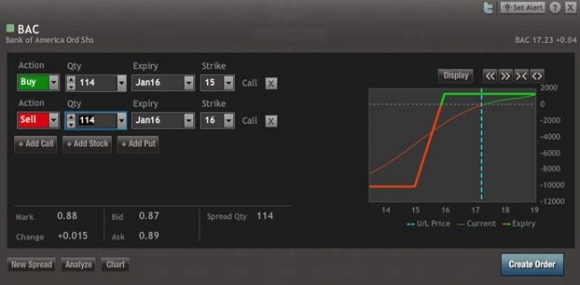

Buy the Bank of America (BAC) January, 2016 $15-$16 in-the-money vertical bull call debit spread at $0.88 or best

Opening Trade

12-9-2015

expiration date: January 15, 2016

Portfolio weighting: 10%

Number of Contracts = 114 contracts

This is a bet that the Federal Reserve is going to raise interest rates in a week.

If they do, this position should move to its maximum potential profit in a day.

If they don?t, you will stop out for a loss.

THAT SAID, THERE IS A 99% PROBABILITY THAT JANET WILL RAISE INTEREST RATES NEXT WEEK.

She has very clearly laid out the criteria for such a move, and with the headline unemployment rate now at 5.0%, we have met all of them.

NOT to move now risks inviting higher inflation in the future, and sooner. That is certainly not in the Fed?s playbook.

That?s why I went so deep in-the-money. We have a wide 10% downside cushion in the share price if the wheels suddenly fall off this trade. That meant reducing my risk, while leaving some money on the table. The expiration breakeven point is $14.88.

You pay your money and you take your chances.

Given the bank?s tremendous upside leverage to rising rates and a recovering economy, many analysts are now pegging the stock with a $30 handle.

Banks have been out of favor for so long they have become deep value stocks, making them a perfect sector for managers to rotate into during the new year.

They have grown weary of continuously jacking up the multiples of a small handful of growth stocks, as they have done for all of 2015.

There is another play here. (BAC) is highly geared to rising interest rates, which will enable them to lend money out at higher interest rates, increasing their spread.

Think of it as long dated put option on the iShares Barclays 20+ Treasury Bond ETF (TLT).

That is not a bad position to have on board, given that we probably put in a multigenerational spike in bond prices last year.

Because of the bank?s long and well-publicized problems with regulators dating back to before the 2008 financial crisis, (BAC) became toxic waste for many portfolio mangers.

The end result of that has been to make (BAC) one of the best-run banks in the industry, and also the cheapest.

This is why I went for the Trade Alert for the long position in (BAC). I knew the fundamentals would allow me to weather any market storms headed my way and put a floor under the stock.

So far, so good.

I have a feeling that I will be visiting the trough here often, and generously.

You can buy this put spread anywhere within the $0.85-$0.90 range and have a reasonable expectation of making money on this trade.? If you can't do options buy the stock outright at market.

Warning! With a low price and a large number of contracts, this trade is particularly sensitive to your commission rate. So if you are overpaying your broker, now is the time to have a conversation with them and negotiate your rates down. It?s easier than you think, especially on spread trades.

The $15 and $16 strikes also make this a nice set up on the charts, hovering just below major support levels.

Keep in mind that the options market is highly illiquid now, so don?t hold me to these prices. They are ballpark estimates, at best.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

Buy 114 January, 2016 (BAC) $15 calls at?????$2.30

Sell short 114 January, 2016 (BAC) $16 calls at..??.$1.42

Net Cost:??????????????????.....$0.88

Potential Profit: $1.00 - $0.88 = $0.12

(114 X 100 X $0.12) = $1,368 or 1.37% profit for the notional $100,000 portfolio.