Follow Up to Trade Alert - (SPY) May 11, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- TAKE PROFITS

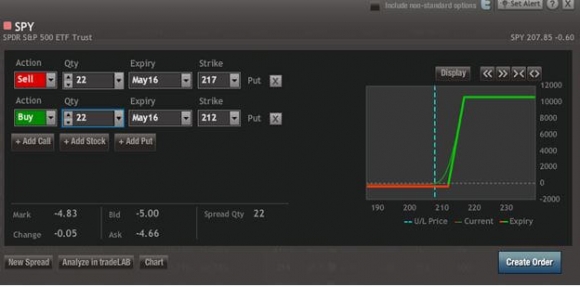

SELL the S&P 58500 SPDR?s (SPY) May, 2016 $212-$217 in-the-money vertical bear put spread at $4.83 or best

Closing Trade

5-11-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 22 contracts

I am going to use this morning?s dive in the stock market to take profits on my position in the S&P 500 SPDR?s (SPY) May, 2016 $212-$217 in-the-money vertical bear put.

This gives us a welcome 8.9% profit during a period when most traders have had their heads handed to them.

Some of you have already emailed me on why I came out of this particular (SPY) put spread among the four I had.

A 40% net short in a single asset class is a rare event for me. So I vowed to cut it back on the next down day for risk control purposes only.

The S&P 500 SPDR?s (SPY) May, 2016 $212-$217 in-the-money vertical bear put spread had the most profit to take, given that it was the furthest out-of-the-money with the shortest expiration date.

If I blow up my performance betting the ranch on a single asset class, I am too old to get my job back at Morgan Stanley.

Besides, they probably wouldn?t have me anyway.

I never believed yesterday?s frantic 220 points rally in the Dow Average for two seconds. No volume, no news, and no cross asset class confirmations meant it was not to be believed.

It was just another opportunity for the high frequency traders to pick the pockets of hedge funds by squeezing them out of their shorts, which they have been doing on a weekly basis all year.

That conviction allowed me to hang on to my aggressive 40% net short position.

?

Better yet, WE ARE POISED TO MAKE AS MUCH AS ANOTHER 10% PROFIT BY THE END OF NEXT WEEK WITH OUR REMAINING POSITIONS!

To remind you of why we are short the S&P 500 in a major way, let me refresh your memories.

It?s all about the strong dollar. A robust buck diminishes the foreign earnings of the big American multinationals, major components of the S&P 500.

I think it is much more likely that stocks grind down in coming weeks to first retest the unchanged on 2016 level at $2,043, and then the 200-day moving average at $2,012.

Share prices are anything but inspirational here.

Price earnings multiples are at all time highs at 19X. The calendar is hugely negative. Soggy and heavily financially engineered Q1 earnings reports came and went.

Huge hedge fund shorts have been covered with large losses, and no one is in a rush to jump back into the short side.

Oh, and the (SPY) is bumping up against granite like two year resistance at $210 that will take months to break through in the best case.

Did I mention that US equity mutual funds have been net sellers of stock since 2014?

This position is also a hedge against what I call ?The Dreaded Flat Line of Death? scenario. This is where the market doesn?t move at all over a prolonged period of time and no one makes any money at all, except us.

If I am right on all of this May will come in as the most profitable month for the Mad Hedge Fund Trader Trade Alert Service in more than a year. For new subscribers, your timing is perfect!

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

SELL 22 May, 2016 (SPY) $217 puts at????.?.??$9.27

BUY to cover short 22 May, 2016 (SPY) $212 puts at.?..$4.44

Net Cost:???????????????????......$4.83

Profit: $4.83 - $4.40 = $0.43

(22 X 100 X $0.43) = $946 or 8.90% profit in 23 trading days.

?