Follow Up to Trade Alert - (FXE) November 16, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (FXE)- UPDATE

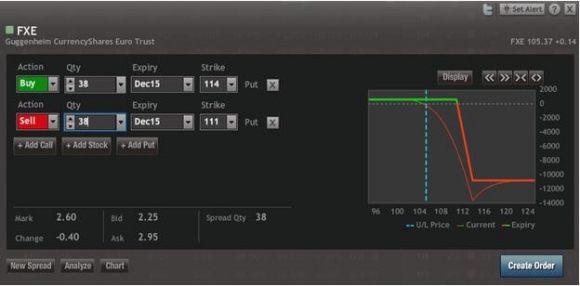

Buy the Currency Shares Euro Trust (FXE) December, 2015 $111-$114 in-the-money vertical bear put spread at $2.60 or best

Opening Trade

11-12-2015

expiration date: December 18, 2015

Portfolio weighting: 10%

Number of Contracts = 38

I hate making money off of a tragedy. Somehow, it doesn?t seem right. I feel I need to take a shower afterwards.

That's what happened when I went into 9-11 net short for a host of reasons having to do with the aftermath dotcom bust and a coming US economic slowdown.

A terrorist attack was only a tiny blip on the radar then, and certainly nothing of the scale of what occurred was even remotely imaginable.

That is what happened last Friday when the first headlines on the Paris terrorist attack came across my screen. Within hours, a handful of casualties turned into France?s 9-11.

Only the day before, I added an (FXE) December $111-$114 vertical bear put debit spread to my model trading portfolio. This is a bet that the Euro will stay at, or below $111 by the December 18, 2015 expiration date.

For those who don?t trade options, I advised buying the ProShares Ultra Short Euro ETF (EUO).

I usually hate adding short positions after prolonged moves down in a security. But the outlook for the beleaguered continental currency is so dire I had no choice.

With the US planning to raise interest rates in December, and the ECB expected to cut them, a falling Euro has become everyone?s no brainer one-way bet in a year that has proved impossible to trade.

This is being driven by a US GDP growth rate of 2.0-2.50%, compared to a feeble 0-0.5% rate in Europe.

I merely jumped on the bandwagon. I never gave a thought about terrorism, ISIS, or any other geopolitical event.

Of course, the Euro collapsed on the news. The (FXE) December $111-$114 vertical bear put debit spread has rocketed by 11.5% in two trading days, adding 1.50% to my 2015 annual return.

It?s a classic case of the harder I work, the luckier I get.

If you had any doubts that the Euro is headed for parity against the greenback by year-end, you can banish those thoughts from your mind.

The immediate upshot of the Paris attacks is that the European Central Bank is going to have to step up their quantitative easing by quite a lot, and sooner. The drag created by the attacks offers no other choice.

France is the world?s largest tourist destination, with 75 million visitors a year (compared to a population of only 66 million).

Travel agents around the world are now offering emergency cancellations to their clients because of contractual force majeure contract clauses. French president Francois Holland has said nothing less than a state of war now exists, putting the kibosh on any planned romantic weekends.

This crisis gets piled on top of a new enormous social services bill for Europe to settle 400,000 Syrian refugees on short notice. There is also the clean diesel disaster at Volkswagen, one of Germany?s largest employers.

Let?s face it. Europe has suddenly become unlucky. But it?s a great time to be short the currency.

When the market hands you lemons, it?s time to make lemonade, or ?limonade?.