Follow Up to Trade Alert - (SPY) July 20, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

NOTE:? This is NOT a new Trade Alert - it is an update to Trade Alert issued on July 18, 2016

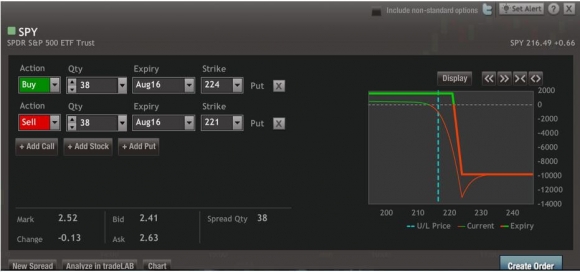

Buy the S&P 500 SPDR?s (SPY) August, 2016 $221-$224 in-the-money vertical bear put spread at $2.52 or best

Opening Trade

7-20-2016

expiration date: August 19, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

I have a prediction to make.

When Donald Trump takes the podium to accept the Republican nomination for the presidency this week, he will not talk about how much money he has made in the stock market over the past seven years.

Nor will he mention how the value of his real estate portfolio has doubled. Completely missing will be mention of a 4.9% unemployment rate, weekly jobless claims at a 43-year low, and corporate profits at an all time high.

What we WILL hear about is the terrible state of the US economy, a coming Great Depression, and an imminent stock market crash that will make the 2008-2009 disaster look like child?s play.

I know he will take this line because he has said it many, many times before.

Needless to say, this is NOT a positive message for the stock market.

Normally, I wouldn?t care about market predictions from an aspiring political candidate. We already know it?s all about bluff, bluster, and empty promises.

However, these are not normal times.

US stocks are now more overbought than any time in their history.

Price earnings multiples at 20X in a 2% a year growth economy is unheard of. The geopolitical backdrop is worsening, with black swans arriving weekly.

And Brexit? Has anyone heard of Brexit?

Usually, this would be enough to cause me to don my helmet and hide out in a deep bombproof desert bunker with a year?s supply of food, water, and ammo.

But it gets worse.

The frenetic rally in stocks we have seen since the post Brexit low six weeks ago, has been of the lowest quality I have ever seen.

It has occurred with steadily falling volume. There has been almost no individual or institutional participation.

It has been all about companies buying back their own stock, and hedge funds covering losing shorts on stop loss orders.

Here is the great irony in what is going on in all asset classes globally.

Central banks are flooding the world with money in order to stimulate economic growth. This was partly spurred by the surprise Brexit. But the rot was already well advanced everywhere.

This has driven interest rates to absurdly low levels. Eventually, this will stimulate economies, as it successfully did in the US from 2009 to 2014.

However, the immediate impact will be to drive up the price of ALL financial assets.

This is why you have seen the unheard of occurrence of simultaneous highs in stocks (SPY), bonds (TLT), precious metals (GLD), REIT?s (GGP), Master Limited Partnerships (AMLP), and the US dollar (UUP).

I know this is supposed to be impossible according to your economic textbooks. But it is happening.

For the mathematicians out there, let me tell you how insane things have gotten in the stock market.

With the Dow Average up NINE CONSECUTIVE DAYS, we are approaching a three standard deviation move in prices.

Usually, you only see moves of this magnitude in sudden gaps DOWN.

You saw this in the two day, $1000 point drop that followed Brexit, the 10% melt down in January triggered by weak Chinese economic data, and August, 2015 $1,100 point flash crash.

To see three standard deviations on a move UP is a once in a lifetime event. The last time I saw one was in 1989 at the end of the great Japanese bull market.

But wait! There?s more!

The S&P 500 is now 7.67% above its 50-day moving average, an occurrence as scarce as hens? teeth. You almost have to be as old as me to remember how often this happens.

The narrowness of this rally is almost unprecedented. My technical friends have been jumping up and down screaming that only 28 of the S&P 500 are at all time highs, and a mere 78 are in clear uptrends.

To see so much buying focused on so few shares is unnerving, to say the least.

All of the above is why I have sold short the S&P 500.

Mind you, this is not the time to bet the ranch. I have put on a position that is as conservative as possible, namely the (SPY) August $221-$224 vertical bear put spread.

I have gone front month, deep in the money, and small in size. The (SPY) has to rise another 1.8% on top of an already incredible 9.60% move for me to lose money on this position. And it has to accomplish the feat in a short 17 days.

If the stock market continues to appreciate, I?ll just roll the position up and double the size.

Here are two downside levels that are key to any retracement:

$2,135 ? is the previous high for the S&P 500 that certainly bears retesting. If it holds, we are going to even higher highs. If it doesn?t, new allocations to equities are put on hold.

$2,080 ? Is the next level up support. If it holds, we will set up a new trading range from $2,080 to $2,170 for the foreseeable future. If this one fails, the market will give back its entire July rally and take us back to the Brexit low of $1,980.

In either of these cases the existing (SPY) short position earns the maximum potential profit of 18.2%. It?s better than a poke in the eye with a sharp stick.

Anyone who is aware of the above might want to join me in my desert bunker.

If you send me a nice email, I?ll save you a place. Just bring your own M-16.

You can pay all the way up to $2.65 for this spread and it still makes sense.

If you can?t do the options, buy the ProShares Short S&P 500 Short Fund ETF (SH) (click here for the prospectus at http://www.proshares.com/funds/sh.html), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS) (click here for the prospectus at http://www.proshares.com/funds/sds.html).

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you wi

ll end up losing much of your profit. Spread pricing can be very volatile with only 9 days to expiration.

Here are the specific trades you need to execute this position:

Buy 38 August, 2016 (SPY) $224 puts at????.?.??$7.90

Sell short 38 August, 2016 (SPY) $221 puts at.???.?..$5.38

Net Cost:???????????????????......$2.52

Potential Profit: $3.00 - $2.52 = $0.48

(38 X 100 X $0.48) = $1,824 or 19.04% profit in 19 trading days.