Follow Up to Trade Alert - (SPY) January 13, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- UPDATE

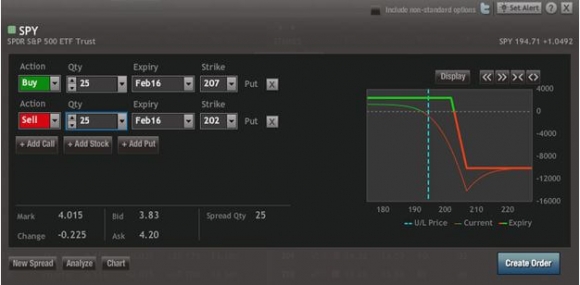

Buy the S&P 500 SPDR?s (SPY) February, 2016 $202-$207 in-the-money vertical bear put spread at $4.01 or best

Opening Trade

1-13-2016

expiration date: February 19, 2016

Portfolio weighting: 10%

Number of Contracts = 25 contracts

I am going to use the $51 handle, three-day rally in the S&P 500 (SPY) to add an additional position on the short side.

To lose money on this trade, the (SPY) would have to come close to posting positive numbers for 2016. With the world solidly in ?RISK OFF? mode, and the professionals are selling every rally, I think this is highly unlikely.

I also believe that oil hasn?t bottomed yet. All we are seeing here is a round of natural short covering you would expect as the price bounces off the big round number of $30, something which computer driven algorithms love to do.

There are many more visits to the $20 handle for oil to come.

If you have some magical insight into the price of oil, better than the entire industry combined, and are convinced that Texas tea bottomed yesterday, then you shouldn?t touch the S&P 500 SPDR?s (SPY) February, 2016 $202-$207 in-the-money vertical bear put spread. In that unlikely scenario, stocks rocket from here.

Then there?s China, whose continued turmoil will bring further US stock losses. I assure you, not even the Chinese know what?s going on in China. They are more like the unfortunate deer that is frozen in the headlights.

The great luxury of the S&P 500 SPDR?s (SPY) February, 2016 $202-$207 in-the-money vertical bear put spread is that it allows you to cash in on continued extremely elevated levels of the Volatility Index (VIX). This is why the potential return is so high for a front month options spread 7 handles in-the-money.

Feast your eyes.

You can pay all the way up to $4.25 for this spread and it still makes sense.

If you can?t do options stand aside. We are too low here for a new naked outright short in the stock.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 25 February, 2016 (SPY) $207 puts at????.?.??$12.60

Sell short 25 February, 2016 (SPY) $202 puts at.????..$8.59

Net Cost:???????????????????......$4.01

Potential Profit: $5.00 - $4.01 = $0.99

(25 X 100 X $0.99) = $2,475 or 2.47% profit for the notional $100,000 portfolio