Follow Up to Trade Alert (GLD) - October 25, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (GLD) - UPDATE

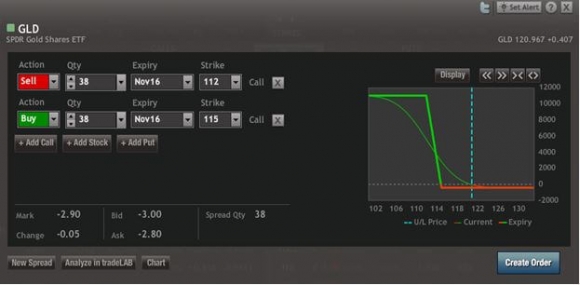

SELL the SPDR Gold Shares (GLD) November, 2016 $112-$115 in-the-money vertical bull call spread at $2.90 or best

Closing Trade

10-25-2016

Expiration Date: November 18, 2016

Portfolio Weighting: 10%

Number of Contracts = 38 contracts

I have no doubt that I nailed the recent bottom on the price of gold (GLD) at $118.50.

I am certain that the SPDR Gold Shares (GLD) November, 2016 $112-$115 in-the-money vertical bull call spread will expire at its maximum potential value of $3.00.

However, prudent, disciplined risk control dictates that I take profits now.

By cashing in here, I get to realize 73.68% of the maximum potential profit in only ten trading days.

I also get to duck the risk of running the position for 18 more trading days, through the uncertainty of the presidential election.

Notice also that for the last several months, gold has been acting like a bond.

It has been trading in lockstep with other interest-sensitive asset classes like REITs, utilities, telecom stocks and master limited partnerships (MLPs).

And we have just had a very nice two-point rally in the Treasury bond market (TLT).

By closing this position, the six-year track record of the Mad Hedge Fund Trader has hit a new all time high FOR A RECORD SEVEN CONSECUTIVE DAYS.

We are on an absolute tear, and no one ever got fired for taking a profit.

So for all of these reasons, I am taking profits in my long gold position.

That way if bonds and gold decide to take another dump, I can jump back in on the long side with a similar position and seize another 100 basis points.

If you didn?t do the options, sell the SPDR Gold Shares (GLD) for a quick trade.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain about how to execute an options spread, please watch my training video How to Execute a Vertical Bull Call Spread

Please keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's volatile markets, individual investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile across platforms.

Here Are the Specific Trades You Need to Execute This Position:

Sell 38 November, 2016 (GLD) $112 calls at????.?.??$9.15

Buy to cover short 38 November, 2016 (GLD) $115 calls .?..$6.25

Net Proceeds:??????????????????......$2.90

Profit: $2.90 - $2.62 = $0.28

(38 X 100 X $0.28) = $1,064, or 10.68% profit in 10 trading days.