Follow Up to Trade Alert - (SPY) May 10, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

?

Trade Alert - (SPY)- TAKE PROFITS - UPDATE

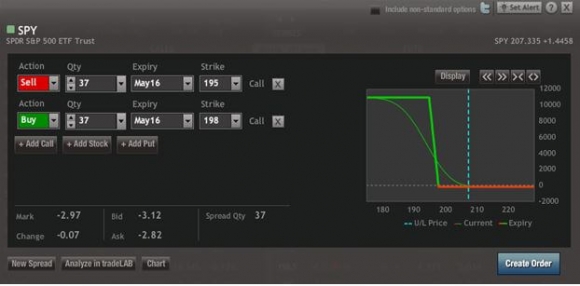

SELL the S&P 500 SPDR?s (SPY) May, 2016 $195-$198 in-the-money vertical bull call spread at $2.97 or best

Closing Trade

5-10-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 37 contracts

You have just made a respectable 10.40% profit in only two trading days. What?s more, you have captured 90.32% of the maximum potential profit in this position.

So it?s time to take a welcome profit. The risk/reward of running this position into the May 20 expiration is no longer favorable.

As I argued vociferously at the February 11 bottom, yield support is underpinning stocks in a huge way, frustrating the hell out of short sellers, market timers, and hedge funds everywhere.

With the volatility Index (VIX) plunging to the $13 handle today we have a nice opportunity to sell the S&P 500 SPDR?s (SPY) May, 2016 $195-$198 in-the-money vertical bull call spread for a few extra pennies than we could yesterday.

This all lends further credibility to my ?Dreaded Flat Line of Death Scenario? whereby markets move sideways in a narrow range and nobody makes any money, except us.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bull Call Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 37 May, 2016 (SPY) $195 calls at????.?.??$12.40

Buy to cover short 37 May, 2016 (SPY) $198 calls at?..$9.43

Net Cost:???????????????????..$2.97

Profit: $2.97 - $2.69 ?= $0.28

(37 X 100 X $0.28) = $1,036 or 10.40% profit in 2 trading days.