Follow Up to Trade Alert - (SPY) May 18, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- TAKE PROFITS UPDATE

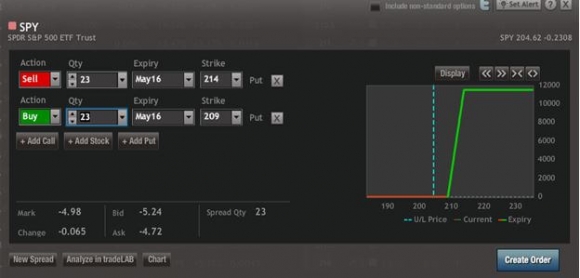

SELL the S&P 500 SPDR?s (SPY) May, 2016 $209-$214 in-the-money vertical bear put spread at $4.98 or best

Closing Trade

5-18-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

WE CAUGHT A WHOPPER TODAY, taking in a 14.48% profit in a mere seven trading days.

So with 96.92% of the maximum potential profit in this position, I am going to take the money and run from the S&P 500 SPDR?s (SPY) May, 2016 $209-$214 in-the-money vertical bear put spread.

This trade takes our May performance up to a stratospheric 12.86%, 2016 the year to date figure to a red hot 14.16%, and the performance since inception to 205.92%.

If you have the ProShares Short S&P 500 Short Fund ETF (SH) (click here for the prospectus at http://www.proshares.com/funds/sh.html), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS) (click here for the prospectus at http://www.proshares.com/funds/sds.html) keep it.

We are going lower.

The Fed minutes released at 2:00 PM this afternoon greatly increased the probability of a Fed rate rise in June. That set the cat among the pigeons.

It focused a bright spotlight on the many reasons shares should go down, including:

1) Talk of an interest rate hike from my former Berkeley economics professor, Federal Reserve Chairman Janet Yellen, is ramping up. If they pull the trigger, you can chop 10% off of the stock market in a week. Yes, central banks DO make mistakes.

2) Corporate earnings are falling. Look no further than the disaster that are retail stocks (M), (TGT), (JCP).

3) At 19 times 2016 earnings, stocks are at decade highs in terms of valuations. Fear of heights anyone. Don the oxygen masks!

4) The calendar is hugely negative. No one ever makes fast money investing in May. Buy stocks today, and you may not break even until next year. Try explaining that one to your boss, your investors, and your next executive outplacement professional.

5) A monster rally in the bond market is predicting an imminent ?RISK OFF? move in global risk assets. Try whistling past the graveyard.

6) So is the near straight line rally in gold stocks (ABX), (GDX), (GLD).

7) Only a rare coincidence of global supply disruptions, like in Canada, Iraq, Libya, Nigeria, and Venezuela, has gotten oil up this high. When production comes back on stream, watch Texas tea roll over to test new lows, taking stocks with it.

8) If England leaves the European Community after its June 23 ?Brexit? referendum, you can kiss the global economy goodbye, including ours. Last time I checked, the polls were 43% to 42% in favor of staying, far too close for comfort. Book that European vacation now before the continent implodes.

9) Turn on the TV or open your Twitter account and you get a hand grenade thrown at you from a presidential candidate. Stocks would rather hide out in a bomb proof bunker.

10) According to my vintage Rolex wristwatch, this bull market is seven years, two months, nine days, four hours, three minutes and 47 seconds old. Sounds pretty geriatric to me.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 9 days to expiration.

Here are the specific trades you need to execute this position:

SELL 23 May, 2016 (SPY) $214 puts at????.?.??$9.50

BUY TO COVER short 23 May, 2016 (SPY) $209 puts a.?..$4.52

Net PROCEEDS:???????????????......$4.98

Profit: $4.98 - $4.35 = $0.63

(23 X 100 X $0.63) = $1,449 or 14.48% profit in 7 trading days.