Follow Up to Trade Alert - (SPY) May 5, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Follow Up to Trade Alert - (SPY) - Update

Buy the S&P 500 SPDR?s (SPY) May, 2015 $213-$216 in-the-money vertical bear put spread at $2.54 or best

Opening Trade

5-5-2015

expiration date: May 15, 2015

Portfolio weighting: 10%

Number of Contracts = 37 contracts

You can pay all the way up to $2.75 for this spread and it still makes sense. If you can?t do the options, stand aside. Don?t even think of going outright short here.

I think the market will continue to grind sideways through the current earnings period. If we go up, it will be a slow climb of a wall of worry.

If shares do appreciate, they will be in the small cap, currency immune Russell 2000, not the big cap multinational S&P 500 (SPY).

So there is time to take in some decent premium through buying the S&P 500 SPDR?s (SPY) May, 2015 $213-$216 in-the-money vertical bear put spread at $2.54 or best.

We only have eight trading days left for these options, and the upside momentum in the market is clearly waning.

This also gives us some downside protection for our remaining two long positions in Apple (AAPL) and Goldman Sachs (GS).

In addition, this put spread partially hedges our substantial long positions in other names. As long as the (SPY) closes below $213 on the May 15 expiration, you should keep the entire $1,794 profit from this trade.

Let?s face it. We?ve had a great run since the stock market bottomed in a furious selling climax on October 15.

Since then, the large cap S&P 500 (SPY) had tacked on some 18%, while the high tech NASDAQ (QQQ) has gained an impressive 23.6%, and the small cap Russell 2000 (IWM) flew 24.4%.

My Own Trade Alert service performance improved by a positively steroidal 27.7%, as the onslaught of testimonials from ecstatic readers confirms (click here).

Therefore, I have cut the size of my trading book by half, and over hedged what I have left, leaving me with the first net short position since the darkest days of 2014.

Why am I running for the sidelines? Am I getting cautious in my old age? Have I suddenly become a wimp?

For a start, we have just entered a period in the calendar when it is notoriously difficult to make money in the market. You?ve heard of ?Sell in May and go away?? This year, it may work with a turbocharger.

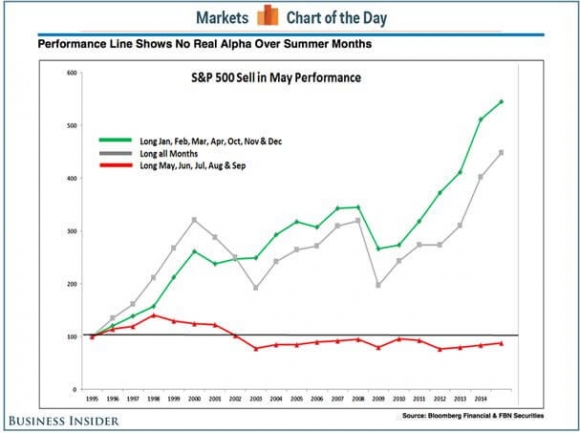

Take a look at he chart below provided by my friends at Business Insider.

It shows that active managers make all of their money during January to April and October to December. Those who are long during the May to September period reliably lose money.

Hey, isn?t that April I see rapidly receding in my rear view mirror?

You may have noticed that the price of oil (USO) has been going up. In fact, the price of Texas tea has added 43% in seven weeks, the sharpest gain since the 1979 oil crisis. As a result, we have just lost 29% of the de facto tax cut for the economy since prices peaked last year at $107 a barrel. You probably have already noticed the double digit rises in the price of gasoline at your local pump.

Not good, not good.

It also appears that the free lunch on interest rates is coming to an end ($TNX). Even if you believe that the Federal Reserve will not act until 2016, that date with destiny is approaching by the day.

You see this is in the steadily rising cost of home mortgages and car loans, neither of which bode well for the economy.

Some may have noticed the meteoric rise on the Euro (FXE) against the US dollar in recent weeks. An aggressive program of quantitative easing seems to be turning around the economy there much faster than expected.

No doubt, businesses on the continent are inspired by the wildly successful results of the same strategy that was employed in the US six years ago. This has led some to assume that Euro QE may end sooner than expected, definitely taking the wind out of the stock markets there.

How about the dollar? Although it has given up half its gains against the Euro this year, it is still high enough to hurt the profits of big multinationals.

We saw evidence of this this morning with the release of the US trade deficit, worst since the crisis days of 2008. The red ink has bubbled up from $34.9 billion in February to $51.4 billion in March, up a staggering 41% month to month.

Clearly, foreign exporters are using their cheaper currency to flood the US market with their goods.

Politics? Did I hear someone mention politics? New candidates are announcing their intensions to run for the top office daily.

What do they all have in common? The need to spend billions of dollars convincing you how terrible the economy is.

This is despite the fact the stock market has tripled, unemployment is at a decade low and home prices have doubled off the bottom (at least they have in San Francisco).

Yes, these campaigns only work on people who don?t look at numbers. But there are a lot of people who don?t look at numbers, eroding confidence, creating confusion and postponing spending decisions until after the November, 2016 election.

All of the above makes me a better seller of rallies than a buyer of dips for the time being. It is certainly worth a 5% drawdown, if not a 10% hickey later on this summer, when no one is looking.

However, we are not entering a new bear market, and the long term strength of the economy augurs for otherwise. We?re just taking a vacation from the bull market.

It all makes a trip to Europe, some 20% cheaper than last year thanks to the Euro collapse, look all the more enticing.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

Buy 39 May, 2015 (SPY) $216 puts at?????$5.96

Sell short 39 May, 2015 (SPY) $213 puts at..?$3.42

Net Cost:??????????????????.....$2.54

Potential Profit: $3.00 - $2.54 = $0.46

(39 X 100 X $0.46) = $1,794 or 1.79% profit for the notional $100,000 portfolio.