Follow Up to Trade Alert - (HD) September 18, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (HD)- BUY

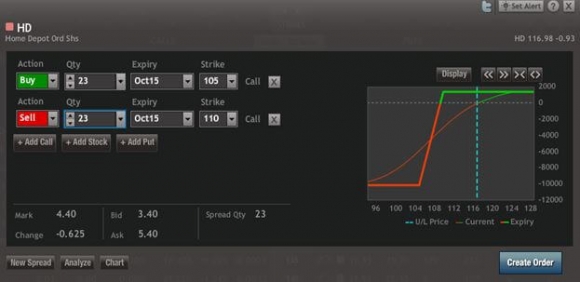

Buy the Home Depot (HD) October, 2015 $105-$110 in-the-money vertical bull call spread at $4.40 or best

Opening Trade

9-18-2015

expiration date: October 16, 2015

Portfolio weighting: 10%

Number of Contracts = 23 contracts

You can pay all the way up to $4.60 for this spread and it still makes sense. If you can?t do options, buy the (HD) shares outright.

Keep in mind that we have ?fast trading? conditions now, so the prices can be anywhere.

With the Volatility Index (VIX) trading above $24, I?ll take that as a ?BUY? signal. That is well up from Thursday?s $17.60 low.

With volatility this high, trades that are seemingly impossible, can get done. This is one of those ?Missions Impossible.?

Now that the Fed decision is out of the way, it?s time to start scaling in to the best companies that will outperform for the rest of the year.

Housing is a big deal.

It has long accounted for a major part of the US economy. Add up all the stuff you can cram into a new home and the services needed to put them there, and you come up with 25% of all the business activity in America.

Housing used to be a great leading indicator for timing your equity investments. As soon as homes, furniture, and white goods started to move, a bell rang, and it was off to the races for stocks.

Except that this time it?s different.

Economists have been puzzled by the near absence of housing in an economic recovery that is now stretching into its sixth year.

Blame lazy Millennials who prefer to rent and not buy, the new, impossibly high credit standards demanded by banks, or the recent terrible track record of homes as investments.

For whatever reason, homes lacked the allure of previous economic cycles. New home construction is proceeding at about a quarter of past peak rates, about 500,000 units a year.

That is, until now

After playing dead for years, homebuilders have suddenly become market front-runners. The time for the laggards to play catch up has arrived.

It appears that at long last, the prospect of an imminent rise in interest rates by the Federal Reserve is stampeding buyers into the market. These shares will now start to discount a rate rise in December, or in early 2016.

July new housing starts came in at a blistering 13%, and multifamily dwellings continue strong. Permits in the crucial single family new home starts for August came in at 699,000, an eight year high.

These are not one offs. Virtually every data point coming out of real estate is now robust.

The play here is that the US built very few homes during the Great Recession. Even if they could get financing, there were no buyers. As a result about 5 million homes ?went missing.?

IN OTHER WORDS, THEY WERE NEVER BUILT!

Now the demand is back, but the industry is substantially smaller than a decade ago, thanks to bankruptcies, distressed takeovers, and downsizing.

There is a structural shortage in housing now that could last another decade, but there are far fewer companies left to build them. A big catch up play is unfolding.

You can see where this is all going?

It Gets Better!

Housing, in fact, is just about to launch into a new Golden Age, because of what is going to take place in 2023, or in eight years.

That is when 85 million low spending, high saving baby boomers cease to be a drag on the economy, safely ensconced in nursing homes, wondering if their diapers will get changed on time.

They will be replaced by 65 million big spending, low saving Gen Xer?s and 85 million up and coming Millennials who are sick of living in their parents? basement.

THAT ADDS UP TO A MONSTROUS 150 MILLION NEW HOME BUYERS!

They will all be stumbling over each other to buy baby boomer homes, triggering a runaway 13-year real estate and home construction boom.

This is fantastic news for homebuilders of every stripe, as well as a little company you may have heard of that is the weekend paradise of addicted do-it-yourself fixer uppers, like me, called Home Depot (HD).

Here Comes the Good Part!

During the crash, Home Depot suffered a near death experience. New discipline, streamlined costs, and deleveraging have since restored the firm to financial health and profitability.

But don?t take my word for it. The company just announced Q2, 2015 earnings that were nothing less than eye popping, up +5.7% on a first half sales gain of 5.1%.

In other words, they knocked the cover off of the ball.

Wall Street noticed.

If you want to know precisely how to enter this order into your online trading platform, please look at the ticket below which I grabbed from optionshouse.

If you are uncertain about How to Execute a Vertical Bull Call Spread, please watch my instructional video on the website by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 23 October, 2015 (HD) $105 calls at????.??$12.20

Sell short 23 October, 2015 (HD) $110 calls at????..?$7.80

Net Cost:?????????????????????.....$4.40

Potential Profit at expiration: $5.00 - $4.40 = $0.60

(23 X 100 X $0.60) = $1,380 or 1.38% profit for the notional $100,000 portfolio.