Follow Up to Trade Alert - (LEN) August 18, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (LEN) ? BUY-UPDATE

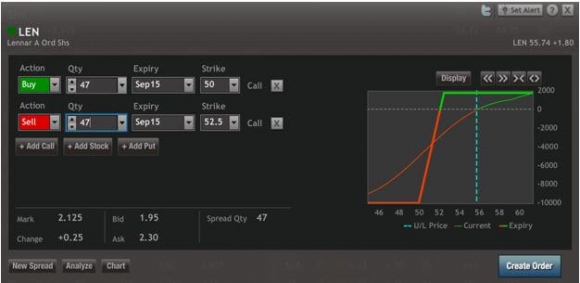

Buy the Lennar Homes (LEN) September, 2015 $50-$52.50 deep in-the-money vertical call spread at $2.125 or best

Opening Trade

8-18-2015

expiration date: September 18, 2015

Portfolio weighting: 10%

Number of Contracts = 47 contracts

You can buy this vertical bull call spread anywhere within a $2.00-$2.20 range and have a reasonable expectation of making money on this trade by the September 18 expiration.

If you can?t do the options then buy the stock outright. It is going up 10%-20% by the end of the year.

I am tired of waiting for a pullback to get into a red-hot sector that has become a market leader.

Today, there was every reason for the stock to fall. Shanghai was down 6%, the (SPY) is weak, and the dollar is making great strides against all other currencies.

But the housing market thought otherwise. July new housing starts came in at a blistering 13%, and multifamily dwellings continue strong. This is not a one off. Virtually every data point coming out of real estate is now strong.

After playing dead for years, homebuilders have become the front-runner. Housing has morphed from a leading to a lagging economic indicator, and now is the time for the laggards to play catch up. Go figure!

The play here is that the US homebuilding industry built very few homes during the Great Recession. Even if they could get financing, there were no buyers. As a result about 5 million homes ?went missing.? They were never built.

Now the demand is back, but the industry is substantially smaller than a decade ago, thanks to bankruptcies, distressed takeovers, and downsizing. There is a structural shortage in housing now that could last another decade and bring much higher prices.

The stock markets generally should move back into a solidly ?RISK ON? environment once the September 17 Federal Reserve interest rate decision gets out of the way. The Iran nuclear deal and the Greek debt resolution are huge positives that have yet to be discounted by the markets.

The great thing about this (LEN) spread is we have to decisively break to 50 day moving average at $51 in the next month to start sweating bullets, a rare event.

Lennar is based in Miami, Florida, and is a national builder of single-family homes, with major operations in Arizona, California, Colorado, Delaware, Florida, Georgia, Illinois, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New York, North Carolina, Pennsylvania, South Carolina, Texas, Virginia.

During the nineties, they particularly focused on converting decommissioned military basis into large, low-end housing estates, such as at the Marine Corps Air Station at El Toro, March Air Force Base, Treasure Island, Mare Island, and Hunters Point, all in California.

At the peak of the last housing bubble in 2006, they were the second largest homebuilder in the United States, and were considered one of the best run companies in the country.

During the crash, Lennar suffered a near death experience, losing $2.4 billion in two years. New discipline, streamlined costs, and deleveraging have since restored the firm to profitability.

If you want to play it safe and buy a basket of homebuilder stocks rather than a single name, by the iShares Dow Jones US Home Construction ETF (ITB) (click here for the link to their website at https://www.ishares.com/us/products/239512/ishares-us-home-construction-etf).

Its three largest holdings are DR Horton (DHI), Lennar Homes (LEN), and Pulte Homes (PHM).

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

Buy 47 September, 2015 (LEN) $50 calls at?????$3.90

Sell short 47 September, 2015 (LEN) $52.50 calls at..??.$1.775

Net Cost:??????????????????.....$2.125

Potential Profit: $2.50 - $2.125 = $0.375

(47 X 100 X $0.375) = $1,760.50 or 1.76% profit for the notional $100,000 portfolio.