Follow Up to Trade Alert - (FXE) May 12, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (FXE)- TAKE PROFITS - UPDATE

SELL the Currency Shares Euro Trust (FXE) May, 2016 $113-$116 in-the-money vertical bear put spread at $2.97 or best

Closing Trade

5-12-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

We?ve got another big win here, picking up a nice 12.50% in just 5 trading days.

We have captured 91.66% of the maximum potential profit in the Currency Shares Euro Trust (FXE) May, 2016 $113-$116 in-the-money vertical bear put spread.

Time to take the money and run. This way we cut our currency risk in half and have dry powder with which to reenter the position at a later date.

If you have the ProShares Ultra Short Euro ETF (EUO), the 2X short Euro fund. Keep it. The Euro is going lower.

As you make recall from out original trade alert, our reasons for selling short the Euro last week were somewhat complicated.

While the April nonfarm payoll report was a bit of a disappointment, It still was in the same ballpark of 200,000 a month we have been seeing for the last several years.

That means the economy is speeding up, not slowing down, and that interest rate hikes will happen sooner, and not later. The Q1 mini recession is now behind us. The dollar should rise and the currencies should fall.

The Currency Shares Euro Trust (FXE) March, 2016 $103-$106 in-the-money vertical bull call spread is a bet that the Euro won?t rise above $113 by the May 20 expiration.

In other words, the (FXE) would have to run up to a new one year high within ten trading days for us to lose money on this trade. I turned out to be correct in my assumptions.

Now that the market has thrown out any chance of a Fed rate hike in June, the capacity for the dollar to disappoint has burned out. Futures markets are only pricing in a 15% probability of such a move.

On top of that, the dollar has been strong for the past seven consecutive Mays. I ascribe this to the large numbers of international trade transactions that settle this month, which generate a lot of dollar buying and foreign currency selling.

This is against a backdrop of foreign governments looking to weaken their own currencies at every opportunity.

Look for someone in Japan to say something very negative next week when they return from the Golden Week vacations. For them, the yen at 107.00 is nothing short of the apocalypse for their economy.

Notice that the greenback has been strong against all currencies since the big turnaround on Tuesday.

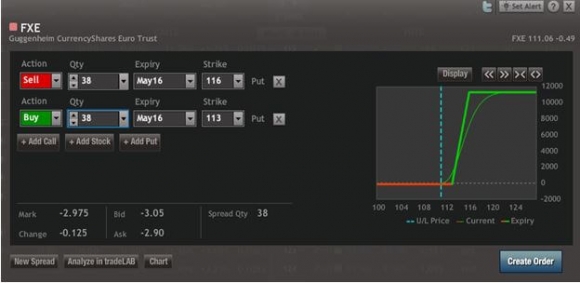

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bear Put Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 38 May, 2016 (FXE) $116 puts at????.?.??$4.95

Buy to cover short 38 May, 2016 (FXE) $113 puts at.?..$1.98

Net Cost:???????????????????......$2.97

Profit: $2.97 - $2.64 = $0.33

(38 X 100 X $0.33) = $1,254 or 12.5% in 5 trading days